- June’s overall reading, the Rural Mainstreet Index (RMI), rose above growth neutral for the month to its highest level since May 2022.

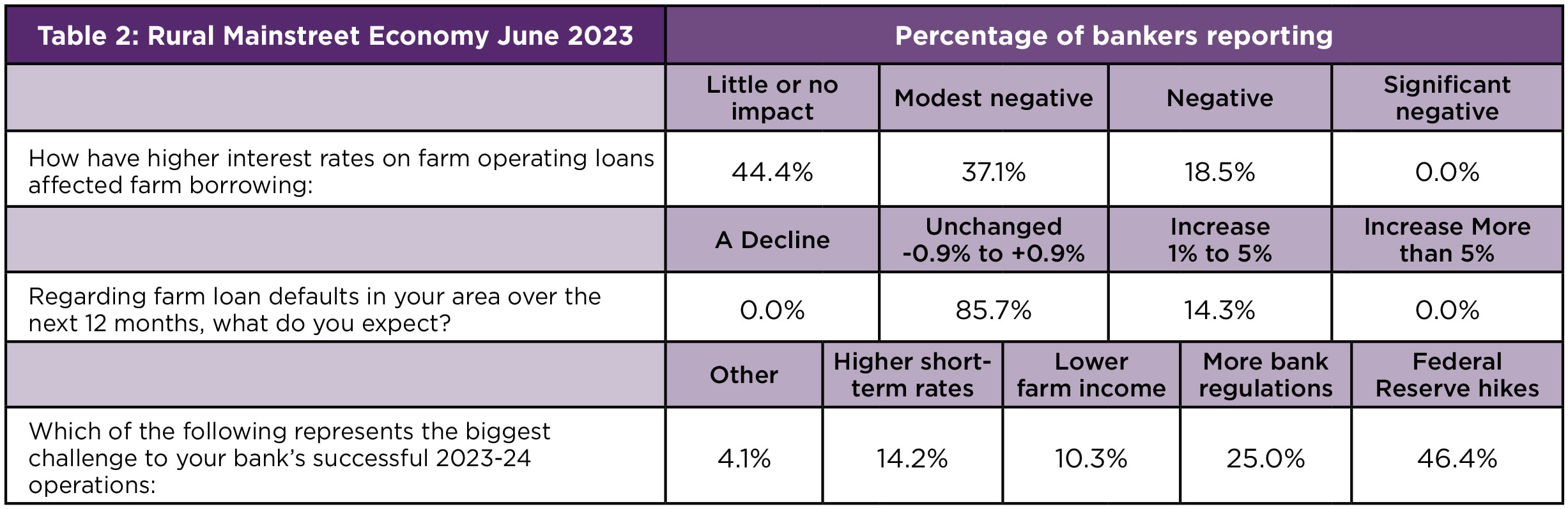

- Bank CEOs ranked Federal Reserve rate hikes as the greatest challenge in the 12 months ahead with rising bank regulations a distant second.

- More than half of bankers reported that higher interest rates were impairing farm equipment purchases.

- Farm equipment sales declined for only the third time in the past 31 months.

- On average, bankers expect farm loan defaults to expand less than 1% over the next 12 months.

- The region exported $13.3 billion of agriculture and livestock in 2022. This represented 26.5% growth from the previous year. Mexico was the chief destination, accounting for 55.2% of the region’s farm exports.

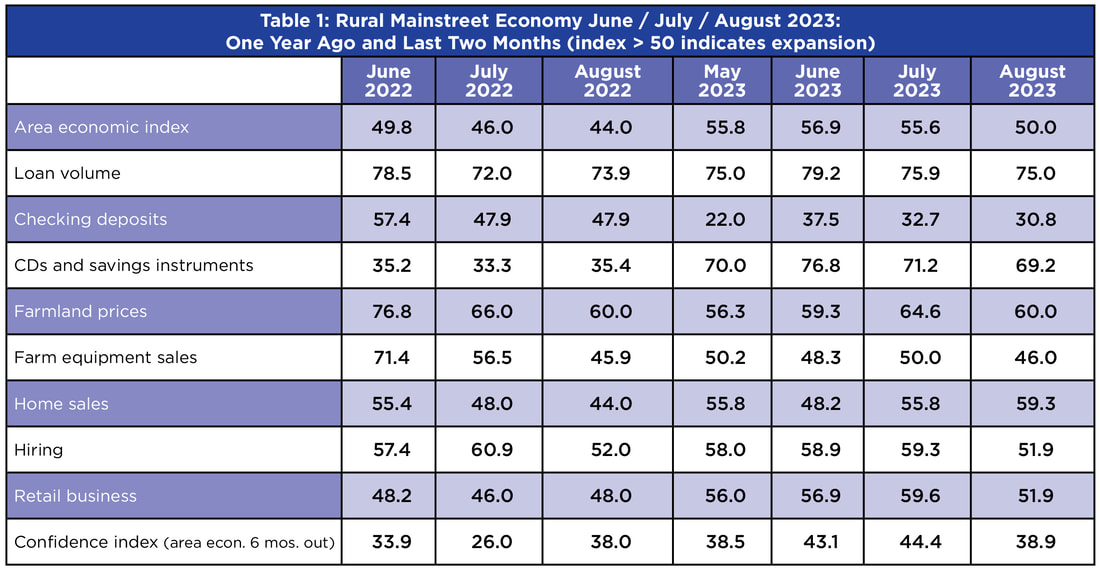

Overall: The region’s overall reading in June climbed to 56.9, the highest reading since May 2022 and up from last month’s 55.8. The index ranges between 0 and 100, with a reading of 50.0 representing growth neutral.

“After negative growth during the first quarter of this year, the Rural Mainstreet economy experienced positive, but slow, economic growth for all of the second quarter. Only 3.4% of bankers reported a downturn in economic conditions for the month,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Farm Equipment Sales: The farm equipment-sales index fell to a weak 48.3 from 50.2 in May. Farm equipment sales declined for only the third time in the past 31 months. “Higher borrowing costs have begun to negatively impact purchases of farm equipment,” said Goss.

More than half of bankers reported that higher interest rates were impairing farm equipment purchases.

On the other hand, Mike Van Erdewyk, CEO of Breda Savings Bank in Breda, Iowa, said, “Higher interest rates are not having a significant impact on farm operations yet as many farmers have paid down operating lines with grain sales.”

Banking: The June loan volume index expanded to a strong 79.2 from May’s 75.0. After two consecutive low monthly readings, the checking-deposit index increased to a weak 37.5 in June from 22.0 in May, while the index for certificates of deposit and other savings instruments soared to 76.8 for June from May’s 70.0.

Bank CEOs ranked Federal Reserve rate hikes as the greatest challenge in the 12 months ahead with rising bank regulations ranked as a distant second.

“Bankers continue to have a very positive outlook for the payment of farm loans with an estimated loan default rate rising less than 1% over the next 12 months,” said Goss.

“Higher short-term interest rates produced by Federal Reserve rate hikes over the past year have posed a significant threat to community banks by expanding the costs of customer deposits while the rates on bank loans have risen little over the same time period,” said Goss.

The region exported $13.3 billion of agriculture and livestock in 2022. This represented 26.5% growth from the previous year. Mexico was the chief destination, accounting for 55.2% of the region’s farm and ranching exports.

Hiring: The new hiring index for June climbed to 58.9 from May’s 58.0. Over the past 12 months, the Rural Mainstreet Economy has expanded jobs by 2.2% compared to a lower 1.5% for urban areas of the same 10 states.

Quotes from bank CEOs for the month:

- Mike Van Erdewyk, CEO of Breda Savings Bank in Breda, Iowa, said, “The fear of a drought seems to be bigger than fear of a recession.”

- Marc Lamon, President of FirsTier Bank in Holdrege, Neb., said, “Liquidity on the banks’ balance sheet is of front concern with competition for consumers’ deposits and desire for higher deposit insurance.”

Home and Retail Sales: June home-sales sank to 48.2 from May’s 55.8. “Higher mortgage rates and a shortage of houses for sale constrained sales across the region,” said Goss.

The retail-sales index for June expanded to 56.9 from May’s 56.0. “Bankers are getting more optimistic regarding the economic outlook for retail sales for the third quarter after an OK quarter two,” said Goss.

The survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. The index provides the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former Chairman of the Independent Community Banks of America, created the monthly economic survey and launched it in January 2006.

Below are the state reports:

| Colorado: Colorado’s RMI for June declined to a strong 63.4 from May’s 65.3. The farmland- and ranchland-price index for June fell to 57.5 from 57.8 in May. The state’s new hiring index was 57.5, down from 57.7 in May. The state exported $118 million of agriculture and livestock in 2022. This represented 21.6% growth from the previous year. Mexico was the chief destination, capturing half of the state’s farm exports. Illinois: The June RMI for Illinois increased to 55.8 from May’s 53.5. The farmland-price index climbed to 57.6 from 54.5 in May. The state’s new-hiring index rose to 63.5 from 61.4 May. The state exported $4 billion of agriculture and livestock in 2022. This represented 84.9% growth from the previous year. Mexico was the chief destination, capturing 40.9% of the state’s farm exports. Jim Eckert, CEO of Anchor State Bank in Anchor, reported that, “Central Illinois is very dry in most areas. Crops look good but are well behind other years and need rain.” Iowa: Iowa’s June RMI expanded to 51.7 from 50.8 in May. Iowa’s farmland-price index advanced to 55.6 from May’s 50.6. Iowa’s new-hiring index for June moved higher to 52.4 from 48.8 in May. The state exported $2.1 billion of agriculture and livestock in 2022. This represented 4.3% growth from the previous year. Mexico was the chief destination, capturing 70.9% of the state’s farm exports. Kansas: The Kansas RMI for June dropped to 55.3 from May’s 57.9. The state’s farmland-price index climbed to 57.4 from 55.7 in May. The June new-hiring index for Kansas declined to 54.7 from 55.1 in May. The state exported $2.1 billion of agriculture and livestock in 2022. This represented a reduction of 0.9% from the previous year. Mexico was the chief destination, capturing 72.5% of the state’s farm exports. Minnesota: The June RMI for Minnesota fell to 54.9 from May’s 59.0. Minnesota’s farmland-price index climbed to 65.8 from 64.2 in May. The new-hiring index for June dipped to 54.6 from 55.5 in May. The state exported $1.4 billion of agriculture and livestock in 2022. This represented 65.2% growth from the previous year. Canada was the chief destination, capturing 61.8% of the state’s farm exports. | Missouri: The state’s June RMI dropped to 44.5 from 47.7 in May. The farmland-price index rose to 54.4 from 52.8 in May. The state’s new hiring gauge dipped to 50.9 from 51.6 in May. The state exported $1.2 billion of agriculture and livestock in 2022. This represented 4.4% growth from the previous year. Mexico was the chief destination, capturing 83.0% of the state’s farm exports. Don Reynolds, Chairman of Regional Missouri Bank in Marceline, reported that, “April, May, and early June have been the driest spring in my memory.” Nebraska: The Nebraska RMI slipped to a healthy 62.9 from 66.0 in May. The state’s farmland-price index for June expanded to 59.6 from May’s 58.0. Nebraska’s June new-hiring index dipped to 69.5 from 72.0 in May. The state exported $1.3 billion of agriculture and livestock in 2022. This represented 11.8% growth from the previous year. Mexico was the chief destination, capturing 69.4% of the state’s farm exports. North Dakota: North Dakota’s RMI for June advanced to 56.8 from May’s 54.8. The state’s farmland-price index climbed to 57.9 from 54.8 in May. The state’s new-hiring index rose to 64.3 from 62.5 in May. The state exported $891 million of agriculture and livestock in 2022. This represented 10.9% growth from the previous year. Canada was the chief destination, capturing 51.3% of the state’s farm exports. South Dakota: The June RMI for South Dakota bounced to 51.2 from 46.7 in May. The state’s farmland-price index advanced to 55.3 from May’s 52.6. South Dakota’s June new hiring index expanded to a healthy 56.3 from 55.6 in May. The state exported $113 million of agriculture and livestock in 2022. This represented 74.9% growth from the previous year. Mexico was the chief destination, capturing 52.9% of the state’s farm exports. Wyoming: The June RMI for Wyoming grew to 54.9 from 53.7 in May. The June farmland- and ranchland-price index rose to 57.0 from 54.5 in May. Wyoming’s new-hiring index increased to 61.7 from May’s 61.5. The state exported $9 million of agriculture and livestock in 2022. This represented a reduction of 42.7% from the previous year. Canada was the chief destination, capturing 52.2% of the state’s farm exports. |

RSS Feed

RSS Feed