- For the 17th straight month, the Rural Mainstreet Index remained below growth neutral.

- Almost one-third of bank CEOs indicated that soaring loan defaults represented the greatest Rural Mainstreet banking threat for 2017.

- Almost nine of ten bankers reported that low agriculture commodity represented the biggest threat to the rural economic for 2017.

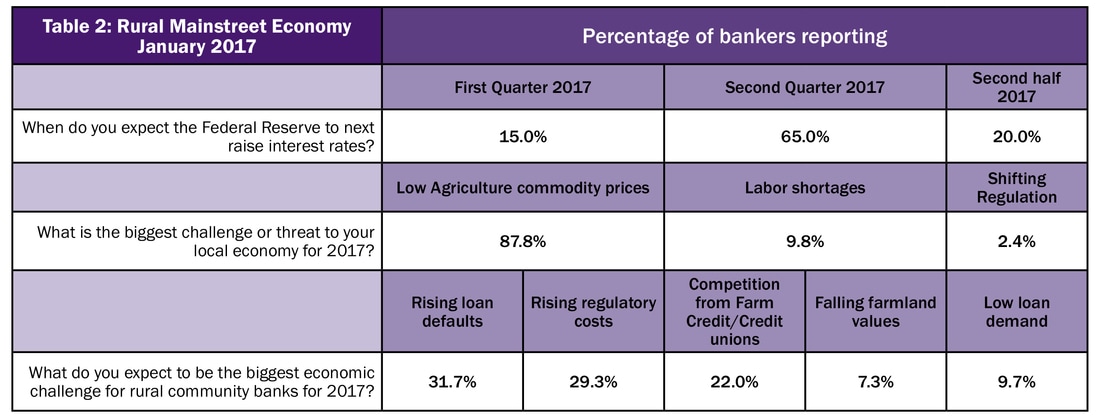

- Eighty percent of bankers expect the Federal Reserve to raise interest rates in the first half of 2017.

- States with January Rural Mainstreet expansions: Illinois, Iowa, Missouri, Nebraska, and South Dakota; States with January Rural Mainstreet contractions: Colorado, Kansas, Minnesota, North Dakota and Wyoming.

OMAHA, Neb. (Jan. 19, 2017) – The Creighton University Rural Mainstreet Index remained weak with a reading below growth neutral for the 17th straight month, according to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy.

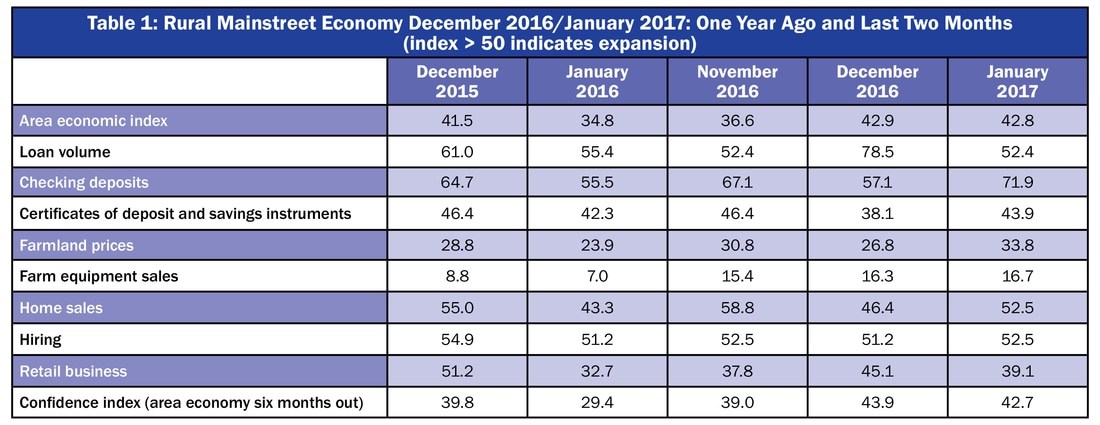

Overall: The index, which ranges between 0 and 100 slipped to 42.8 from 42.9 in December. This was the 17th straight month the economic gauge dipped below growth neutral 50.0.

“The overall index was virtually flat from last month. Over the past 12 months, livestock commodity prices have tumbled by 7.3 percent and grain commodity prices have slumped by 11.7 percent. The economic fallout from this price weakness continues to push growth into negative territory for five of the 10 states in the region,” said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University's Heider College of Business.

When asked to identify the greatest economic threat to their local economy 87.8 percent of the bankers, indicated that continuing low agriculture commodity prices was the greatest challenge or threat for 2017.

States with January Rural Mainstreet expansions: Illinois, Iowa, Missouri, Nebraska, and South Dakota; States with January Rural Mainstreet contractions: Colorado, Kansas, Minnesota, North Dakota and Wyoming.

The January farm equipment-sales index increased to 16.7 from 16.3 in December.

“Since July 2013, weakness in farm income and low agricultural commodity prices have restrained the sale of agricultural equipment across the region. This is having a significant and negative impact on both farm equipment dealers and agricultural equipment manufacturers across the region,” said Goss.

Banking: Borrowing by farmers remained above growth neutral for January, but is growing at a much slower pace than for December as the January loan-volume index fell to 52.4 from last month’s 78.5. The checking-deposit index climbed to 71.9 from 57.1 in December while the index for certificates of deposit and other savings instruments increased to 43.9 from 38.1 in December.

This month bankers were asked to name the biggest challenge to rural community banks in 2017. Almost one third, or 31.7 percent, indicated escalating loan defaults represented the greatest challenge to Rural Mainstreet banks in 2017.

Pete Haddeland, CEO of the First National Bank in Mahnomen, Minnesota, said, “The longer we stay in this Ag cycle, the more problems Banks will see.”

Eighty percent of bankers expect the Federal Reserve to raise interest rates in the first half of 2017. The remaining 20 percent anticipate the next interest rate increase to occur in the second half of 2017.

Hiring: The job gauge rose to 52.5 from December’s 51.2. For the region, Rural Mainstreet employment is down by 0.6 percent over the past 12 months. Over the same period of time, urban employment for the region expanded by 1.2 percent.

Confidence: The confidence index, which reflects expectations for the economy six months out, sank to 42.7 from 43.9 in December indicating a continued pessimistic outlook among bankers. “Until agricultural commodity prices begin to trend higher, I expect banker’s economic outlook to remain weak,” said Goss.

Home and Retail Sales: Home sales moved higher for the Rural Mainstreet economy for January with a reading of 52.5 from December’s 46.4. The January retail-sales index fell to 39.1 from December’s 45.1.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) rose to 38.7 from 24.9 in December. The farmland and ranchland-price index increased to 43.8 from December’s 25.5. Colorado’s hiring index for January rose to 58.3 from December’s 55.2. Colorado job growth over the last 12 months; Colorado Rural Mainstreet, -2.7 percent; Urban Colorado, 2.8 percent. Illinois: The January RMI for Illinois improved to a regional high of 63.2 from 34.2 in December. The farmland-price index climbed to 34.6 from December’s 17.9. The state’s new-hiring index rose to 55.0 from last month’s 52.4. Illinois job growth over the last 12 months; Illinois Rural Mainstreet, +1.4 percent; Urban Illinois 0.6 percent. Iowa: The January RMI for Iowa fell to 50.2 from 63.5 in December. Iowa’s farmland-price index for January fell to 48.6 from 49.3 in December. Iowa’s new-hiring index for January slipped to a still strong 60.1 from December’s 63.9. Iowa job growth over the last 12 months; Iowa Rural Mainstreet, +0.4 percent; Urban Iowa, 0.8 percent. Kansas: The Kansas RMI for January increased to 29.6 from December’s 16.0. The state’s farmland-price index plummeted to 18.3 from 41.2 in December. The new-hiring index for Kansas rose to 49.0 from 47.9 in December. Kansas job growth over the last 12 months; Kansas Rural Mainstreet, -0.9 percent; Urban Kansas, no change. Minnesota: The January RMI for Minnesota sank to a weak 39.0 from December’s 41.7. Minnesota’s farmland-price index climbed to 30.1 from 24.0 in December. The new-hiring index for the state slipped to a still solid 53.3 from last month’s 54.7. Minnesota job growth over the last 12 months; Minnesota Rural Mainstreet, -0.3 percent; Urban Minnesota 1.4 percent. | Missouri: The January RMI for Missouri advanced to 51.3 from 27.1 in December. The farmland-price index slumped to 19.9 from December’s 37.9. Missouri’s new-hiring index rose to 49.6 from 39.6 in December. Missouri job growth over the last 12 months; Missouri Rural Mainstreet, +0.6 percent; Urban Missouri 2.2 percent. Nebraska: The Nebraska RMI for January expanded to 52.6 from December’s 51.4. The state’s farmland-price index rose to 37.7 from December’s 29.6. Nebraska’s new-hiring index declined to a healthy 56.1 from 56.7 in December. Nebraska job growth over the last 12 months; Nebraska Rural Mainstreet, +0.7 percent; Urban Nebraska, 1.3 percent. North Dakota: The North Dakota RMI for January sank to 37.9 from December’s 38.9. The farmland-price index increased to 31.2 from December’s 29.9. North Dakota’s new-hiring index increased to 34.0 from 32.1 in December. North Dakota job growth over the last 12 months; North Dakota Rural Mainstreet, -4.7 percent; Urban North Dakota, 0.5 percent. South Dakota: The January RMI for South Dakota fell to a healthy 56.9 from December’s 60.5. The farmland-price index climbed to 43.4 from December’s 39.7. South Dakota's new-hiring index slipped to a healthy 58.2 from December’s 60.4. South Dakota job growth over the last 12 months; South Dakota Rural Mainstreet, +0.9 percent; Urban South Dakota, 3.6 percent. Wyoming: The January RMI for Wyoming increased to a weak 37.8 from 30.6 in December. The January farmland and ranchland-price index fell to 24.5 from December’s 35.6. Wyoming’s new-hiring index slipped to 42.8 December’s 43.0. Wyoming job growth over the last 12 months; Wyoming Rural Mainstreet, -2.5 percent; Urban Wyoming, -4.3 percent. |

RSS Feed

RSS Feed