| Overview With the current pressures on margins and profitability, operating efficiency is critical to both short-term and long-term success. Operating processes are the backbone to how your bank’s processes get done. Bankers know operating efficiency is important. However, many senior bank managers are more focused on other priorities than to stop and focus on operating efficiency. There are 5 keys ways your bank can improve operating efficiency and keep you a step ahead. This article will outline the what and the how of successfully improving efficiency in your bank. |

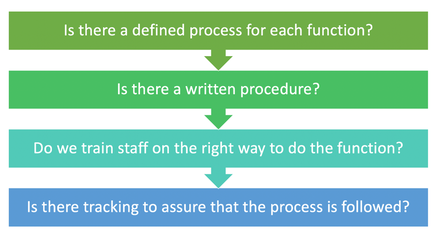

| Any time you bank has staff completing the same function in different ways, you have inefficiency and risk. Identify the “best practice”, draft a procedure and train staff on the way that procedure should be completed. Many banks do not have standard operating procedures, nor do many banks have a standard way of training staff on the procedure. Often, training is completed with a “sit by me” approach. Depending on who the employee is learning from, the training on a process could be vary. Consistency of operating processes is the foundation for efficiency. |

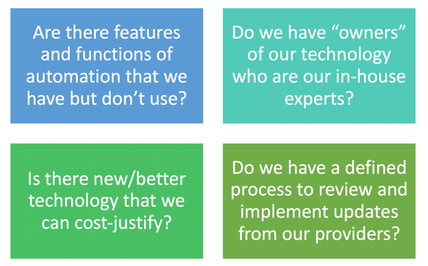

| We must remember, technology is a tool, not a solution. It is necessary to have standard processes in place and we need to define how technology will support any given process. It is important to have an “owner” of various applications. These “owners” must know the features and functions of any technology, draft procedures and train staff on full utilization of the technology. It is necessary to review various workflows to examine how technology is being used for the process. One simple example is a review of your bank’s accounts payable process. How many vendors are being paid via ACH rather than by check? |

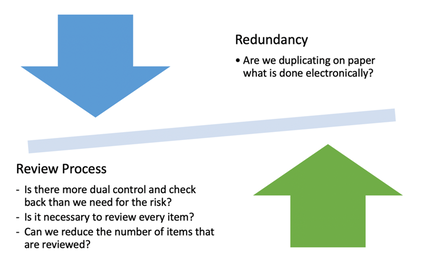

| It is necessary to review individual processes within your bank, with the eye on carefully asking “why is this process being completed”? One of the biggest culprits in this category is then tendency to “over-control” a simple process. While a certain amount of check-back and verification of input is necessary, is there more being done than necessary? Some bank staff will review input “just to be sure”, when there is no real benefit to the review. |

| Efficiency will always be at its best when we have the work assigned to the correct desk. It’s critical to ask ourselves, “Are we best matching the skills of our team with the work that needs to be done?” Centralized expertise can generally be valuable when very specialized functions are considered. Many banks are centralizing fraud, IRA, and other key functions. Where are your bank’s most critical functions performed? Should some functions be centralized? Is there logic in where the administrative and processing functions performed? |

| Productivity is the most important element yet can be the most difficult to manage. Are our people professionally trained and matched with jobs that fit their skillset? If not, is further training needed to excel or do some employees need to be shifted to other positions to best meet their professional aspirations and the needs of the bank? The key to staff productivity is metrics. A bank needs to measure activity volumes, quality (errors), and production. Turning metrics into ratios is the key to productivity measurement. How many new loans per lender? How many new accounts per banker? How many input errors to total transactions? Banks are realizing the need for department scorecards and use them as measures of productivity. These will point out areas to improve. |

Loren Prairie has over thirty years of experience in all phases of bank operations in a variety of sizes of banks, including operations workflow, efficiency, strategic planning, staffing, and organizational issues. Since 1998, Loren has worked as a consultant exclusively for community banks. For more about CBI Affiliate Member PCI Performance Management visit www.prairiebankconsulting.com.

RSS Feed

RSS Feed