- For a third straight month the overall index remained above growth neutral.

- Farmland price growth and agriculture-equipment sales continue to decline.

- Trade concerns slam the business confidence index

- More than three-fourths of bank CEOs reported that export markets were very important to their local economy.

- Almost one-third of bankers support the abolition of NAFTA and undertaking a new agreement.

- More than one-fifth of bankers support the elimination of oil refinery waivers to RFS obligations.

OMAHA, Neb. (April 19, 2018) – The Creighton University Rural Mainstreet Index slipped in April, but remained above growth neutral for a third straight month, according to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy. This is the first time since the middle of 2015 that the survey has recorded three straight months of overall indices above growth neutral.

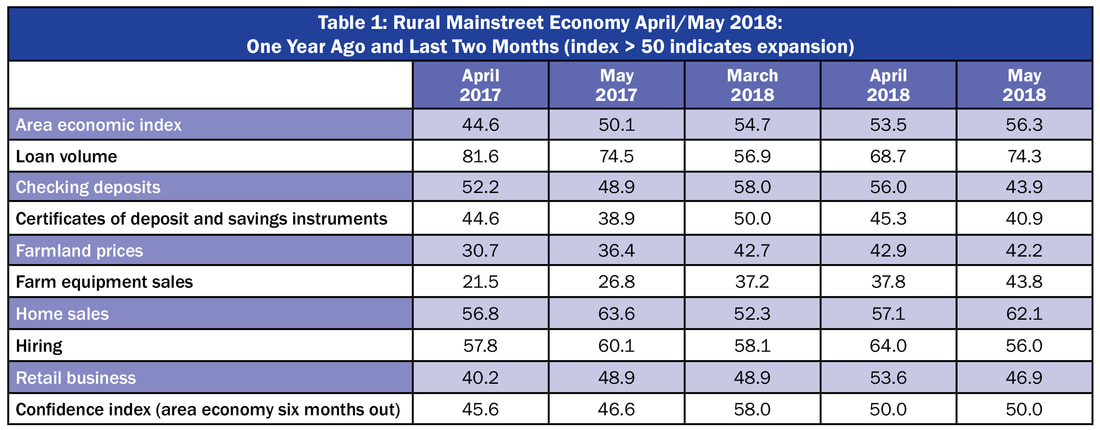

Overall: The overall index dipped slightly to 53.5 from 54.7 in March. The index ranges between 0 and 100 with 50.0 representing growth neutral.

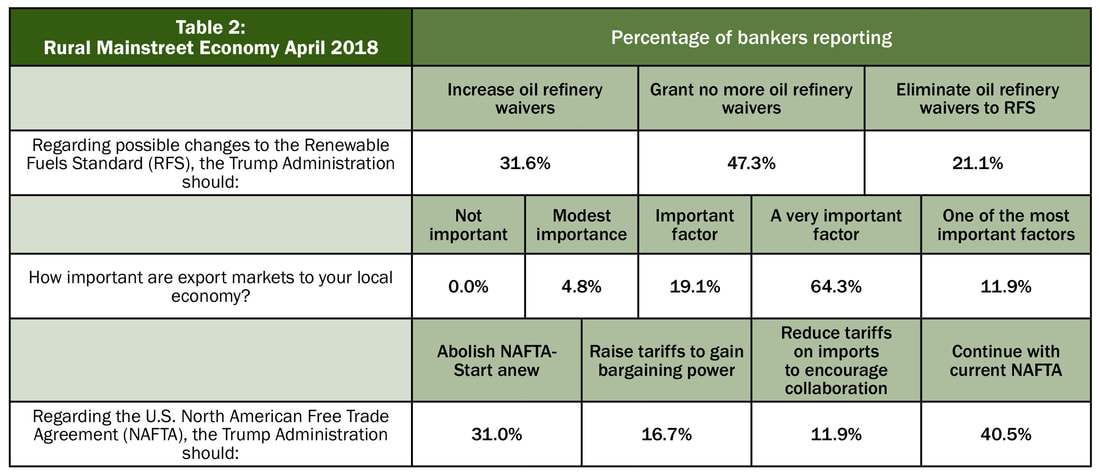

Recent trade tariffs, both implemented and proposed, have reverberated throughout agricultural areas of the region. Some have advanced various federal measures to assist agriculture, including eliminating oil refinery wavers to the renewable fuels standard (RFS). Approximately 21.1 percent of bankers supported the elimination of the waivers, 47.3 percent backed granting no more waivers, while 31.6 percent, supported increasing oil refinery waivers.

According to Larry Winum, CEO of Glenwood State Bank in Glenwood, Iowa, who recently met with DC legislators, said, “The meeting was for regulatory relief (s.2155) that will benefit both the consumer and community banks, and passing a new farm bill that will allow farmers to continue to feed the world. We came away optimistic that Congress will pass legislation on both issues. The growth of our economy depends on it.”

Farming and Ranching: The farmland and ranchland-price index for April increased to 42.9 from March’s 42.7. This is the 53rd straight month the index has fallen below growth neutral 50.0.

The April farm equipment-sales index climbed to a weak 37.8 from March’s 37.2. This marks the 56th consecutive month the reading has moved below growth neutral, 50.0.

Banking: Borrowing by farmers expanded for April as the loan-volume index rose to 68.7 from 56.8 in March. The checking-deposit index fell to 56.0 from March’s 58.0, while the index for certificates of deposit and other savings instruments sank to 45.3 from 50.0 in March.

Hiring: The employment gauge soared to 64.0 from March’s healthy 58.1. The Rural Mainstreet economy is now experiencing positive year-over-year job growth. The Rural Mainstreet economy has added jobs at a 0.4 percent pace over the past 12 months. Job growth in rural areas is now exceeding that of the urban areas of the 10-state region.

Confidence: The confidence index, which reflects expectations for the economy six months out, sank to 50.0 from March’s 58.0 indicating waning economic optimism among bankers. “An unresolved North America Free Trade Agreement (NAFTA) and rising trade tensions with China are significant concerns,” said Goss.

When asked this month how important export markets are to their local economy, bankers expressed great support for export markets. More than three-fourths, or 76.2 percent, of bank CEOs reported that export markets were very important to their local economies.

In terms of NAFTA, almost one-third, or 31.0 percent, backed abolishing NAFA and starting negotiations on a fresh agreement. Approximately, 40.5 percent supported continuing with the current NAFTA.

Home and Retail Sales: The home-sales index moved higher for the Rural Mainstreet economy in April advancing to 57.1 from March’s 52.3. The April retail-sales index improved to 53.6 from March’s weak 48.9.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005. Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index (RMI) fell to 54.8 from 62.0 in March. The farmland and ranchland-price index dipped to 43.4 from March’s 44.9. Colorado’s hiring index for April declined to 68.9 from March’s 73.0. Colorado’s Rural Mainstreet job growth over last 12 months: 2.4 percent. Illinois: The April RMI for Illinois sank to 52.2 from 58.4 in March. The farmland-price index fell to 43.5 from 47.3 in March. The state’s new-hiring index advanced to 70.5 from last month’s 65.8. Illinois’ Rural Mainstreet job growth over last 12 months: 1.7 percent. Iowa: The April RMI for Iowa advanced to 54.5 from 52.8 in March. Iowa’s farmland-price index for April rose to 43.3 from March’s 42.7. Iowa’s new-hiring index for April expanded to 67.5 from March’s 58.5. Iowa’s Rural Mainstreet job growth over last 12 months: 0.1 percent. Kansas: The Kansas RMI for April slipped to 53.9 from March’s 55.7. The state’s farmland-price index decreased to 43.0 from 45.8 in March. The new-hiring index for Kansas climbed to 65.3 from March’s 60.5. Kansas’s Rural Mainstreet job growth over last 12 months: 0.1 percent. Minnesota: The April RMI for Minnesota slipped to 54.7 from March’s 54.9. Minnesota’s farmland-price index increased to 43.4 from 42.7 in March. The new-hiring index for the state climbed to 68.6 from March’s 58.8. Pete Haddeland, CEO of the First National Bank in Mahnomen reported, “We are several weeks out for field work.” Minnesota’s Rural Mainstreet job growth over last 12 months: 0.5 percent. | Missouri: The April RMI for Missouri declined to 57.0 from 59.0 in March. The farmland-price index expanded to 44.3 from 44.0 in March. Missouri’s new-hiring index for April was unchanged from March’s 54.1. Missouri’s Rural Mainstreet job growth over last 12 months: 4.0 percent. Nebraska: The Nebraska RMI for April expanded to 54.0 from March’s 52.3. The state’s farmland-price index sank to 39.9 from last month’s 42.6. Nebraska’s new-hiring index climbed to 65.4 from 57.8 in March. Nebraska’s Rural Mainstreet job growth over last 12 months: 2.4 percent. North Dakota: The North Dakota RMI for April grew to 52.7 from March’s 51.4. The state’s farmland-price index moved lower to 42.5 from 41.7 in March. North Dakota’s new-hiring index jumped to 60.4 from 51.8 in March. North Dakota’s Rural Mainstreet job growth over last 12 months: minus 3.1 percent. South Dakota: While the April RMI for South Dakota moved above growth neutral, the index declined to 52.8 from March’s 54.4. The state’s farmland-price index climbed to 43.4 from March’s 42.6. South Dakota's new-hiring index expanded to 68.9 from 55.1 in March. South Dakota’s Rural Mainstreet job growth over last 12 months: 0.9 percent. Wyoming: The April RMI for Wyoming sank to 52.9 from March’s 55.5. The April farmland and ranchland-price index slumped to 38.9 from 42.9 in March. Wyoming’s new-hiring index soared to 74.1 from March’s 53.8. Wyoming’s Rural Mainstreet job growth over last 12 months: 1.7 percent. |

(Click each table to view larger.)

Follow Ernie Goss on Twitter www.twitter.com/erniegoss

RSS Feed

RSS Feed