- For a sixth straight month, the overall Rural Mainstreet Index sank below growth neutral.

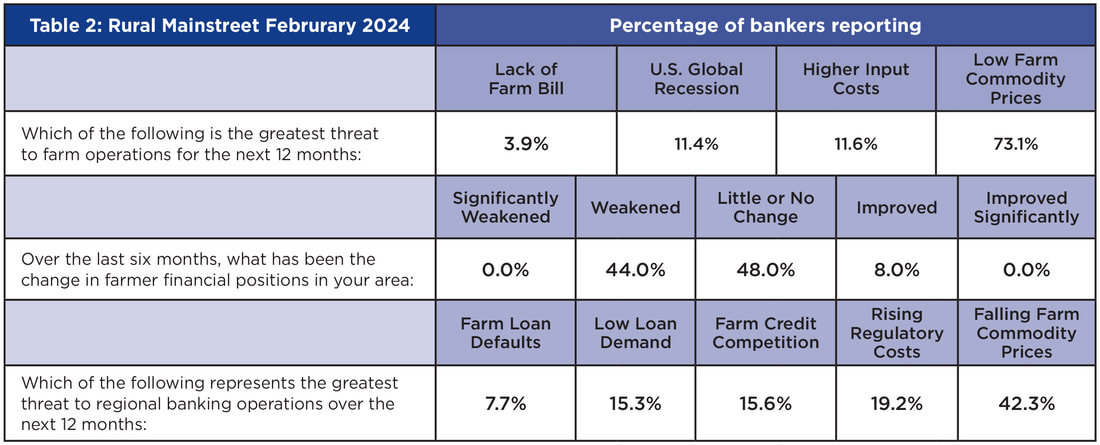

- Almost three-fourths of bank CEOs named low farm commodity prices as the biggest risk for farms in 2024.

- More than four of 10 bankers named falling farm commodity prices as the biggest risk for community banks in 2024.

- Approximately 44% of bankers indicated that the financial positions of farmers in their area had weakened over the past six months.

- Farmland prices expanded for the 51st straight month.

- The farm equipment sales index slumped below growth neutral for the eighth time in the past nine months.

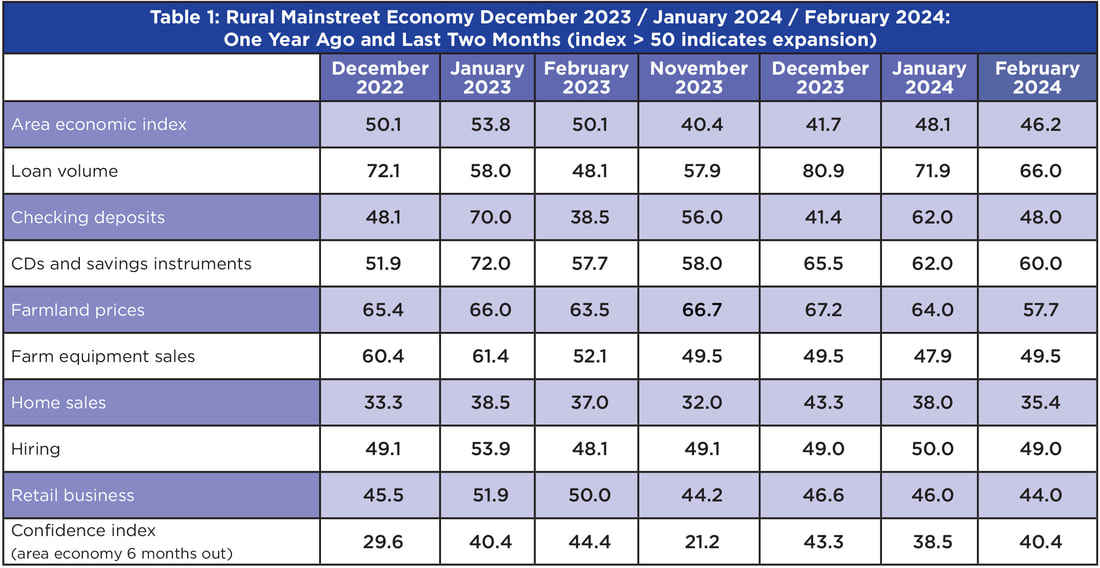

Overall: The region’s overall reading for February fell to 46.2 from 48.1 in January. The index ranges between 0 and 100, with a reading of 50.0 representing growth neutral.

“Higher interest rates, weaker agriculture commodity prices and a credit squeeze are having a significant and negative impact on Rural Mainstreet businesses and on Rural Mainstreet farmers,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Farming and Ranching Land Prices: The region’s farmland price index fell to a still solid 57.7 from January’s 64.0. The farmland price index has remained above growth neutral for 51 consecutive months. “Creighton’s survey continues to point to solid, but slowing, growth in farmland prices. Approximately 19.2% of bankers reported that farmland prices expanded from January levels,” said Goss.

Almost three-fourths of bank CEOs named low farm commodity prices as the biggest risk for farms in 2024.

According to trade data from the International Trade Association, regional exports of agricultural goods and livestock for 2023 were $12.1 billion, which was down 8.7% from $13.3 billion in 2022.

Approximately 44% of bankers indicated that the financial positions of farmers in their area had weakened over the past six months.

Farm Equipment Sales: The farm equipment sales index for February increased to a still weak 49.5 from January’s 47.9. “This is the eighth time in the past nine months that the index has fallen below growth neutral. Higher borrowing costs, tighter credit conditions and weaker grain prices are having a negative impact on the purchases of farm equipment,” said Goss.

Jim Eckert, CEO of Anchor State Bank in Anchor, Ill., said, “Our farmers are not projecting very profitable operations in 2024. Although some input costs are down from last year, weak grain prices for the 2024 crop are depressed and expected to remain so.”

Banking: The February loan volume index declined to a still strong 66.0 from 71.9 in January. The checking deposit index plummeted to 48.0 from January’s 62.0. The index for certificates of deposits and other savings instruments slipped to a still strong 60.0 from 62.0 in January.

More than four of 10 bankers indicated falling farm commodity prices as the biggest risk for community banks in 2024.

Hiring: The new hiring index for February sank to 49.0 from January’s growth neutral, 50.0. “Approximately 78% of bankers reported no change in hiring from January’s hiring activity,” said Goss.

Confidence: Rural bankers remain very pessimistic about economic growth for their area over the next six months. The February confidence index increased to 40.4 from January’s 38.5. Weak and falling agriculture commodity prices and higher interest rates over the past several months continued to constrain banker confidence.

Home and Retail Sales: Both home sales and retail sales sank below growth neutral for the last four months. The February home-sales index slumped to 35.4 from 38.0 in January. “Elevated mortgage rates and a limited supply of homes are sinking the home sales index below growth neutral in rural areas,” said Goss.

The retail-sales index for February fell to 44.0 from 46.0 in January. “High consumer debt and elevated interest rates are cutting into retail sales on the Rural Mainstreet Economy,” said Goss.

| Colorado: Colorado’s RMI for February declined to 70.0 from January’s 73.7. The farmland and ranchland price index for February dropped to 63.3 from January’s 69.7. The state’s new hiring index declined to 56.6 from 57.5 in January. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $224 million, which was up 90.1% from $118 million in 2022. Illinois: The February RMI for Illinois sank to 45.6 from January’s 50.0. The farmland price index declined to 56.3 from 63.0 in January. The state’s new hiring index dipped to 48.1 from January’s 49.1. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $4.5 billion, which was up 14.5% from $4.0 billion in 2022. Iowa: February’s RMI for the state decreased to 38.8 from 44.3 in January. Iowa’s farmland price index for February declined to 54.4 from January’s 61.4. Iowa’s new hiring index for February increased to 45.7 from 45.1 in January. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $1.5 billion, which was down 26.5% from $2.1 billion in 2022. Kansas: The Kansas RMI for February sank to 37.9 from January’s 41.9. The state’s farmland price index fell to 54.1 from 60.7 in January. The new hiring index for Kansas dipped to 45.4 from 46.3 in January. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $1.4 billion, which was down 36.6% from $2.1 billion in 2022. Minnesota: The February RMI for Minnesota declined to 42.9 from 44.1 in January. Minnesota’s farmland price index decreased to 55.6 from 61.3 in January. The new hiring index for February increased to 47.2 from 47.1 in January. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $1.2 billion, which was down 11.4% from $1.4 billion in 2022. | Missouri: The state’s February RMI increased to 37.3 from January’s regional low of 31.6. The farmland price index declined to 54.0 from 57.7 in January. The state’s new hiring gauge rose to 45.2 from 42.7 in January. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $1.23 billion, which was up 1.65% from $1.21 billion in 2022. Nebraska: The Nebraska RMI for February slumped to 34.4 from 39.5 in January. The state’s farmland price index for February declined to 53.1 from 60.0 in January. Nebraska’s February new-hiring index slumped to 44.2 from 45.5 in January. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $0.87 billion, which was down 35.5% from $1.35 billion in 2022. North Dakota: North Dakota’s RMI for February dipped to 63.5 from 64.3 in January. The state’s farmland price index declined to 61.4 from 67.0 in January. The state’s new hiring index expanded to 54.4 from January’s 54.2. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $986 million, which was up 10.7% from $891 million in 2022. South Dakota: The February RMI for South Dakota improved to 50.9 from 50.5 in January. The state’s farmland price index dropped to 57.8 from 63.1 in January. South Dakota’s February new hiring index increased to 49.9 from 49.3 in January. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $135 million, which was up 18.9% from $113 million in 2022. Wyoming: The February RMI for Wyoming increased to 58.0 from January’s 56.9. The February farmland and ranchland price index sank to 59.8 from 64.9 in January. Wyoming’s new hiring index rose slightly to 52.5 from 51.6 in January. According to trade data from the International Trade Association, exports of agriculture goods and livestock for 2023 were $5 million, which was down 38.5% from $9 million in 2022. |

RSS Feed

RSS Feed