- Overall index climbs to highest reading for 2019. It also marked the fourth time in the past five months that the overall index has risen above growth neutral.

- The trade war with China and the lack of passage of the USMCA are driving confidence and the economic outlook lower for most areas of the region.

- On average, bankers, expect a 1.3% expansion with 17.1% of bank CEOs anticipating a decline in retail sales from last year.

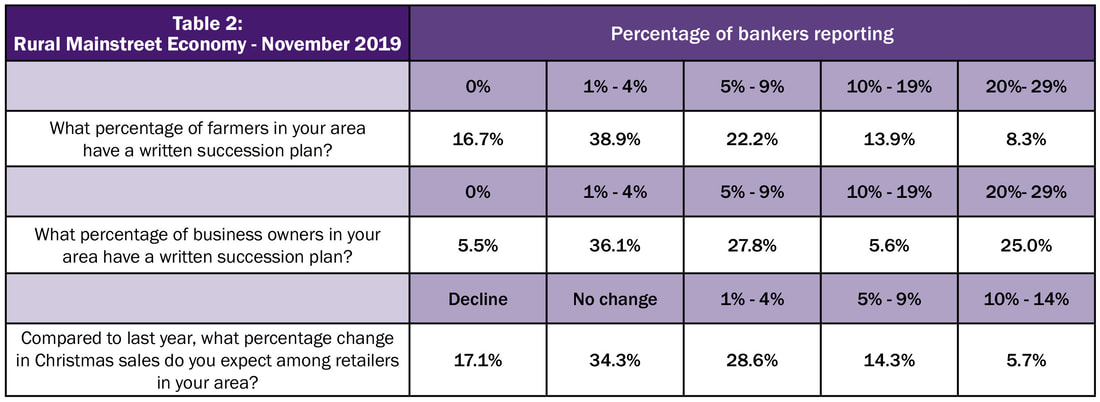

- Bankers reported that approximately 16.7% of farmers and 5.5% of business owners in their area had no organization succession plan.

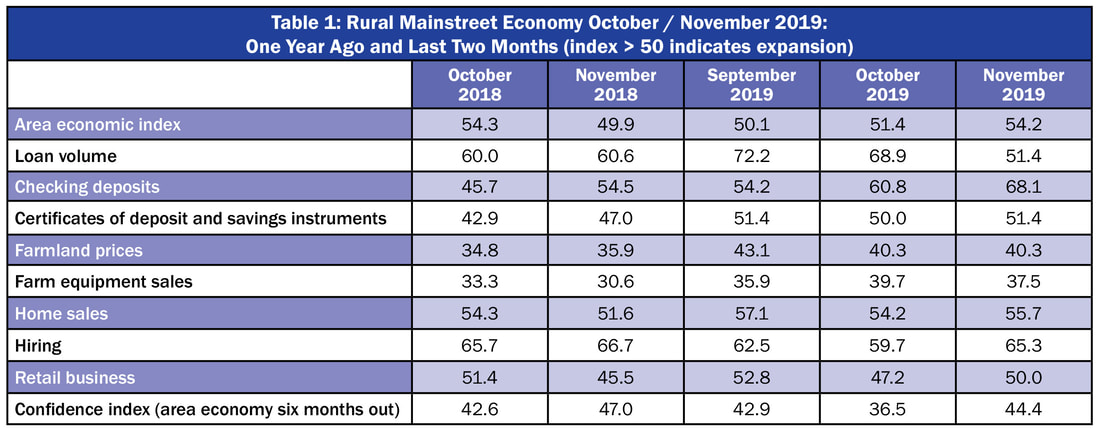

Overall: The overall index rose to 54.2 from 51.4 in October. Although still tepid, this is the highest reading for 2019. It also marked the fourth time in the past five months that the overall index rose above growth neutral.

“Federal agriculture crop support payments and somewhat higher grain prices have boosted the Rural Mainstreet Index slightly above growth neutral for the month. Given a continued weak rural economy, bank CEOs, on average, expect holiday buying to increase by only 1.3% above last year’s levels,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Jeff Bonnett, president of Havana National Bank in Havana, Illinois, reported that, “The latest harvests are showing significant declines in test weights leading to the point that 2019 harvest production looks to be running below average.” Bonnett goes on to say that grain prices are still sitting at extremely low levels for such yields.

Farming and Ranching: The farmland and ranchland-price index for November increased slightly to a weak 40.4 from October’s 40.3. This is the 72nd straight month the index has remained below growth neutral 50.0.

The November farm equipment-sales index declined to 37.5 from October’s 39.7. This marks the 74th month the reading has remained below growth neutral 50.0.

Bankers reported that approximately 16.7% of farmers and 5.5% of business owners in their area had no organization succession plan.

Hiring: The employment gauge expanded to a very strong 65.3 from October’s healthy 59.7. Despite the trade war and flooding over the past several months, Rural Mainstreet businesses continue to hire at a solid pace.

Over the past 12 months, the Rural Mainstreet economy added jobs at a 0.9% pace, or well below the pace of urban area growth of 1.1% for the same period. Rural areas of two Mainstreet states, Missouri, and Nebraska, lost jobs over the past 12 months.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, increased to a still weak 44.4 from October’s 36.5, and continues to indicate a very negative economic outlook among bankers. “The trade war with China and the lack of passage of the USMCA (NAFTA’s replacement) are driving confidence and the economic outlook lower for most areas of the region,” said Goss.

Said Joseph Anglin, CFO of the Pioneer Bank & Trust in Black Hills, South Dakota, “The Democrats impeachment debacle is putting a negative damper on the country and hurting peoples’ outlook. Hopefully when their process is done, our customers outlook will improve again from the current damper.”

Home and Retail Sales: The home-sales index climbed to a healthy 55.7 from October’s 54.2. The retail sales index for November increased to 50.0 from 47.2 in October.

This month bankers were asked to project the change in holiday retail sales from last year’s buying season. On average, bankers expect a 1.3% expansion with 17.1% of bankers anticipating a decline in retail sales from last year.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index (RMI) for November advanced to 58.0 from October’s 55.5. The farmland and ranchland-price index slipped to 41.2 from October’s 41.3. Colorado’s hiring index for November climbed to 71.8 from 67.8 in October. Over the past 12 months rural areas in Colorado have experienced job growth of 3.7% compared to a somewhat weaker, but still healthy, 1.9% for urban areas of the state. Illinois: The November RMI for Illinois rose to 54.5 from 51.1 in October. The farmland-price index increased to 40.3 from October’s 40.1. The state’s new-hiring index expanded to 62.5 from last month’s 56.0. Over the past 12 months rural areas in Illinois have experienced job gains of 2.4% compared to a weaker 0.9% for urban areas of the state. Jim Eckert, president of Anchor State Bank in Anchor, said, “Harvest is largely complete in our area. Corn is down slightly in yields from recent years. Soybean yields are down 10-20%.” Iowa: The November RMI for Iowa increased to 52.5 from October’s 49.6. Iowa’s farmland-price index was unchanged from October’s 39.7. Iowa’s new-hiring index for November advanced to 57.1 from October’s 52.1. Over the past 12 months rural areas in Iowa have experienced job additions with a gain of 0.2% compared to a stronger 0.9% for urban areas of the state. Kansas: The Kansas RMI for November improved to 55.0 from 51.5 in October. The state’s farmland-price index sank to 39.3 from October’s 40.2. The new-hiring index for Kansas slipped to 56.7 from 57.0 in October. Over the past 12 months rural areas in Kansas have experienced job additions of 1.3% compared to a stronger 1.5% for urban areas of the state. Minnesota: The November RMI for Minnesota advanced to 55.3 from October’s 52.7. Minnesota’s farmland-price index was unchanged from October’s 40.5. The new-hiring index for November climbed to 64.6 from October’s 60.1. Over the past 12 months rural areas in Minnesota have experienced job growth of 1.2% compared to job losses amounting to minus 0.1% for urban areas of the state. According to Lonnie Clark, president of the State Bank of Chandler, “After the wet spring and wind this summer and fall, the corn was down and hard to combine and the yields are down with the corn.” | Missouri: The November RMI for Missouri rose to growth neutral 50.0 from 44.7 in October. The farmland-price index sank to 39.1 from October’s 39.2. Missouri’s new-hiring index for November increased to 49.1 from October’s 46.3. Over the past 12 months rural areas in Missouri have experienced job losses with job reductions of minus 1.9% compared to a much stronger gain of 1.5% for urban areas of the state. Nebraska: The Nebraska RMI for November rose to 51.0 from October’s 48.5. The state’s farmland-price index sank to 39.3 from last month’s 44.6. Nebraska’s new-hiring index fell to 48.6 from October’s 49.1. Over the past 12 months rural areas in Nebraska have lost jobs at a rate of minus 1.6% compared to a gain of 2.0% for urban areas of the state. North Dakota: The North Dakota RMI for November expanded to 55.0 from October’s 51.6. The state’s farmland-price index increased to 40.5 from 40.3 in October. The state’s new-hiring index advanced to 63.9 from October’s 57.7. Over the past 12 months rural areas in North Dakota have experienced job growth of 1.1% compared to 0.1% for urban areas of the state. South Dakota: The November RMI for South Dakota moved above growth neutral for the month, expanding to regional high of 56.2 from October’s 54.3. The state’s farmland-price index dipped 40.7 from October’s 40.9. South Dakota’s new-hiring index slipped to a very strong 63.5 from October’s 64.5. Over the past 12 months rural areas in South Dakota have experienced job growth of 1.4% compared to 2.2% for urban areas of the state. Wyoming: The November RMI for Wyoming advanced to 55.3 from October’s 53.3. The November farmland and ranchland-price index sank to 40.5 from October’s 40.7. Wyoming’s new-hiring index rose to 64.7 from October’s 61.8. Over the past 12 months rural areas in Wyoming have experienced job growth of 0.8% compared to a stronger 1.3% for urban areas of the state. |

RSS Feed

RSS Feed