- For the seventh time in the past eight months the Rural Mainstreet Index remained above growth neutral.

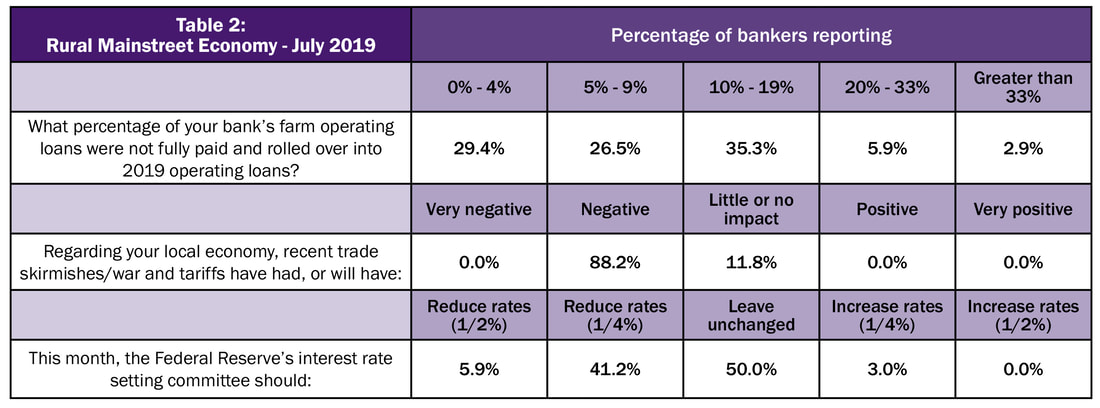

- Bankers reported that approximately one in 10 farm operating loans from 2018 were not repaid and were rolled into 2019 loans.

- Less than half of bank CEOs think the Federal Reserve should reduce short-term interest rates at its July meetings.

- Almost nine of 10 bankers reported that tariffs and trade skirmishes have had, or will have, a negative impact on their local economy.

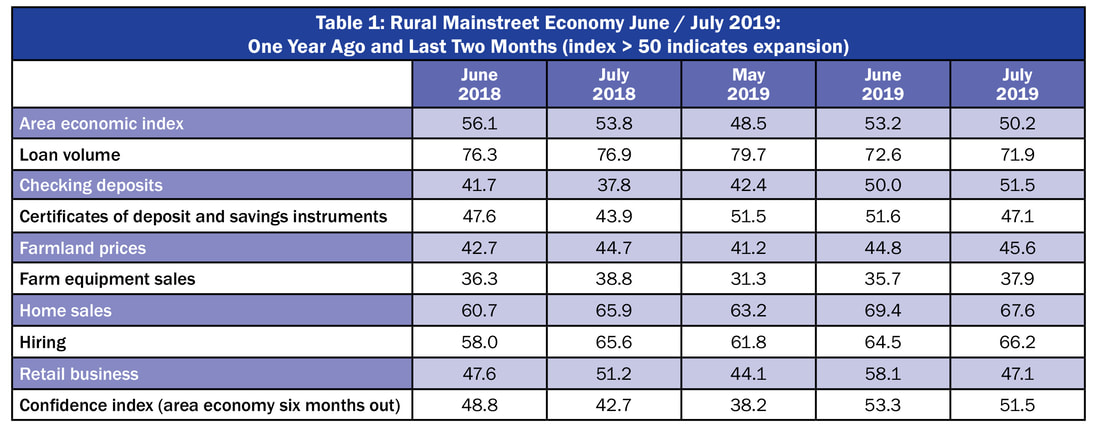

Overall: The overall index fell to 50.2 from 53.2 in June. This is the seventh time in the past eight months that the index has remained above growth neutral. The index ranges between 0 and 100 with 50.0 representing growth neutral, and an RMI below the growth neutral threshold. 50.0, indicates negative growth for the month.

“Higher agriculture commodity prices and rebuilding from recent floods supported the Rural Mainstreet Index (RMI) for the month. Furthermore, almost nine of 10 bankers reported tariffs and trade skirmishes have had, or will have, a negative impact on their local economy. This is up from eight of 10 recorded last September,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

The July farm equipment-sales index increased to 37.9 from June’s 35.7. This marks the 71st straight month the reading has remained below growth neutral 50.0.

Banking: Borrowing by farmers for July remained very strong. The borrowing index slipped to 71.9 from June’s 72.6. The checking-deposit index rose to 51.5 from June’s 50.0, while the index for certificates of deposit and other savings instruments slumped to 47.1 from 51.6 in June.

Bankers reported that approximately one in ten 2018 farm operating loans were not repaid and were rolled into 2019 loans.

But James Brown, CEO of Hardin County Savings Bank in Eldora, Iowa, said, “I think you will find that most banks don't roll over 2018 unpaid operating notes into the 2019 LOC notes. If there is still grain to cover operating debt, we extend the loan until it is marketed.”

Less than half of the bank CEOs think the Federal Reserve should reduce short-term interest rates at their July meetings.

Hiring: The employment gauge climbed to a very strong 66.2 from June’s 64.5. Despite tariffs and flooding over the past several months, Rural Mainstreet businesses continue to hire at a solid pace.

Over the past 12 months, the Rural Mainstreet economy added jobs at a 0.3% pace compared to a higher 1.2 % for urban areas of the same 10 states. Rural areas in three Rural Mainstreet states, Iowa, Missouri, and Nebraska lost jobs over the past 12 months.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, slipped to 51.5 from June’s 53.3, indicating a positive, but somewhat weak economic outlook among bankers.

Home and Retail Sales: The home-sales index decreased to a still strong 67.6 from June’s 69.4. The retail sales index for July plummeted to 47.1 from June’s 58.1. “It appears that the region experienced a significant slump from June’s solid reading,” said Goss.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index (RMI) for July dipped to 53.0 from 54.2 in June. The farmland and ranchland-price index climbed to 46.2 from June’s 45.0. Colorado’s hiring index for July climbed to 74.5 from June’s 70.7. Over the past 12 months rural areas in Colorado have experienced job growth of 2.9% compared to a somewhat weaker, but still healthy, 1.6% for urban areas of the state. Illinois: The July RMI for Illinois decreased to 49.1 from 51.0 in June. The farmland-price index rose to 45.2 from 44.1 in June. The state’s new-hiring index soared to 59.5 from last month’s 45.2. Over the past 12 months rural areas in Illinois have experienced job growth of 0.4% compared to a stronger 1.3% for urban areas of the state. Jim Eckert, president of Anchor State Bank in Anchor, reported, “In our area most crops were planted, albeit very late due to excessive moisture. Crops look good but are far behind previous years. The last two weeks have been hot and dry, and crops will soon suffer, if we don't get rain.” Iowa: The July RMI for Iowa sank to 49.9 from June’s 51.1. Iowa’s farmland-price index improved to 45.4 from June’s 44.1. Iowa’s new-hiring index for July soared to 61.6 from 48.9 in June. Over the past 12 months rural areas in Iowa have experienced job losses with growth at minus 1.0% compared to a much stronger 1.4% for urban areas of the state. Kansas: The Kansas RMI for July slid to 49.0 from 51.6 in June. The state’s farmland-price index grew to 45.2 from June’s 44.3. The new-hiring index for Kansas advanced to 59.4 from 56.8 in June. Over the past 12 months rural areas in Kansas have experienced job growth of 0.5% compared to a stronger 1.5% for urban areas of the state. Minnesota: The July RMI for Minnesota climbed to 55.3 from June’s 53.8. Minnesota’s farmland-price index rose to 45.5 from 44.8 in June. The new-hiring index for July declined to 63.0 from June’s 68.9. Over the past 12 months rural areas in Minnesota have experienced job growth of 1.2% compared to a significantly weaker minus 0.1% for urban areas of the state. | Missouri: The July RMI for Missouri fell to 45.1 from 48.0 in June. The farmland-price index for the state increased to 44.1 from June’s 43.3. Missouri’s new-hiring index for July rose to 48.9 from June’s 47.1. Over the past 12 months rural areas in Missouri have experienced mounting job losses with job reductions of minus 2.4% compared to a much stronger 1.6% for urban areas of the state. Nebraska: The Nebraska RMI for July fell to 47.9 from June’s 50.6. The state’s farmland-price index increased to 44.0 from last month’s 44.0. Nebraska’s new-hiring index expanded to 56.3 from June’s 49.5. Over the past 12 months rural areas in Nebraska have lost jobs at a rate of minus 0.5% compared to a stronger 1.1% for urban areas of the state. North Dakota: The North Dakota RMI for July declined to 51.0 from June’s 55.7. The state’s farmland-price index increased to 45.7 from 45.4 in June. The state’s new-hiring index fell to a still strong 64.5 from 67.7 in June. Over the past 12 months rural areas in North Dakota have experienced job growth of 0.8% compared to a weaker 0.1% for urban areas of the state. South Dakota: The July RMI for South Dakota remained above growth neutral, but declined to 51.5 from June’s 54.9. The state’s farmland-price index improved to 45.8 from June’s 45.1. South Dakota’s new-hiring index advanced to 66.1 from 65.4 in June. Over the past 12 months rural areas in South Dakota have experienced job growth of 1.6% compared to an even stronger 2.1% for urban areas of the state. Wyoming: The July RMI for Wyoming sank to 51.7 from June’s 55.4. The July farmland and ranchland-price index increased to 45.9 from June’s 45.3. Wyoming’s new-hiring index slipped to 66.5 from 66.8 in June. Over the past 12 months rural areas in Wyoming have experienced job growth of 1.6% compared to a slightly weaker 1.3% for urban areas of the state. |

RSS Feed

RSS Feed