- The overall index, while remaining below growth neutral, rose to its highest level since September 2015.

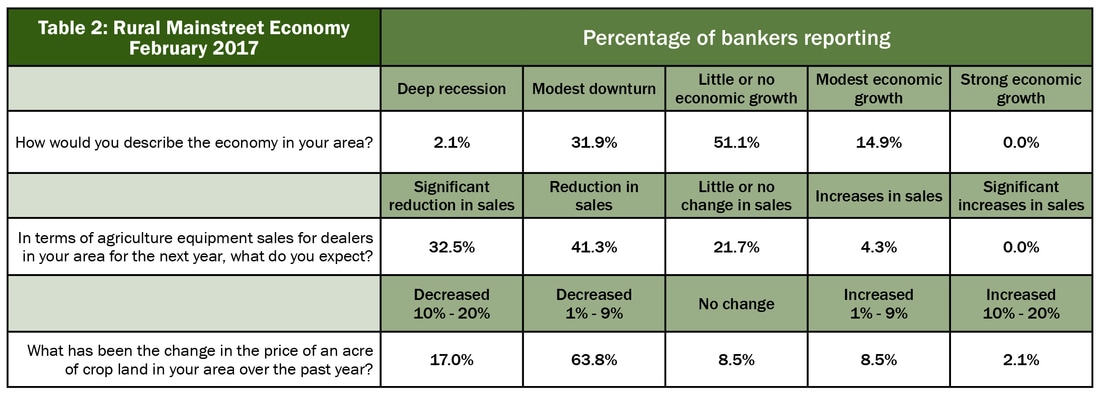

- More than one-third of bank CEOs reported their local economy remains in an economic downturn. Only 14.9 percent of bankers indicated their local economy was expanding.

- On average, farmland prices have declined by 5.1 percent over the past 12 months.

- Approximately 73.9 percent of bankers expect agriculture- equipment sales to continue to decline in their area over the next year.

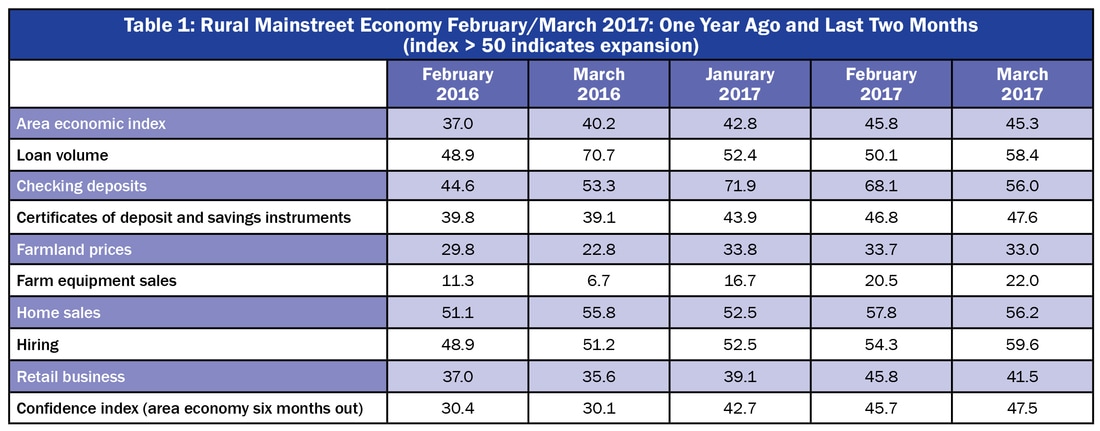

Overall: The index, which ranges between 0 and 100 advanced to 45.8 from 42.8 in January. This is the highest overall index since September 2015.

“Weak farm commodity prices continue to squeeze Rural Mainstreet economies. However, the negatives are getting less negative. Over the past 12 months, livestock commodity prices have tumbled by 9.4 percent and grain commodity prices have slumped by 6.3 percent, both an improvement over last month,” said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University's Heider College of Business.

Only 14.9 percent of bankers reported that their local economy was expanding. Approximately 34 percent indicated their local economy was in a recession with the remaining 51.1 percent indicating little or no economic growth.

According to Todd Douglas, CEO of the First National Bank in Pierre, South Dakota, “What we see in the agriculture industry is that farmers hurt the worst are those who farm small grain crops exclusively.” Douglas indicated operators that diversify in cattle, cattle feeding, hogs and other like type lines, are maintaining, or at least not experiencing as large a drop in net worth.

Bankers indicated that farmland prices in their area had declined by an average of 5.1 percent across the region over the past 12 months.

But there was a great deal of variation across the region. Pete Haddeland, CEO First National Bank in Mahnomen, Minnesota, for example, reported, “Land values are holding up here. We did not see the big prices increases.” He also indicated that farmers harvested great crops last year.

The February farm equipment-sales index increased to 20.5 from 16.7 in January.

Almost three-fourths of the bankers expect agriculture equipment sales to continue to decline over the next 12 months. Only 4.3 percent expect agriculture equipment sales to increase over the same period of time.

Banking: Borrowing by farmers remained above growth neutral for February, but is growing at a much slower pace than for January as the loan-volume index fell to 50.1 from last month’s 52.4. The checking-deposit index slipped to 68.1 from 71.9 in January, while the index for certificates of deposit and other savings instruments increased to 46.8 from 43.9 in January.

Despite weaker farm income, defaults remain relatively low. As stated by Don Reynolds, CEO of Regional Missouri Bank in Marceline, Missouri, “We are pleased that most of our farm customers have been able to meet payment obligations this year.”

Hiring: The job gauge rose to 54.3 from January’s 52.5. For the region, Rural Mainstreet employment is down by 0.6 percent over the past 12 months. Over the same period of time, urban employment for the region expanded by 1.2 percent.

Confidence: The confidence index, which reflects expectations for the economy six months out, improved to a weak 45.7 from 42.7 in January indicating a continued pessimistic outlook among bankers. “Until agricultural commodity prices begin to trend higher, I expect banker’s economic outlook to remain weak,” said Goss.

Home and Retail Sales: Home sales moved higher for the Rural Mainstreet economy for February with a reading of 57.8, which is up from January’s 52.5. The February retail-sales index increased to 45.8 from January’s 39.1.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) rose to 37.1 from 24.9 in January. The farmland and ranchland-price index soared to 66.6 from January’s 25.5. Colorado’s hiring index for January climbed to 68.2 from January’s 55.2. Illinois: The February RMI for Illinois improved to 46.4 from 34.2 in January. The farmland-price index grew to 34.8 from January’s 17.9. The state’s new-hiring index climbed to 56.7 from last month’s 52.4. Iowa: The February RMI for Iowa fell to 46.1 from 50.2 in January. Iowa’s farmland-price index for February sank to 40.1 from 48.6 in January. Iowa’s new-hiring index for February slipped to a still strong 58.6 from January’s 60.1. Kansas: The Kansas RMI for February increased to 40.8 from January’s 29.6. The state’s farmland-price index slumped to 16.8 from 18.3 in January. The new-hiring index for Kansas slipped to 48.3 from 49.0 in January. Minnesota: The February RMI for Minnesota climbed to 47.5 from January’s 39.0. Minnesota’s farmland-price index rose to 38.1 from 30.1 in January. The new-hiring index for the state jumped to 57.9 from last month’s 53.3. | Missouri: The February RMI for Missouri advanced to 55.9 from 51.3 in January. The farmland-price index jumped to 56.2 from January’s 19.9. Missouri’s new-hiring index rose to 64.4 from 49.6 in January. Nebraska: The Nebraska RMI for February declined to 47.1 from 52.6 in January. The state’s farmland-price index rose to 39.3 from January’s 37.7. Nebraska’s new-hiring index climbed 58.3 from 56.1 in January. North Dakota: The North Dakota RMI for February increased to 38.0 from January’s 37.9. The farmland-price index sank to 19.9 from January’s 31.2. North Dakota’s new-hiring index increased to 38.1 from 34.0 in January. South Dakota: The February RMI for South Dakota fell to a healthy 55.9 from January’s 56.9. The farmland-price index climbed to 59.2 from January’s 43.4. South Dakota's new-hiring index advanced to 65.5 from January’s 58.2. Wyoming: The February RMI for Wyoming increased to a weak 42.3 from 37.8 in January. The February farmland and ranchland-price index fell to 22.3 from January’s 24.5. Wyoming’s new-hiring index increased to 46.1 from January’s 42.8. |

RSS Feed

RSS Feed