- After six consecutive months of below growth neutral readings, the region’s overall economic reading rose above the growth neutral threshold for a second straight month.

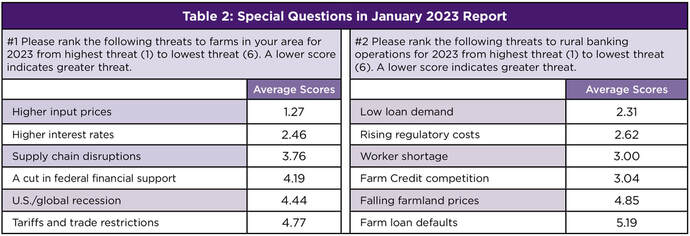

- In terms of 2023 threats to farms in their area, bank CEOs ranked higher input prices as the greatest threat, followed by higher interest rates.

- In terms of 2023 threats to rural bankers, bank CEOs ranked low loan demand as the greatest threat to rural banks, followed by rising regulatory costs.

- Farmland prices continued to expand.

- Despite higher interest rates, solid farm income pushed farm equipment sales higher.

Overall: The region’s overall reading in January rose above the growth neutral threshold. The January index climbed to 53.8 from 50.1 in December. The index ranges between 0 and 100, with a reading of 50.0 representing growth neutral.

Larry Winum, CEO of Glenwood State Bank in Glenwood, Iowa, said, “All indications are that the Fed is going to continue to raise rates to get inflation under control. I think they should tap the brakes after the first quarter of 2023 and let the economy catch its breath.”

Farming and Ranching: The region’s farmland price index climbed to 66.0 from December’s 65.4. This was the 28th straight month that the index has registered above 50.0.

Bankers expect strong farm economic conditions to continue. On average, bankers ranked falling farmland prices and farm loan defaults as the lowest challenges to their banking operations for 2023.

James Brown, CEO of Hardin County Savings Bank in Eldora, Iowa, said, “Higher input costs are the only major problem on the near time horizon.”

Between 2021 and 2022, regional agriculture product exports expanded by 30.9% to $11.8 billion in 2022.

Farm Equipment Sales: As a result of strong farm financial conditions, the farm equipment-sales index climbed to 61.4, its highest level since June of last year, and up from 60.4 in December. The index has risen above growth neutral for 24 of the last 26 months.

Banking: The January loan volume index declined to a still solid 58.0 from 72.1 in December. The checking-deposit index increased to 70.0 from December’s 48.1, while the index for certificates of deposit and other savings instruments soared to 72.0, a record high, from 51.9 in December.

Joseph Anglin, Chief Financial Officer at Pioneer Bank & Trust in Rapid City, S.D., said, “One of the bigger challenges in many markets, much like Farm Credit, is the tax-exempt advantage of credit unions that don't follow their federal mandate.”

“Higher farm input costs, greater farm equipment sales and drought conditions in portions of the region supported strong borrowing from farmers. At the same time, higher interest rates encouraged greater CD purchases by farmers,” said Goss.

Hiring: The new hiring index for January increased to 53.9 from December’s 49.1. Labor shortages continue to be a significant issue constraining growth for Rural Mainstreet businesses. Despite labor shortages, Rural Mainstreet expanded non-farm employment by 3.3% over the past 12 months. This compares to 3.0% growth for urban areas of the same 10 states for the same period of time.

Confidence: The slowing economy, higher borrowing costs and labor shortages continued to constrain the business confidence index to a weak 40.4 from 29.6 in December. “Over the past 10 months, the regional confidence index has fallen to levels indicating a very negative outlook,” said Goss.

Home and Retail Sales: The home-sales index increased to a weak 38.5 from 33.3 in December. “This is the eighth straight month that the home-sales index has fallen below growth neutral. An almost doubling of the 30-year mortgage rate over the past year and low inventory levels slowed home sales in the region over that time period,” said Goss.

The retail-sales index for January climbed to 51.9 from December’s weak 45.5. “Even so, bankers were pessimistic regarding the economic outlook with downward pressure on retail sales for the first quarter of 2023,” said Goss.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) for January slipped to 69.4 from 69.6 in December. The farmland- and ranchland-price index climbed to 76.2 from 69.1 in December. Colorado’s new hiring index for January dropped to 61.9 from December’s 62.0. Between 2021 and 2022, agriculture product exports from Colorado expanded by 23.4% to $95 million in 2022. Illinois: The January RMI for Illinois sank to 45.8 from December’s 46.0. The farmland-price index climbed to 66.2 from 65.7 in December. The state’s new-hiring index dipped to 49.5 from December’s 49.6. Between 2021 and 2022, agriculture product exports from Illinois expanded by 86.2% to $3.3 billion in 2022. Iowa: Iowa’s January RMI increased to 56.3 from 54.2 in December. Iowa’s farmland-price index improved to 70.6 from December’s 69.2. Iowa’s new-hiring index for January moved upward to 55.1 from December’s 53.4. Between 2021 and 2022, agriculture product exports from Iowa expanded by 8.2% to $1.9 billion in 2022. Said James Brown, CEO of Hardin County Savings Bank in Eldora: “Farmer balance sheets continue the three-year trend of increasing working capital and net worth without raising the value on their financial statements.” Brown indicates that this will likely lower borrowing from farm customers. Kansas: The Kansas RMI for January expanded to a solid 54.1 from 49.9 in December. The state’s farmland-price index climbed to 69.7 from December’s 67.3. The new-hiring index for Kansas rose to 63.9 from 51.6 in December. Between 2021 and 2022, agriculture product exports from Kansas expanded by 3.3% to $2.0 billion in 2022. Minnesota: The January RMI for Minnesota increased to 44.5 from December’s 42.9. Minnesota’s farmland-price index rose to 65.6 from 64.4 in December. The new-hiring index for January increased slightly to 48.9 from 48.0 in December. Between 2021 and 2022, agriculture product exports from Minnesota expanded by 104% to $1.3 billion in 2022. | Missouri: Missouri’s January RMI dropped to 59.2 from 63.9 in December. The farmland-price index fell to 71.9 from December’s 73.3. The state’s new hiring gauge shrank to 56.6 from 59.0 in December. Between 2021 and 2022, agriculture product exports from Missouri expanded by 6.4% to $1.0 billion in 2022. Nebraska: The Nebraska Rural Mainstreet Index moved above growth neutral to 53.6 from 50.3 in December. The state’s farmland-price index for January was unchanged from 69.5 in December. Nebraska’s January new-hiring index increased to 53.7 from 51.9 in December. Between 2021 and 2022, agriculture product exports from Nebraska expanded by 13.5% to $1.3 billion in 2022. North Dakota: North Dakota’s RMI for January fell to 58.9 from December’s 60.4. The state’s farmland-price index slipped to 71.7 from 71.8 in December. The state’s new-hiring index declined to 56.4 from 57.1 in December. Between 2021 and 2022, agriculture product exports from North Dakota expanded by 16.1% to $830 million in 2022. South Dakota: The January RMI for South Dakota increased to 43.3 from 41.7 in December. The state’s farmland-price index climbed to 65.1 from December’s 63.9. South Dakota’s January hiring index rose to a weak 48.3 from 47.4 in December. Between 2021 and 2022, agriculture product exports from South Dakota expanded by 100.0% to $102 million in 2022. Wyoming: The January RMI for Wyoming slumped to 47.7 from 49.4 in December. The January farmland- and ranchland-price index decreased to 67.0 from 67.2 in December. Wyoming’s new-hiring index slipped to 50.5 from December’s 51.4. Between 2021 and 2022, agriculture product exports from Wyoming expanded by 100.0% to $4 million in 2022. |

Follow Ernie Goss on Twitter www.twitter.com/erniegoss

RSS Feed

RSS Feed