- For the sixth time in the past seven months the Rural Mainstreet Index climbed above growth neutral.

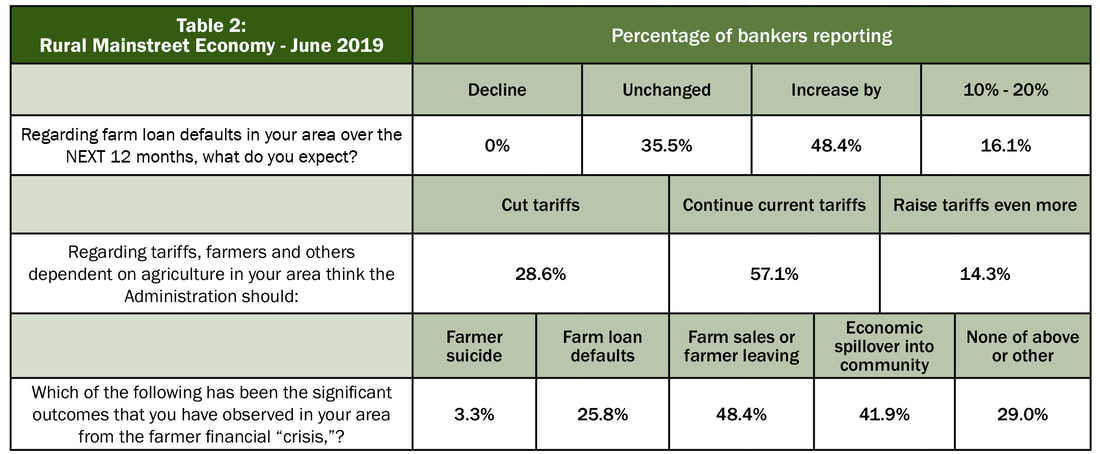

- More than one in four bank CEOs reported rising loan defaults due to farmer financial woes.

- Almost half of bankers reported that due to crisis level farm income, farmers in their area have responded by selling the farm, or otherwise leaving the farm.

- Almost seven of 10 bank CEOs support continuing or raising current tariff levels.

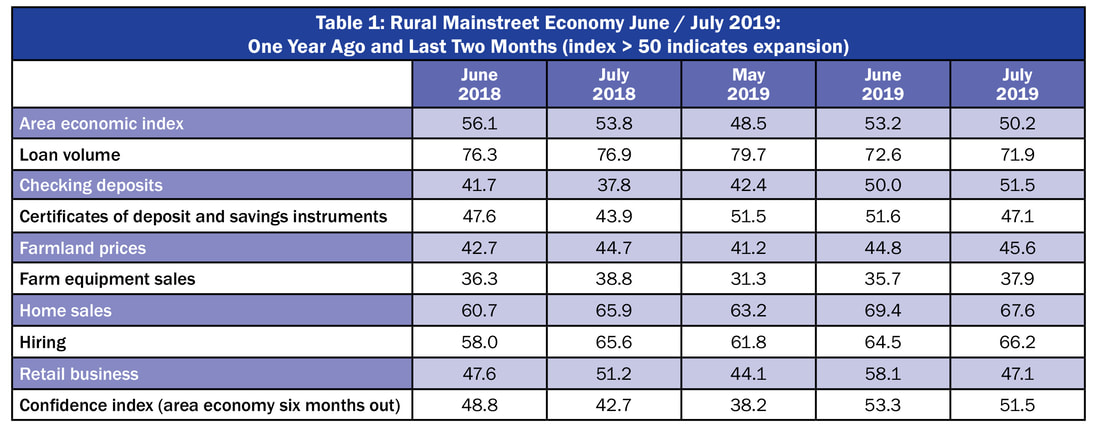

Overall: The overall index climbed to 53.2 from 48.5 in May. This is the sixth time in the past seven months that the index has risen above growth neutral. The index ranges between 0 and 100 with 50.0 representing growth neutral, and an RMI below the growth neutral threshold. 50.0, indicating negative growth for the month.

“Higher agriculture commodity prices and rebuilding from recent floods boosted the Rural Mainstreet Index (RMI) for the month. Furthermore, despite the negatives from the trade war, 69.4 percent of bankers support either raising, or continuing current tariffs,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Jeff Bonnett, president of Havana National Bank in Havana, Illinois, said it has been estimated that anywhere from 15 to 20 million acres were not planted in corn.

According to Bonnett, “Based upon this information, corn prices should be in the $5.75 to $6 (or more) a bushel range. What are we missing? Will the true corn acres planted be revealed after the required certification through FSA due by July 15th?”

The June farm equipment-sales index increased to 35.7 from May’s 31.3. This marks the 70th straight month the reading has fallen below growth neutral 50.0.

Banking: Borrowing by farmers for June remained very strong. The borrowing index fell to a strong 72.6 from May’s 79.7 and April’s record high 81.3. The checking-deposit index rose to 50.0 from May’s 42.4, while the index for certificates of deposit and other savings instruments rose slightly to 51.6 from 51.5 in May.

Hiring: The employment gauge climbed to a very strong 64.5 from May’s 61.8. Despite tariffs and flooding over the past several months, Rural Mainstreet businesses continue to hire at a solid pace.

Over the past 12 months, the Rural Mainstreet economy added jobs at a 0.2 percent pace compared to a higher 1.3 percent for urban areas of the same 10 states. Rural areas in four Rural Mainstreet states, Iowa, Missouri, Nebraska and Illinois, lost jobs over the past 12 months.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, expanded to 53.3 from May’s abysmal 38.2, indicating a positive, but somewhat weak economic outlook among bankers.

Home and Retail Sales: The home-sales index increased to a very strong 69.4 from May’s healthy 63.2. The retail sales index for June advanced to a healthy 58.1 from May’s 44.1. “It appears that the region is experiencing a rebound from recent low retail sales resulting from floods for several states in the region,” said Goss.

Each month, community bank presidents and CEOs in nonurban agriculturally and energy-dependent portions of a 10-state area are surveyed regarding current economic conditions in their communities and their projected economic outlooks six months down the road. Bankers from Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming are included.

Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index (RMI) for June rose to 54.2 from 49.6 in May. The farmland and ranchland-price index climbed to 45.0 from 41.3. Colorado’s hiring index for June climbed to 70.7 from May’s 61.3. Dale Leighty, CEO and chairman of the First National Bank of Las Animas said, “Land values are up because of demand for hemp/marijuana production in Colorado.” Illinois: The June RMI for Illinois increased to 51.0 from May’s 46.3. The farmland-price index rose to 44.1 from 40.5 in May. The state’s new-hiring index fell to 49.5 from last month’s 52.7. Jim Eckert, president of Anchor State Bank in Anchor, reported, “Planting is mostly complete in our area, but areas north and south of us are significantly behind in planting.” Iowa: The June RMI for Iowa expanded to 51.1 from May’s 46.5 Iowa’s farmland-price index sank to 44.1 from May’s 47.2. Iowa’s new-hiring index for June slumped to 48.9 from 53.1 in May. According to James Brown, CEO of Hardin County Savings Bank in Eldora, “If our farmers take advantage of improved corn prices, it will be a much better year for our customers. That will certainly vary region to region depending on planting conditions and ultimate yields.” Kansas: The Kansas RMI for June climbed to 51.6 from May’s 48.9. The state’s farmland-price index grew to 44.3 from 40.7 in May. The new-hiring index for Kansas advanced to 56.8 from 54.4 in May. Minnesota: The June RMI for Minnesota climbed to 53.8 from May’s 52.3. Minnesota’s farmland-price index rose to 44.8 from 41.2 in May. The new-hiring index for June expanded to 68.9 from May’s 60.6. Daniel Otten, chairman and CEO of Farmers State Bank in Albert Lea, reported that, “Our specific area within 30-mile radius did not experience the spring rains and all crops are planted and in 80% good to excellent condition. Far better than the rest of cornbelt.” | Missouri: The June RMI for Missouri climbed to 48.0 from 43.3 in May. The farmland-price index for the state increased to 43.3 from May’s 39.7. Missouri’s new-hiring index for June rose to 47.1 from May’s 44.7. Nebraska: The Nebraska RMI for June expanded to 50.6 from May’s 45.9. The state’s farmland-price index increased to 44.0 from last month’s 40.4. Nebraska’s new-hiring index declined to 49.5 from May’s 51.5. North Dakota: The North Dakota RMI for June improved to 55.7 from May’s 51.0. The state’s farmland-price index increased to 45.4 from 41.7 in May. The state’s new-hiring index soared to 67.7 from 65.2 in May. South Dakota: The June RMI for South Dakota remained above growth neutral, and climbed to 54.9 from May’s 50.2. The state’s farmland-price index improved to 45.1 from May’s 41.5. South Dakota’s new-hiring index advanced to 65.4 from 63.0 in May. Wyoming: The June RMI for Wyoming expanded to 55.4 from May’s 50.7. The June farmland and ranchland-price index increased to 45.3 from May’s 41.6. Wyoming’s new-hiring index expanded to 66.8 from 64.3 in May. |

RSS Feed

RSS Feed