IBA Securities - Division of Broker Dealer Financial Services Corp.

Acting as a fiduciary carries a greater level of responsibility. Fiduciaries are bound to act in their clients' best interests. The regulatory framework around fiduciary status has been the subject of much attention and uncertainty in recent years. Adhering to a fiduciary standard gives your investment recommendations a greater weight and level of accountability. This standard requires you to take into account your clients' entire financial circumstances, making holistic wealth management services even more important.

The new DOL Fiduciary Rule makes one a fiduciary when a recommendation is made with respect to rollovers, transfers, or distributions from a Qualified Retirement Plan (including 401ks) or IRA -- which is collectively known as "retirement asset movement" -- and is paid a fee or other compensation as a result. In addition, the DOL Fiduciary Rule also includes existing retirement accounts for which you are advising. The retirement asset movement must be in the client's best interest. The advice regarding retirement asset movement and reasons why it is in the clients' best interest will need to be documented and maintained. As a result, one needs a number of processes and resources in place by June 9, 2017, when the rule goes into effect.

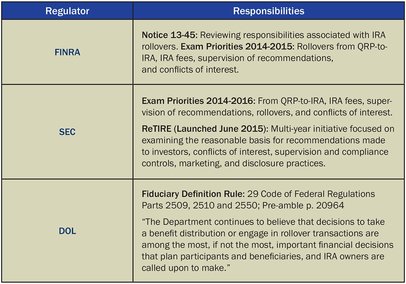

When it comes to retirement asset movement, several regulators are focusing on one's recommendations regarding rollover transactions and retirement account transfers. That is why we will introduce a new standardized process to support the convergence of the following regulatory responsibilities:

While it is anticipated there may be changes in the rule going forward, at this time we are required to implement the following for retirement accounts:

- Sending a Transition Notification Disclosure to all existing retirement account holders.

- A Retirement Asset Movement Questionnaire will become a part of the standard review and recommendation processes. The questions and analysis must be completed whenever you have a discussion (other than one of an educational nature only) with a client or prospect on rolling over his/her Qualified Retirement Plan

- We have been emphasizing the importance of documentation for recommendations on all accounts. Documentation with respect to your advice on retirement accounts and assets is now mandatory. That documentation must adequately justify the three requirements of the DOL rule. Those requirements are:

- Best Interest Investment Advice. At the time the recommendation is made one must acknowledge the recommendation made is without regards to the financial interests of you or the firm and that the recommendation is made solely with regards to the client's stated investment objectives, risk tolerance, financial circumstances and investment needs. This refers to "Covered Recommendations" only.

- The Compensation You Receive is Reasonable. This is where you note the meetings you have had with the client, the services you have provided to the client, the research you have done for the client, the discussions you have had with the client and so forth. In other words, you need to detail/justify the work you have done and the services you have provided.

- You Cannot Make any Materially Misleading Statements Regarding Fees or Compensation. This is straightforward-do not mislead on the compensation you are going to receive from the transaction(s).

- CDs,

- Corporate debt securities that meet standards for credit worthiness and liquidity, and

- Treasury issues and GSE bonds deemed allowable.

As we continue to navigate this huge change to our business we are absolutely committed to continue to provide banks with the tools, systems and compliance oversight that will help you protect your bank. We have devoted extensive resources to updating technology, working with outside consultants, developing policies and procedures for business submission and other behind the scenes efforts to comply with this new rule. We feel that we are partnered with the best advisors that epitomize our philosophy of "putting the client's interest first" and now the DOL rule is asking us to document and prove that process to the greatest extent. For more information, please do not hesitate to contact Cody Phelps, Relationship Manager or Lisa Smith, President & CEO at 1-800-352-5634 at IBA Securities - Divison of Broker Dealer Financial Services.

RSS Feed

RSS Feed