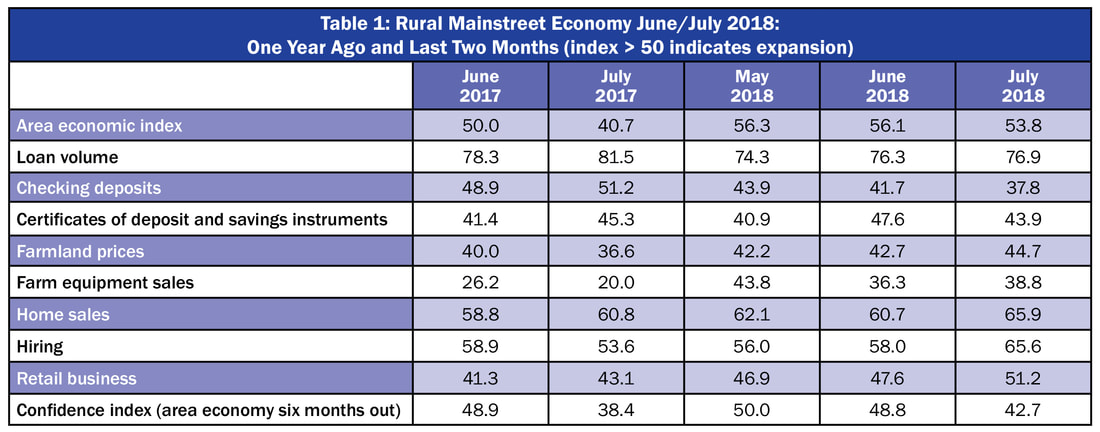

- For a fifth straight month the overall index rose above growth neutral.

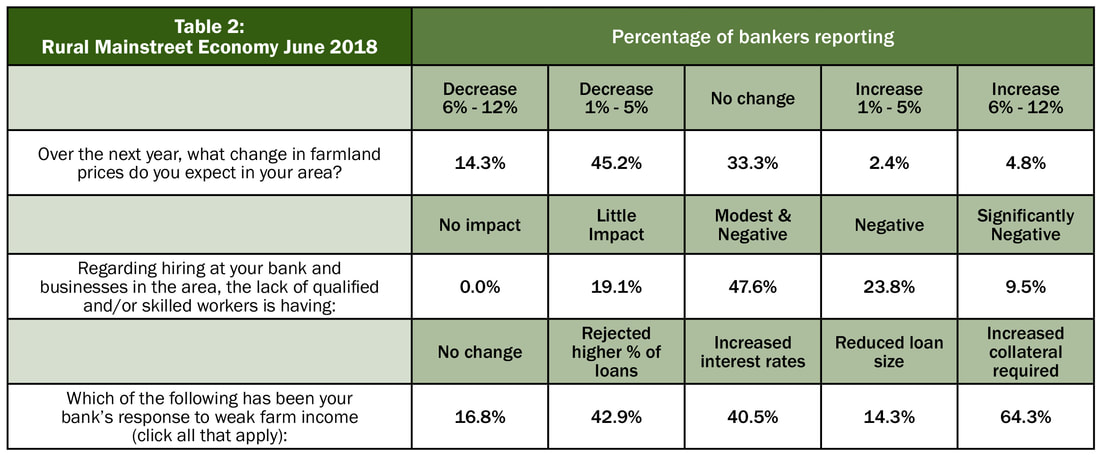

- In reaction to weak farm income, the percentage of banks increasing farm loan rejection rates expanded from 23.9 percent to 42.9 percent over the past year.

- Almost two-thirds of bankers indicated their banks had increased collateral requirements on farm loans in reaction to weak farm income.

- On average, bankers expect farmland prices to decline by 2.1 percent over the next 12 months. This is less than the 3.1 percent projected fall recorded last year at this time.

Overall: The overall index slid slightly 56.1 from 56.3 in May. The index ranges between 0 and 100 with 50.0 representing growth neutral.

“Surveys over the past several months indicate the Rural Mainstreet economy is trending upward with improving, and positive economic growth. However, the negative impacts of recent trade skirmishes has yet to show up in our survey results. While agriculture commodity prices have improved recently, prices remain below breakeven for a large share of grain farmers,” said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Bankers were asked to project the average change in farmland prices in their area over the next 12 months. On average, bankers expect farmland prices to sink by another 2.1 percent over the next year. This is an improvement from last year at this time when a 3.1 percent decline was expected.

The June farm equipment-sales index plummeted to an anemic 36.3 from May’s 43.8. This marks the 58th consecutive month the reading has moved below growth neutral 50.0.

Banking: Borrowing by farmers expanded for June as the loan-volume index rose to 76.3 from 74.3 in May. The checking-deposit index slumped to 41.7 from May’s 43.9, while the index for certificates of deposit and other savings instruments climbed to a still fragile 47.6, up from 40.9 in May.

Bankers reported their bank’s reaction to the continuing weak farm income. Almost two-thirds, or 64.3 percent, indicated their bank had increased collateral requirements on farm loans. Approximately, 40.5 percent indicated that their bank rejected a higher percentage of farm loan applications. This is up significantly from 12 months ago when only 23.9 percent indicated an increase in farm loan rejection rates.

Hiring: The employment gauge improved to a solid 58.0 from May’s 56.0. The Rural Mainstreet economy is now experiencing positive year-over-year job growth with added jobs at a 0.9 percent pace over the past 12 months compared to a slightly higher 1.0 percent for urban areas of the region. Both job growth readings are below U.S. job growth over the same period of time.

Confidence: The confidence index, which reflects expectations for the economy six months out, fell to 48.8 from May’s 50.0, indicating declining economic optimism among bankers. “Just as last month, an unresolved North America Free Trade Agreement (NAFTA) and rising trade tensions with China continue to be a concern,” said Goss.

Dan Coup, CEO of the First National Bank in Hope, Kansas, similar to other Rural Mainstreet bankers said, “Price prospects for grain are a big concern with the trade war talks with China and other countries.”

Home and Retail Sales: The home-sales index moved higher for the Rural Mainstreet economy in remained at a healthy reading with the June index declining slightly to 60.7 from 62.1 in May.

Jim Stanosheck, CEO of State Bank of Odell, Nebraska, echoed many Rural Mainstreet communities when he said his community has a low inventory of homes for sale or rent. This supply constraint has boosted prices and reduced sales.

Retail sales dropped for the month, but at a slower rate than in May, with a June reading of 47.6 compared to May’s index of 46.9.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005. Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index (RMI) for June expanded to 59.5 from 58.8 in May. The farmland and ranchland-price index advanced to 44.0 from May’s 42.8. Colorado’s hiring index for June declined to 60.1 from May’s 60.6. Colorado’s Rural Mainstreet job growth over the last 12 months was 6.8 percent. Illinois: The June RMI for Illinois declined slightly to 57.0 from 57.2 in May. The farmland-price index increased to 43.0 from 42.5 in May. The state’s new-hiring index rose to 59.4 from last month’s 57.7. Jim Eckert, president of Anchor State Bank in Anchor, reported, “Central Illinois was very dry in April and May, however 3"-6" of general rains came last week. Crops look good, but subsoil is low and we will require timely rains to insure a good crop.” Illinois’ Rural job growth over the last 12 months was 1.8 percent. Iowa: The June RMI for Iowa climbed to 55.9 from 54.0 in May. Iowa’s farmland-price index for June increased to 42.6 from May’s 42.1. Iowa’s new-hiring index for June expanded to 54.8 from May’s 53.5. Iowa’s Rural Mainstreet job growth over the last 12 months was minus 0.7 percent. Kansas: The Kansas RMI for June climbed to 56.4 from May’s 56.2. The state’s farmland-price index decreased to 41.2 from 42.1 in May. The new-hiring index for Kansas improved to 58.9 from 53.9 in May. Dan Coup, CEO of the First National Bank in Hope, Kansas, reported that, “Continued dry weather is having a big impact on our farm economy. We had a very poor wheat harvest, grass hay being cut is 15 to 20 percent of normal, and pasture conditions are causing cattle to be pulled off grass early.” Kansas’s Rural Mainstreet job growth over the last 12 months was 1.3 percent. Minnesota: The June RMI for Minnesota dipped to 55.3 from May’s 56.0. Minnesota’s farmland-price index increased to 42.3 from 42.1 in May. The new-hiring index fell to 52.6 from May’s 53.1. Pete Haddeland, CEO of the First National Bank in Mahnomen said, “Crops look great.” Minnesota’s rural Mainstreet Job grow over the last 12 months is minus 2.6 percent. | Missouri: The June RMI for Missouri jumped to 59.4 from 59.0 in May. The farmland-price index grew to 44.0 from 43.2 in May. Missouri’s new-hiring index for June bounced to 68.8 from May’s 64.9. Missouri’s Rural Mainstreet job growth over the last 12 months was 3.4 percent. Nebraska: The Nebraska RMI for June decreased to 55.9 from May’s 56.0. The state’s farmland-price index increased to 42.6 from last month’s 42.0. Nebraska’s new-hiring index rose to 55.0 from 52.8 in May. Nebraska’s Rural Mainstreet job growth over the last 12 months was minus 0.3 percent. North Dakota: The North Dakota RMI for June slipped to 51.0 from May’s 52.3. The state’s farmland-price index moved slightly higher to 40.6 from 40.5 in May. The state’s new-hiring index plummeted to 35.2 from 38.0 in May. North Dakota’s Rural Mainstreet job growth over the last 12 months was minus 5.5 percent. South Dakota: The June RMI for South Dakota remained above growth neutral, but was down at 56.2 from May’s 56.5. The state’s farmland-price index increased to 42.7 from May’s 42.2. South Dakota's new-hiring index climbed to 56.2 from 54.9 in May. South Dakota’s Rural Mainstreet job growth over the last 12 months was 0.6 percent. Wyoming: The June RMI for Wyoming rose to 58.2 from May’s 57.5. The June farmland and ranchland-price index increased to 43.2 from 42.7 in May. Wyoming’s new-hiring index improved slightly to 59.4 from May’s 59.0. Wyoming’s Rural Mainstreet job growth over the last 12 months was minus 1.2 percent. |

Follow Ernie Goss on Twitter www.twitter.com/erniegoss

RSS Feed

RSS Feed