- The May 2023 Rural Mainstreet Index (RMI) rose above growth neutral to its highest reading since May 2022.

- On average, bankers estimated that farmland prices in their area rose 4.3% over the past 12 months.

- On average, bankers expect farmland prices in their area to remain stagnant (0%) for the next 12 months.

- For the second straight month, checking deposits decreased to a record low.

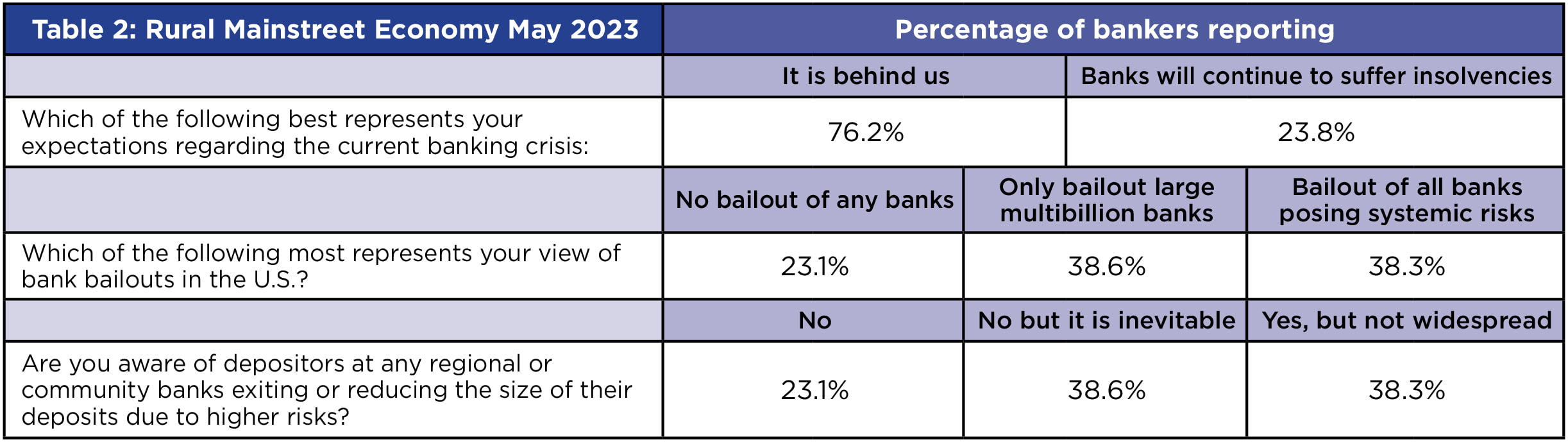

- Approximately 84.6% of bank CEOs expect banks to continue to report insolvency challenges.

- Between the 2008-09 banking crisis and December 2022, the region lost 41.5% of its banks through mergers and insolvencies.

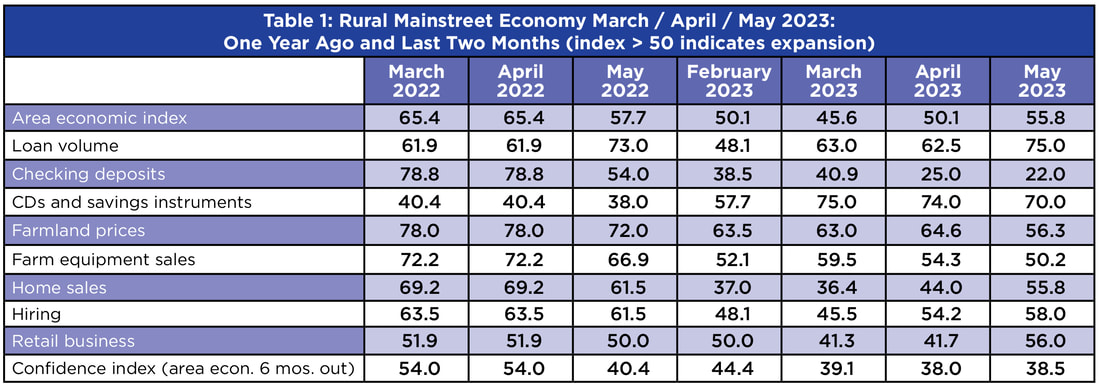

Overall: The region’s overall reading in May climbed to 55.8 from April’s 50.1. The index ranges between 0 and 100, with a reading of 50.0 representing growth neutral.

“The Rural Mainstreet economy continues to experience slow economic growth. Only 11.5% of bankers reported improving economic conditions for the month, with 88.5% indicating no change in economic conditions from April’s slow growth,” said Dr. Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Farming and Ranching Land Prices: The region’s farmland price index dropped to 56.3 from April’s 64.6. This was the 32nd straight month that the index has advanced above 50.0.

Bankers reported that non-pasture farmland prices in their area grew by an average of 4.3% over the past 12 months. The bankers responded negatively about the future by reporting an average expected price growth of 0.0% over the next 12 months.

Banking: The May loan volume index expanded to a strong 75.0 from 62.5 in April. The checking-deposit index plummeted to a second consecutive low of 22.0 from April’s 25.0, while the index for certificates of deposit and other savings instruments declined to 70.0 from April’s 74.0.

“Two consecutive record low checking deposit indices point to higher deposit outflows, even for community banks,” said Goss.

Only 15.4% of bank CEOs anticipate the end of the banking insolvency crisis while the remaining 84.6% expect banks to continue to report insolvency challenges.

James Brown, CEO of Hardin County Savings in Eldora, Iowa, said, “The liquidity problem will continue for some time, and we will see more regulation because of it. And as a bonus for their (regulators) being late to the table, we will all pay higher FDIC payments for as long as we can see.”

Jeff Bonnett, CEO of Havana National Bank in Havana, Ill., said, “I hope that the ICBA and state community bank associations can be successful in clarifying my point as ‘community banks’ should NOT pay for this big bank mess with increased FDIC assessments.”

Hiring: The new hiring index for May climbed to 58.0 from 54.2 in April. Labor shortages continue to be a significant issue constraining growth for Rural Mainstreet businesses. Over the past 12 months, the Rural Mainstreet Economy has expanded jobs by 2.5% compared to a lower 1.9% for urban areas of the same 10 states.

Other quotes from bank CEOs for the month:

- Jeffrey Gerhart, former Chair of the Independent Community Bankers of America said, “Winter snow cover and recent rains in northeast Nebraska are a welcome change from the dry weather of the past couple of years. While flooding could create problems, the farming community appreciates the moisture.”

- Mike Van Erdewyk, CEO of Breda Savings Bank in Breda, Iowa, said, “Federal Reserve rate changes are being perceived as ‘paper cuts’ and not solving the problem.”

Home and Retail Sales: The home-sales index climbed to 55.8 from April’s 44.0. “After 11 straight months of below growth neutral readings, the home-sales index bounced above the threshold,” said Goss.

The retail-sales index for May expanded to 56.0 from April’s weak 41.7. “Bankers were pessimistic regarding the economic outlook for retail sales for the second quarter after an anemic quarter one,” said Goss.

| Colorado: Colorado’s RMI for May climbed to 65.3 from April’s 53.1. The farmland- and ranchland-price index for May fell to 57.8 from April’s 65.6. The state’s new hiring index was 57.7, up from 54.9 in April. Between the 2008-09 banking crisis and December 2022, Colorado lost 54.7% of its banks through mergers and insolvencies, ending 2022 with 12 banks per million in population. Illinois: The May RMI for Illinois increased to 53.5 from April’s 49.6. The farmland-price index sank to 54.5 from 61.9 in April. The state’s new-hiring index rose to 61.4 from 50.5 in April. Between the 2008-09 banking crisis and December 2022, Illinois lost 44.0% of its banks through mergers and insolvencies, ending 2022 with 30 banks per million in population. Iowa: Iowa’s May RMI expanded to 50.8 from 44.8 in April. Iowa’s farmland-price index sank to 50.6 from April’s 57.4. Iowa’s new-hiring index for May moved higher to 48.8 from 44.8 in April. Between the 2008-09 banking crisis and December 2022, Iowa lost 36.3% of its banks through mergers and insolvencies, ending 2022 with 78 banks per million in population. Kansas: The Kansas RMI for May climbed to 57.9 from April’s 52.1. The state’s farmland-price index sank to 55.7 from 63.3 in April. The May new-hiring index for Kansas rose to 55.1 from 52.1 in April. Between the 2008-09 banking crisis and December 2022, Kansas lost 41.2% of its banks through mergers and insolvencies, ending 2022 with 71 banks per million in population. Minnesota: The May RMI for Minnesota soared to 59.0 from April’s 50.9. Minnesota’s farmland-price index climbed to 64.2 from 62.8 in April. The new-hiring index for May rose to 55.5 from 54.7 in April. Between the 2008-09 banking crisis and December 2022, Minnesota lost 42.2% of its banks through mergers or insolvencies, ending 2022 with 45 banks per million in population. | Missouri: The state’s May RMI climbed to 47.7 from 41.3 in April. The farmland-price index fell to 52.8 from April’s 60.6. The state’s new hiring gauge dipped to 51.6 from 53.2 in April. Between the 2008-09 banking crisis and December 2022, Missouri lost 41.0% of its banks through mergers and insolvencies, ending 2022 with 34 banks per million in population. Nebraska: The Nebraska RMI advanced above growth neutral to 66.0 from 52.7 in April. The state’s farmland-price index for May sank to 58.0 from April’s 65.4. Nebraska’s May new-hiring index grew to 72.0 from 57.8 in April. Between the 2008-09 banking crisis and December 2022, Nebraska lost 39.9% of its banks through mergers and insolvencies, ending 2022 with 76 banks per million in population. North Dakota: North Dakota’s RMI for May declined to 54.8 from April’s 55.7. The state’s farmland-price index slumped to 54.8 from 61.4 in April. The state’s new-hiring index climbed to 62.5 from 57.8 in April. Between the 2008-09 banking crisis and December 2022, North Dakota lost 34.0% of its banks through mergers and insolvencies, ending 2022 with 82 banks per million in population. South Dakota: The May RMI for South Dakota increased to 46.7 from 39.5 in April. The state’s farmland-price index sank to 52.6 from April’s 59.8. South Dakota’s May new hiring index expanded to a healthy 55.6 from 47.8 in April. Between the 2008-09 banking crisis and December 2022, South Dakota lost 36.0% of its banks through mergers and insolvencies, ending 2022 with 63 banks per million in population. Wyoming: The May RMI for Wyoming grew to 53.7 from 44.5 in April. The May farmland- and ranchland-price index declined to 54.5 from 61.9 in April. Wyoming’s new-hiring index soared to 61.5 from April’s 50.5. Between the 2008-09 banking crisis and December 2022, Wyoming lost 34.9% of its banks through mergers and insolvencies, ending 2022 with 48 banks per million in population. |

RSS Feed

RSS Feed