- For the first time since March of this year, the overall Rural Mainstreet Index sank below growth neutral.

- Approximately half of bankers expect economic conditions to worsen in the next six months.

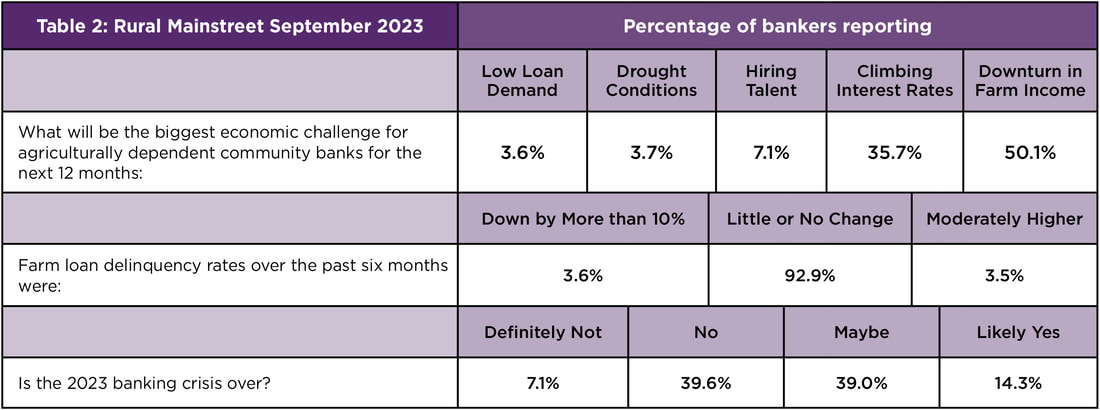

- A downturn in farm income was registered by bank CEOs as the No. 1 challenge to banking profitability for the next 12 months.

- For the fifth time in the past 12 months, farming equipment sales declined.

- Fewer than 4% of bankers reported an upturn in farm loan delinquencies over the past six months.

- Bank CEOs expect rising interest rates to represent the second greatest challenge to banking operations over the next 12 months.

- Approximately 46.4% of bankers indicated that they expect another banking crisis in 2023.

- The region’s agriculture exports, including processed foods, fell from $19.95 billion in the first seven months of 2022 to $18.45 billion for the same period in 2023, for a 7.4% slump.

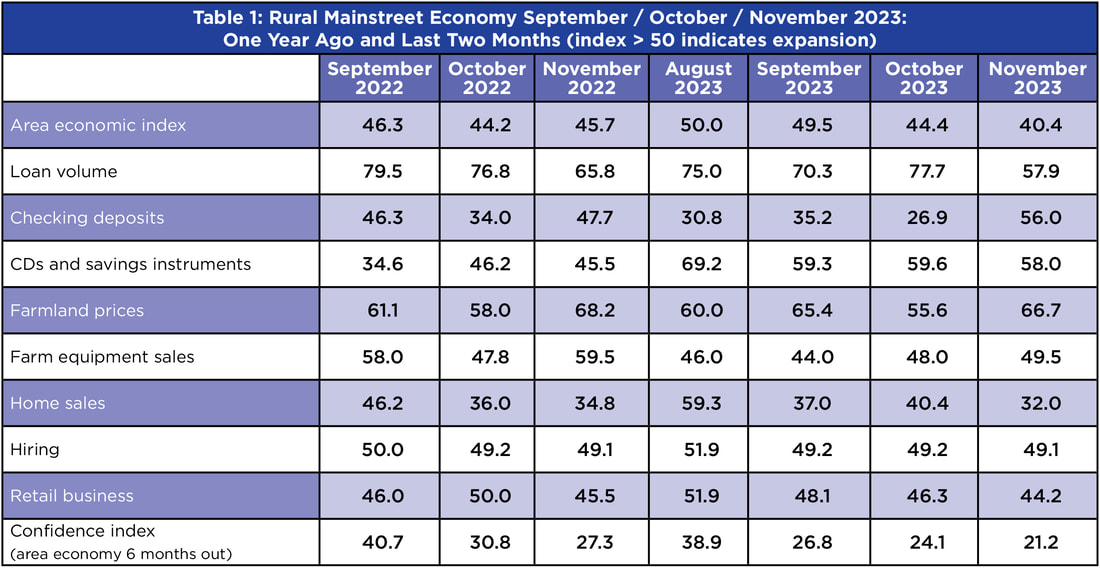

Overall: The region’s overall reading for September fell to 49.5 from August’s 50.0. The index ranges between 0 and 100, with a reading of 50.0 representing growth neutral.

“This is the weakest recorded reading since March of this year. Bankers indicated that the biggest challenge to community bank profitability over the next 12 months will be a downturn in farm income,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Farm Equipment Sales: The farm equipment-sales index for September slumped to 44.0 from August’s 46.0. “This is the fifth time in the past 12 months that the index has fallen below growth neutral. Higher borrowing costs are having a negative impact on the purchases of farm equipment,” said Goss.

“Several bankers in this month’s survey voiced concerns over economic losses of pork producers in the region,” said Goss.

Jim Eckert, CEO of Anchor State Bank in Anchor, Ill., said, “Low corn prices will severely impact farm incomes.”

Banking: The September loan volume index dipped to a still strong 70.3 from August’s 75.0. The checking deposit index increased to a very weak 35.2 from 30.8 in August, and the index for certificates of deposits and other savings instruments decreased to 59.3 from 69.2 for August.

“Higher short-term interest rates produced by Federal Reserve rate hikes over the past year continue to pose a significant threat to community banks by expanding the costs of customer deposits while the rates on bank loans have risen little over the same time period,” said Goss.

Bankers were asked the greatest challenge to banking operations over the next 12 months. More than one-third of bankers, or 35.7%, named rising interest rates as the biggest challenge over the 12-month period.

Despite higher interest rates and lower farm income, only 3.5% of bank CEOs reported an increase in farm loan delinquencies.

When asked if the 2023 banking crisis that spiked in March of this year was over, almost half, or 46.4% of bankers, expect another banking crisis this year.

James Brown, CEO of Hardin County Savings in Eldora, Iowa reflected the sentiment of many bankers in the region when he said, “When I say that the banking crisis isn't over, I am referring to the increased scrutiny from examiners regarding liquidity. They will be very tough on that issue and that will cause some problems internally with banks of all sizes.”

Hiring: The new hiring index for September dropped to 49.2 from August’s 51.9. Over the past 12 months, the Rural Mainstreet Economy has expanded jobs by 1.9% compared to a lower 1.3% for urban areas of the same 10 states.

Confidence: Higher interest rates, deposit outflows and a rising regulatory environment continued to constrain the business confidence index to a much weaker 26.8 from 38.9 in August. “This month’s reading is the most negative outlook recorded since July 2022. Over the past 12 months, the regional confidence index has fallen to levels indicating a very negative outlook,” said Goss.

“Approximately half of bankers expect economic conditions to worsen in the next six months,” said Goss.

The region’s agriculture exports, including processed foods, fell from $19.95 billion in the first seven months of 2022 to $18.45 billion for the same period in 2023, for a 7.4% slump.

Home and Retail Sales: Both home sales and retail sales slumped significantly for September. The September home-sales index fell to 37.0, the lowest reading since March of this year, and down from August’s healthy 59.3. “Higher mortgage rates are beginning to sink home sales,” said Goss.

The retail-sales index for September dropped to 48.1, which is down from August’s tepid 51.9. “High consumer debt and elevated interest rates are cutting into retail sales,” said Goss.

| Colorado: Colorado’s RMI for September soared to 79.1 from 53.2 in August. The farmland- and ranchland-price index for September improved to 72.2 from August’s 64.3. The state’s new hiring index was 59.2, up from 58.0 in August. According to data from the International Trade Association, Colorado’s agriculture exports, including processed food, fell from $1.43 billion in the first seven months of 2022 to $1.35 billion for the same period in 2023, for a decline of 5.4%. Illinois: The September RMI for Illinois declined to 53.2 from August’s 55.6. The farmland-price index rose to 64.9 from 60.5 in August. The state’s new-hiring index decreased to 50.1 from 53.2 in August. According to data from the International Trade Association, Illinois’ agriculture exports, including processed food, expanded from $4.38 billion in the first seven months of 2022 to $5.32 billion for the same period in 2023, representing 21.4% growth. Jim Eckert, CEO of Anchor State Bank in Anchor said, “Area farmers are just beginning harvest. They estimate yields will be somewhat lower than 2022, due to early drought conditions.” Iowa: Iowa’s September RMI sank to 41.4 from 53.7 in August. Iowa’s farmland-price index for September expanded to 61.5 from August’s 59.9. Iowa’s new-hiring index for September dropped to 45.9 from 52.6 in August. According to data from the International Trade Association, Iowa’s agriculture exports, including processed food, fell from $3.61 billion in the first seven months of 2022 to $3.08 billion for the same period in 2023, for a decline of 14.8%. Kansas: The Kansas RMI for September fell to 48.7 from August’s 51.1. The state’s farmland-price index climbed to 63.6 from 59.2 in August. The new-hiring index for Kansas sank to 48.5 from August’s 59.0. According to data from the International Trade Association, Kansas’ agriculture exports, including processed food, fell from $3.42 billion in the first seven months of 2022 to $2.53 billion for the same period in 2023, for a decline of 26.1%. Minnesota: The September RMI for Minnesota sank to 41.6 from August’s 47.7. Minnesota’s farmland-price index declined to 60.2 from 63.5 in August. The new-hiring index for September fell to 46.0 from August’s 50.5. According to data from the International Trade Association, Minnesota’s agriculture exports, including processed food, fell from $2.11 billion in the first seven months of 2022 to $1.75 billion for the same period in 2023, for a decline of 16.8%. | Missouri: The state’s September RMI improved to 40.2 from 37.5 in August. The farmland-price index expanded to 61.2 from 55.4 in August. The state’s new hiring gauge slipped to 45.5 from 46.9 in August. According to data from the International Trade Association, Missouri’s agriculture exports, including processed food, expanded from $1.57 billion in the first seven months of 2022 to $1.61 billion for the same period in 2023, representing 2.4% growth. Nebraska: The Nebraska RMI for September fell to 48.0 from 54.8 in August. The state’s farmland-price index for September advanced to 63.4 from 60.2 in August. Nebraska’s September new-hiring index declined to 48.3 from August’s 53.0. According to data from the International Trade Association, Nebraska’s agriculture exports, including processed food, fell from $2.73 billion in the first seven months of 2022 to $2.15 billion for the same period in 2023, for a decline of 21.1%. North Dakota: North Dakota’s RMI for September increased to 62.2 from 52.1 in August. The state’s farmland-price index climbed to 67.4 from 62.3 in August. The state’s new-hiring index declined to 53.2 from August’s 55.5. According to data from the International Trade Association, North Dakota’s agriculture exports, including processed food, fell from $701 million in the first seven months of 2022 to $676 million for the same period in 2023, for a decline of 3.6%. South Dakota: The September RMI for South Dakota improved to 45.9 from 43.3 in August. The state’s farmland-price index rose to 62.8 from 57.0 in August. South Dakota’s September new hiring index sank to 47.5 from 48.9 in August. According to data from the International Trade Association, South Dakota’s agriculture exports, including processed food, fell from $513 million in the first seven months of 2022 to $512 million for the same period in 2023, for a decline of 0.2%. Wyoming: The September RMI for Wyoming decreased to 54.7 from August’s 55.5. The September farmland- and ranchland-price index advanced to 65.7 from 60.4 in August. Wyoming’s new-hiring index rose to 51.1 from August’s 50.2. According to data from the International Trade Association, Wyoming’s agriculture exports, including processed food, fell from $6 million in the first seven months of 2022 to $4 million for the same period in 2023, for a decline of 33.3%. |

RSS Feed

RSS Feed