- For a tenth straight month, the Rural Mainstreet Index remained below growth neutral.

- Farmland prices remained below growth neutral for the 31st straight month.

- Due to the weak agriculture economy, 73.5 percent of bankers increased collateral requirements, half boosted interest rates, and 35.3 percent rejected a higher percentage of farm loans.

- Rural Mainstreet businesses boosted hiring for the month.

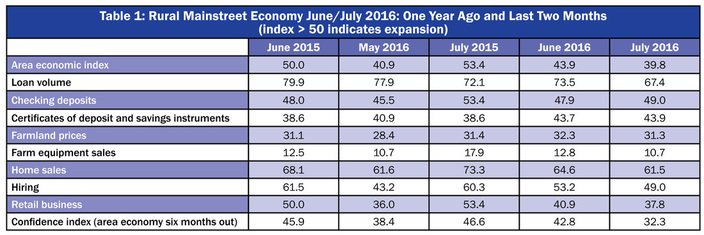

Overall: The index, which ranges between 0 and 100, rose to 43.9 from May’s 40.9. While remaining very fragile, the Rural Mainstreet Index (RMI) has increased four of the last five months.

“This is the 10th straight month the overall index has remained below growth neutral. Even though agriculture and energy commodity prices have increased recently, they remain well below last year’s prices and from their peak levels in 2011. Over the past 12 months, farm prices are down by 9.5 percent, grain prices are off by 4 percent, and livestock are down by 15 percent,” said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University's Heider College of Business.

Due to reductions in farm income and agriculture commodity prices over the past three years, bankers have altered their farm lending practices. Almost three of four, or 73.5 percent increased collateral requirements, half boosted interest rates, more than one-third, or 35.3 percent rejected a higher percentage of farm loans. Approximately, 17.6 percent of the bankers reported that their banks reduced the average size of farm loans.

Farming and Ranching: The farmland and ranchland-price index for June climbed to 32.3 from 28.4 in May. This is the 31st straight month the index has languished below growth neutral 50.0.

As in previous months, there is a great deal of variation across the region in the direction and magnitude of farmland prices, with prices growing in some portions of the region.

Despite declines in farm income, the percentage of farmland cash sales have remained almost unchanged from February 2015, when approximately one-fifth of farmland sales were for cash.

The June farm equipment-sales index expanded to a dismal 12.8 from 10.7 in May. “Weakness in farm income and low agriculture commodity prices continue to restrain the sale of agriculture equipment across the region,” said Goss.

Banking: The June loan-volume index dipped to 73.5 from last month’s 77.9. The checking-deposit index increased to 47.9 from May’s 45.5, while the index for certificates of deposit and other savings instruments improved to 43.7 from 40.9 in May.

Hiring: After moving below growth neutral for May, the Rural Mainstreet hiring index rose above the threshold for June. Rural Mainstreet businesses boosted employment levels for the month with an index of 53.2 from May’s 43.2. “Rural Mainstreet employment is down by almost 1 percent from this time last year. This contrasts to employment gains for urban areas of the region of approximately 1.5 percent for the 12-month period,” said Goss.

Confidence: The confidence index, which reflects expectations for the economy six months out, increased to 42.8 from 38.4 in May indicating a continuing pessimistic outlook among bankers. “Recent improvements in agriculture commodity prices boosted the index slightly higher,” said Goss.

Home and Retail Sales: Home sales remain the bright spot of the Rural Mainstreet economy with a June strong index of 64.6 from 61.6 in May. The June retail-sales index rose to a weak 40.9 from 36.0 last month. “Home sales held up for the month, but rural retailers, much like their urban counterparts, are experiencing downturns in sales,” said Goss.

Each month, community bank presidents and CEOs in nonurban agriculturally and energy-dependent portions of a 10-state area are surveyed regarding current economic conditions in their communities and their projected economic outlooks six months down the road. Bankers from Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming are included. The survey is supported by a grant from Security State Bank in Ansley, Neb.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) rose to 51.3 from 46.4 in May. The farmland and ranchland-price index slid to 52.6 from May’s 68.0. Colorado’s hiring index for June advanced to 59.8 from May’s 57.8. Colorado’s job growth over the last 12 months; Rural Mainstreet, 0.9 percent; Urban Colorado, 2.8 percent. Illinois: The June RMI for Illinois fell to a regional low of 31.8 from May’s 40.7. The farmland-price index sank to 22.7 from May’s 23.7. The state’s new-hiring index increased to 48.9 from last month’s 41.7. Illinois’ job growth over the last 12 months; Rural Mainstreet, -1.5 percent; Urban Illinois 1.3 percent. Iowa: The June RMI for Iowa soared to 59.1 from May’s 40.3. Iowa’s farmland-price index for June climbed to 51.5 from 47.3 in May. Iowa’s new-hiring index for June advanced to 59.4 from 50.3 in May. Iowa’s job growth over the last 12 months; Rural Mainstreet, 1.9 percent; Urban Iowa, 0.9 percent. Kansas: The Kansas RMI for June slumped to 25.1 from May’s 37.3. The state’s farmland-price index for June increased to 22.5 from 10.7 in May. The new-hiring index for Kansas expanded to a weak 44.9 from 37.0 in May. The state’s job growth over the last 12 months; Rural Mainstreet, -2.4 percent; Urban Kansas, 0.8 percent. Minnesota: The June RMI for Minnesota advanced to 44.1 from May’s 40.8. Minnesota’s farmland-price index climbed to 36.9 from 34.6 in May. The new-hiring index for the state expanded to 54.1 from last month’s 45.7. Minnesota’s job growth over the last 12 months; Rural Mainstreet, 0.0 percent; Urban Minnesota 1.3 percent. | Missouri: The June RMI for Missouri increased to 44.2 from 30.7 in May. The farmland-price index expanded to 29.9 from May’s 29.8. Missouri’s new-hiring index advanced to 46.7 from 17.5 in May. Missouri’s job growth over the last 12 months; Rural Mainstreet, -4.7 percent; Urban Missouri 1.7 percent. Nebraska: The Nebraska RMI for June climbed to a regional high of 63.2 from 43.3 in May. The state’s farmland-price index advanced to 49.7 from May’s 44.5. Nebraska’s new-hiring index rose to 58.8 from 49.3 in May. Nebraska’s job growth over the last 12 months; Rural Mainstreet, 2.4 percent; Urban Nebraska, 1.0 percent. North Dakota: The North Dakota RMI for May increased to 36.7 from 17.5 in May. The farmland-price index increased to 28.2 from 14.8 in May. North Dakota’s new-hiring index improved to 38.9 from May’s 35.1. North Dakota’s job growth over the last 12 months; Rural Mainstreet, -9.9 percent; Urban North Dakota, 0.6 percent. South Dakota: The June RMI for South Dakota sank to 39.7 from 40.3 in May. The farmland-price index grew to 27.7 from 26.1 in May. South Dakota's new-hiring index expanded to 50.8 from May’s 42.6. South Dakota’s job growth over the last 12 months; Rural Mainstreet, -0.5 percent; Urban South Dakota 1.9 percent. Wyoming: The June RMI for Wyoming increased to 41.2 from May’s 34.3. The June farmland and ranchland-price index rose to 24.5 from 12.3 in May. Wyoming’s new-hiring index increased to 389 from May’s 31.7. Wyoming’s job growth over the last 12 months; Rural Mainstreet, -4.4 percent; Urban Wyoming, -3.4 percent. |

RSS Feed

RSS Feed