- For a sixth straight month the overall index rose above growth neutral.

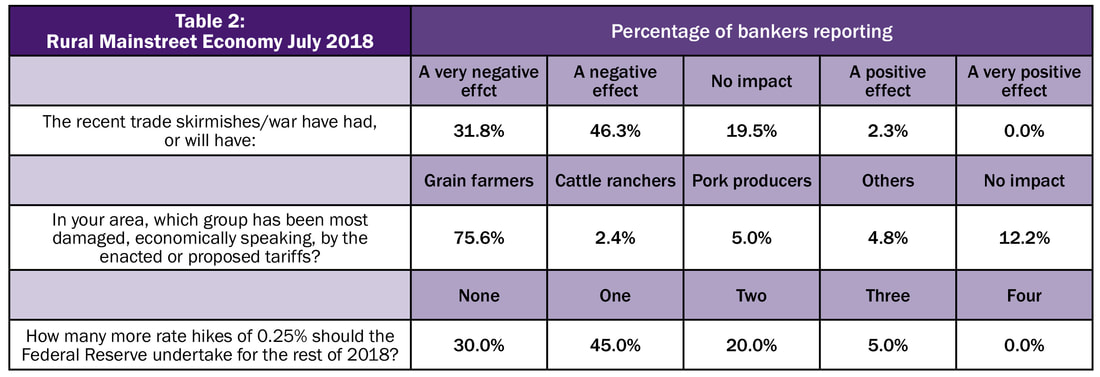

- Almost one-third of bank CEOs recommended that the Federal Reserve leave short-term interest rates at their current levels for the rest of the year.

- More than three of five, or 78 percent, of bank CEOs reported that current trade skirmishes and rising tariffs have had a negative impact on their local economy.

- Approximately 75.6 percent of bankers reported negative impacts of trade rifts and tariffs on grain farmers in their area.

- Economic confidence plummeted among bankers for the month.

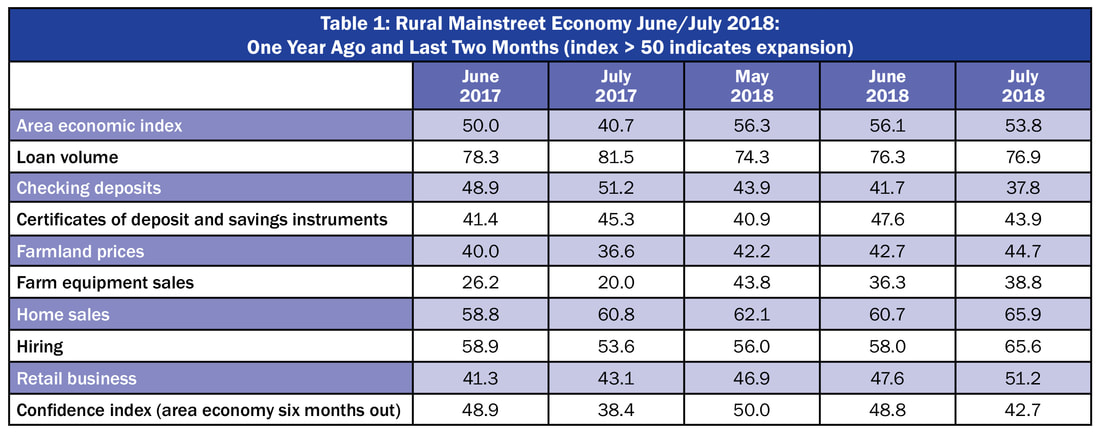

Overall: The overall index slid to 53.8 from 56.1 in June. The index ranges between 0 and 100 with 50.0 representing growth neutral.

“Surveys over the past several months indicate the Rural Mainstreet economy is solid but with less positive economic growth. However, the negative impacts of recent trade skirmishes have begun to surface with the weakening of already anemic grain prices,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Pete Haddeland, CEO of the First National Bank in Mahnomen, Minnesota, said, “Grain prices are at, in some cases, 10-year lows. Not good.”

According to Fritz Kuhlmeier, CEO of Citizens State Bank in Lena, Illinois, “The trade issues/tariffs have been devastating on our local dairy industry when tacked on top of already below cost or breakeven milk prices.”

The July farm equipment-sales index increased to 38.8 from June’s 36.3. This marks the 59th consecutive month the reading has moved below growth neutral 50.0.

Many bankers reported good, or above average rainfall, with crop production off to a good start. Furthermore, in portions of the region, the recreation industry was boosting the economy.

Banking: Borrowing by farmers expanded for July as the loan-volume index rose slightly to 76.9 from 76.3 in June. The checking-deposit index slumped to 37.8 from June’s 41.7, while the index for certificates of deposit and other savings instruments slid to 43.9 from 47.6 in June.

This month bankers were asked, “How many times should the Federal Reserve raise interest rates for the rest of 2018?”

“Almost one-third, or 30 percent of bank CEOs recommended keeping rates at their current level, 45 percent suggested one additional interest rate increase, 20 percent supported two additional rate hikes and 5 percent recommended three more rate increases for 2018,” said Goss.

Hiring: The employment gauge improved to a very strong 65.6 from June’s 58.0. The Rural Mainstreet economy is now experiencing positive job growth.

Confidence: The confidence index, which reflects expectations for the economy six months out, sank to 42.7 from June’s 48.8, indicating plummeting economic optimism among bankers. “Just as last month, an unresolved North America Free Trade Agreement (NAFTA) and rising trade tensions/tariffs with China continue to be a concern,” said Goss.

Bankers were asked to gauge the impact of current rising trade skirmishes and tariffs. More than three of five, or 78 percent, reported that these actions have had a negative impact on their local economy. Approximately 75.6 percent reported negative impacts on grain farmers.

Home and Retail Sales: The home-sales index soared to its highest level in almost three years to 65.9 from 60.7 for June. Retail sales improved for the month to 51.2 from June’s 47.6.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005. Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index (RMI) for July fell to 57.3 from 59.5 in June. The farmland and ranchland-price index slipped to 43.2 from June’s 44.0. Colorado’s hiring index for July rose to 60.8 from June’s 59.5. Colorado’s Rural Mainstreet job growth over the last 12 months was 3.0 percent. Illinois: The July RMI for Illinois increased to 57.9 from 57.0 in June. The farmland-price index was unchanged from June’s 43.0. The state’s new-hiring index rose to 61.2 from last month’s 59.4. Illinois’ Rural Mainstreet job growth over the last 12 months was 1.9 percent. Iowa: The July RMI for Iowa climbed to 56.0 from 55.9 in June. Iowa’s farmland-price index for July declined to 42.1 from June’s 42.6. Iowa’s new-hiring index for July fell to 50.1 from June’s 54.8. Iowa’s Rural Mainstreet job growth over the last 12 months was minus-1.0 percent. Kansas: The Kansas RMI for July climbed to 56.9 from June’s 56.4. The state’s farmland-price index increased to 43.0 from 41.2 in June. The new-hiring index for Kansas dipped to 58.8 from 58.9 in June. Kansas’s Rural Mainstreet job growth over the last 12 months was 2.9 percent. Minnesota: The July RMI for Minnesota dipped to 54.8 from June’s 55.3. Minnesota’s farmland-price index slipped to 42.1 from 42.3 in June. The new-hiring index fell to 50.4 from June’s 52.6. Minnesota’s Rural Mainstreet job growth over the last 12 months was minus-2.6 percent. | Missouri: The July RMI for Missouri fell to 58.7 from 59.4 in June. The farmland-price index declined to 43.7 from June’s 44.0. Missouri’s new-hiring index for July declined to 66.1 from June’s 68.8. Missouri’s Rural Mainstreet job growth over the last 12 months was 0.4 percent. Nebraska: The Nebraska RMI for July climbed to 56.3 from June’s 55.9. The state’s farmland-price index increased to 43.7 from last month’s 42.6. Nebraska’s new-hiring index rose to 56.5 from 55.0 in June. Nebraska's Rural Mainstreet job growth over the last 12 months was 1.1 percent. North Dakota: The North Dakota RMI for July advanced to 51.2 from June’s 51.0. The state’s farmland-price index moved slightly higher to 40.7 from 40.6 in June. The state’s new-hiring index increased to 36.3 from 35.2 in June. North Dakota’s Rural Mainstreet job growth over the last 12 months was minus-2.8 percent. South Dakota: The July RMI for South Dakota remained above growth neutral and increased to 56.3 from June’s 56.2. The state’s farmland-price index was unchanged from June’s 42.7. South Dakota’s new-hiring index climbed to 56.5 from 56.2 in June. South Dakota’s Rural Mainstreet job growth over the last 12 months was 1.5 percent. Wyoming: The July RMI for Wyoming fell to 57.1 from June’s 58.2. The July farmland and ranchland-price index sank to 43.1 from June’s 43.7. Wyoming’s new-hiring index improved slightly to 59.9 from June’s 59.4. Wyoming’s Rural Mainstreet job growth over the last 12 months was minus-0.9 percent. |

RSS Feed

RSS Feed