- The overall index rose to highest level since July 2015.

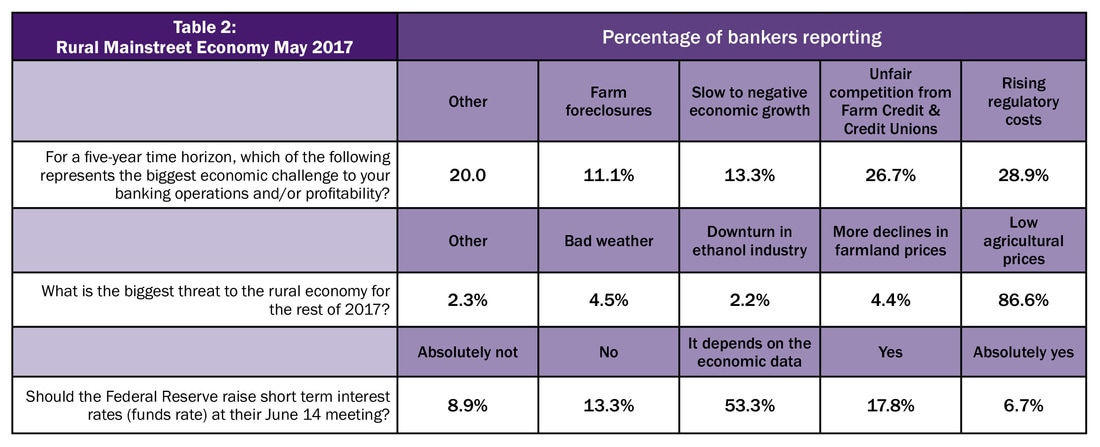

- Almost one in four bank CEOs said the Federal Reserve should raise short-term interest rates at June meetings.

- Agriculture equipment-sales index jumped to its highest level in more than two years.

- Approximately 28.9 percent of bankers named rising regulatory costs as the biggest challenge to banking operations over the next 5 years.

- Approximately 11.1 percent of bankers reported farm foreclosures represented the greatest risk to banking operations, more than double the 4.5 percent who identified such foreclosures as the greatest risk in May 2016 survey.

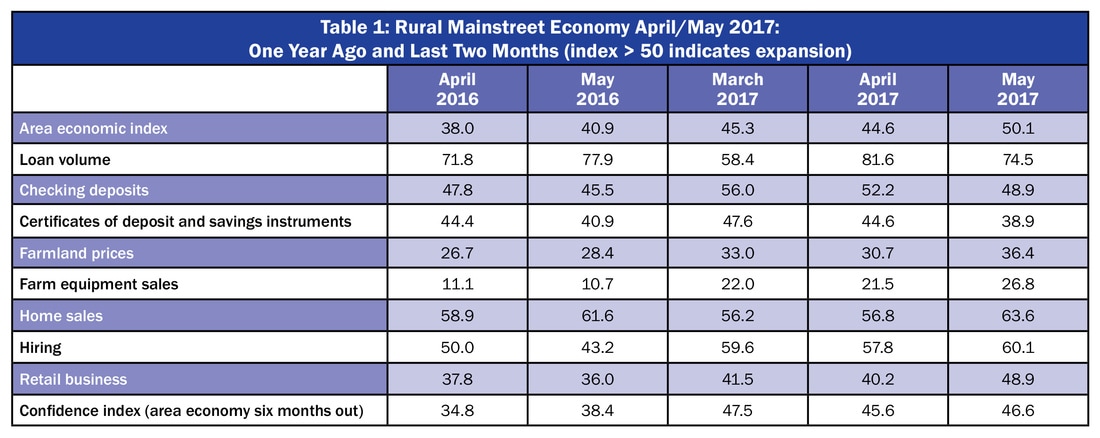

Overall: The index, which ranges between 0 and 100, climbed to 50.1 from 44.6 in April. May’s reading was the highest recorded reading since July 2015. The last time the overall index was at or above growth neutral was August 2015.

“Stabilizing and slightly improving farm commodity prices helped push the overall index into a weak but above growth neutral for May,” said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University's Heider College of Business. “The U.S. Department of Agriculture is projecting that net U.S. farm income will sink by 8.7 percent to $62.3 billion for 2017, the fourth consecutive year of declines after reaching a record high in 2013. This downward trend has weighted on our survey results for almost two years.”

This month, and in May 2016, bank CEOs were asked to name the biggest economic challenge to their banking operations over the next five years. The largest share of bankers, or 28.9 percent, named rising regulatory costs as the top challenge or risk. This is almost the same percent as 2016. More than one in five, or 26.7 percent, detailed government subsidized competition from Farm Credit and credit unions as the greatest challenge, or almost double the 13.6 percent reported in May 2016.

The May farm equipment sales index increased to 26.8 from 21.5 in April. This marks the 45th consecutive month the reading has fallen below growth neutral 50.0, and is the highest recorded reading since January 2015.

Banking: Borrowing by farmers was very strong for May as the loan-volume index fell to a strong 74.5 from last month’s record 81.6. The checking-deposit index slumped to 48.9 from 52.2 in April, while the index for certificates of deposit and other savings instruments rose to 46.6 from 44.5in April.

Almost one in four bank CEOs, or 24.5 percent, said the Federal Reserve should increase short-term interest rates at its next meeting on June 14. On the other hand, approximately 22.2 percent want the Fed to keep rates at current levels.

Jeffrey Gerhart, president and chairman of the Bank of Newman Grove in Nebraska and former Chairman of the Independent Community Bankers of America, said “The Federal Reserve needs to raise interest rates. They've been too low far too long.”

Hiring: The job gauge advanced to 60.1 from April’s 57.8. Rural Mainstreet businesses not linked to agriculture increased hiring for the month at a solid pace.

Confidence: The confidence index, which reflects expectations for the economy six months out, expanded to a weak 46.6 from 45.6 in April indicating a continued pessimistic outlook among bankers. “Until agricultural commodity prices begin to trend higher, I expect banker’s economic outlook to remain weak,” said Goss.

Home and Retail Sales: Home sales moved higher for the Rural Mainstreet economy for May with a reading of 63.6 compared to April’s 56.8. The May retail-sales index increased to 48.9 from April’s 40.2. “Much like their urban counterparts, Rural Mainstreet retailers are experiencing weak sales,” reported Goss.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) climbed to 48.4 from 41.8 in April. The farmland and ranchland-price index expanded to 35.2 from April’s 29.6. Colorado’s hiring index for May rose to 56.9 from April’s 55.9. Illinois: The May RMI for Illinois increased to 49.2 from 41.3 in April. The farmland-price index fell to 29.4 from April’s 30.5. The state’s new-hiring index advanced to 55.1 from last month’s 51.1. Iowa: The May RMI for Iowa climbed to 49.4 from 39.1 in April. Iowa’s farmland-price index for May slipped to 34.9 from 35.8 in May. Iowa’s new-hiring index for May climbed to 60.8 from April’s 51.5. Kansas: The Kansas RMI for May advanced to 48.8 from April’s 41.0. The state’s farmland-price index increased to 35.5 from 29.3 in April. The new-hiring index for Kansas jumped to 58.9 from 54.7 in April. Minnesota: The May RMI for Minnesota jumped to 50.6 from April’s 45.9. Minnesota’s farmland-price index rose to 36.7 from 31.2 in April. The new-hiring index for the state climbed to a strong 66.9 from last month’s 62.5. According to Pete Haddeland, CEO of the First National Bank in Mahnomen, “Planting is doing very well in our area,70 percent to 80 percent complete.” | Missouri: The May RMI for Missouri fell to 53.7 from 62.0 in April. The farmland-price index improved slightly to 38.8 from April’s 37.6. Missouri’s new-hiring index declined to a strong 80.8 from 88.2 in April. Nebraska: The Nebraska RMI for May jumped to 50.5 from 43.9 in April. The state’s farmland-price index rose to 36.7 from April’s 30.4. Nebraska’s new-hiring index expanded to 66.4 from 59.3 in April. North Dakota: The North Dakota RMI for May rose to 45.7 from April’s 25.3. The farmland-price index bounced higher to 33.4 from April’s 23.0. North Dakota’s new-hiring index rose to 45.1 from 29.5 in April. South Dakota: The May RMI for South Dakota climbed to 47.3 from April’s 41.9. The farmland-price index increased to 34.5 from April’s 29.6. South Dakota's new-hiring index sank to 52.1 from April’s 56.1. Wyoming: The May RMI for Wyoming advanced to 47.5 from April’s 36.5. The May farmland and ranchland-price index expanded to 34.7 from April’s 27.5. Wyoming’s new-hiring index climbed to 53.2 from 47.5 in April. |

RSS Feed

RSS Feed