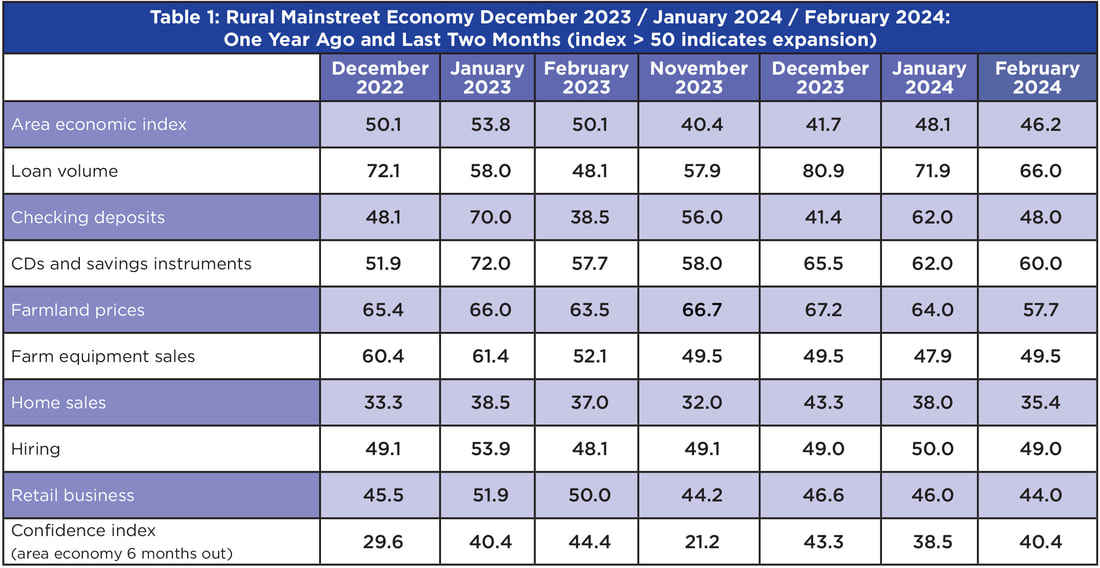

- For a fourth straight month, the overall Rural Mainstreet Index sank below growth neutral.

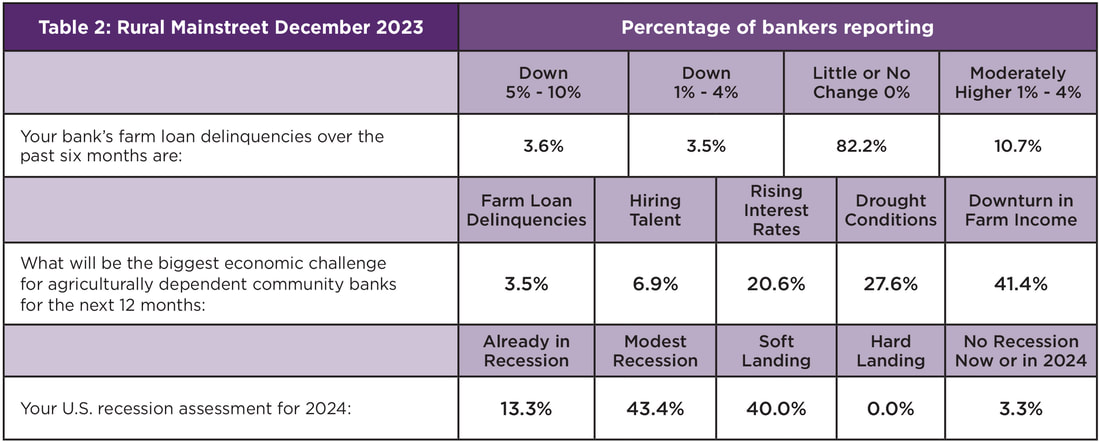

- Farm loan delinquencies fell to one-tenth of one percentage point over the past six months.

- More than half of bank CEOs expect a 2024 recession.

- According to the International Trade Administration, the export of agriculture products from the region declined from $14.1 billion for the first ten months of 2022 to $12.0 billion for the same period in 2023 for a 14.7% slump.

Overall: The region’s overall reading for December rose to 41.7 from 40.4 in November. The index ranges between 0 and 100, with a reading of 50.0 representing growth neutral.

“Higher interest rates and a credit squeeze are having a significant and negative impact on Rural Mainstreet businesses. Approximately 13.3% of bank CEOs indicated that their local economy was already in a recession while another 43.3% expect a recession in early 2024,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

When asked to name the greatest 2024 economic threat for community banks, approximately four of 10 identified a downturn in farm income as the chief 2024 hazard.

Farming and Ranching Land Prices: The region’s farmland price index increased to 67.2 from November’s 66.7. “Creighton’s survey continues to point to solid, but slowing, growth in farmland prices. Approximately, 41.4% of bankers reported that a downturn in farm income was the greatest threat to community banks in 2024,” said Goss.

Farm Equipment Sales: The farm equipment-sales index for December was unchanged from November’s weak 49.5. “This is the sixth time in the past seven months that the index has fallen below growth neutral. Higher borrowing costs and tighter credit conditions are having a negative impact on the purchases of farm equipment,” said Goss.

“For a third consecutive month, several bankers voiced concerns over economic losses of pork producers in their area,” said Goss.

Matthew Brown, Vice President of Ag & Commercial Banking with CBI Bank and Trust in Washington, Iowa, stated, “Still seeing significant stress with hog integrators in the area.”

Echoing the concern for hog operations, Terry Engelken, Vice President of Washington State Bank in Washington, Iowa, reported, “Hog finishers are still losing money. The lower corn price is improving the situation.”

According to the International Trade Administration, the export of agriculture products from the region declined from $14.1 billion for the first ten months of 2022 to $12.0 billion for the same period in 2023 for a 14.7% slump.

Banking: The December loan volume index soared to 80.9 from 57.9 in November and from October’s 77.7. The checking deposit dropped to a very weak 41.4 from November’s 56.0. This is the tenth time in 2023 that the index has fallen below growth neutral. The index for certificates of deposits and other savings instruments expanded to a healthy 65.5 from 58.0 in November.

Larry Winum, CEO of Glenwood State Bank in Glenwood, Iowa, reported, “Glad to see the Federal Reserve tap the brakes on raising interest rates. Time to pause and see how the economy reacts to the current rate environment. (It) will be interesting to see if they actually achieve a soft landing.”

Hiring: The new hiring index for December slipped to 49.0 from November’s 49.1. “Only 3.6% of bank CEOs reported an increase in employment in their area while 14.1% indicated a pullback in hiring for the month,” said Goss.

Confidence: Even though the confidence index climbed to 43.3 from November’s record low 21.2, higher interest rates, deposit outflows and a slowing farm economy over the past several months continued to constrain the business confidence.

Home and Retail Sales: Both home sales and retail sales sank below growth neutral for December and November. The December home-sales index increased to 43.3 from 32.0 in November. “High mortgage rates and limited supplies are sinking the home sales index below growth neutral in rural areas,” said Goss.

The retail-sales index for December increased to a weak 46.6 from November’s 44.2. “High consumer debt and elevated interest rates are cutting into retail sales in rural areas of the region,” said Goss.

| Colorado: Colorado’s RMI for December declined to 52.4 from November’s solid 58.9. The farmland and ranchland price index for December increased to 74.1 from November’s 73.2. The state’s new hiring index rose to 59.4 from 58.8 in November. According to the International Trade Administration, the export of agriculture products from Colorado expanded from $102.0 million for the first ten months of 2022 to $146.0 million for the same period in 2023 for 43.1% growth. Illinois: The December RMI for Illinois climbed to 46.5 from November’s 44.8. The farmland price index rose to 66.3 from 65.8 in November. The state’s new hiring index increased slightly to 49.7 from November’s 49.4. According to the International Trade Administration, the export of agriculture products from Illinois expanded from $2.9 billion for the first ten months of 2022 to $3.6 billion for the same period in 2023 for 23.6% growth. Iowa: Iowa’s December RMI jumped to 45.5 from 32.4 in November. Iowa’s farmland price index for December climbed to 64.0 from November’s 62.0. Iowa’s new hiring index for November increased to 45.1 from 44.2 in October. According to the International Trade Administration, the export of agriculture products from Iowa declined from $1.8 billion for the first ten months of 2022 to $1.3 billion for the same period in 2023 for a 29.3% slump. James Brown, CEO of Hardin County Savings Bank in Eldora, said, “Almost all farmers have lost working capital with little to no gain in net worth. Lower crop yields and prices are the major cause along with our few customers who have cattle and/or hogs.” Kansas: The Kansas RMI for December dipped to 38.3 from November’s 39.6. The state’s farmland price index slipped to 64.0 from 64.1 in November. The new hiring index for Kansas fell to 46.8 from November’s 47.6. According to the International Trade Administration, the export of agriculture products from Kansas declined from $1.9 billion for the first ten months of 2022 to $1.1 billion for the same period in 2023 for a 43.6% slump. Minnesota: The December RMI for Minnesota improved to a weak 36.0 from November’s 33.8. Minnesota’s farmland price index climbed to 63.3 from 62.4 in November. The new hiring index for December increased to 46.0 from November’s 45.6. According to the International Trade Administration, the export of agriculture products from Minnesota declined from $1.2 billion for the first ten months of 2022 to $1.0 billion for the same period in 2023 for a 16.1% slump. | Missouri: The state’s December RMI increased to 41.2 from November’s regional low 29.8. The farmland price index declined to 59.6 from 61.3 in November. The state’s new hiring gauge sank to 41.3 from 44.2 in November. According to the International Trade Administration, the export of agriculture products from Missouri declined from $1.02 billion for the first ten months of 2022 to $1.01 billion for the same period in 2023 for a 1.4% slump. Nebraska: The Nebraska RMI for December slumped to 37.3 from 39.7 in November. The state’s farmland price index for December declined to 63.7 from 64.1 in November. Nebraska’s December new-hiring index slumped to 46.5 from November’s 47.6. According to the International Trade Administration, the export of agriculture products from Nebraska declined from $1.2 billion for the first ten months of 2022 to $614.0 million for the same period in 2023 for a 47.1% slump. North Dakota: North Dakota’s RMI for December decreased to 52.3 from 53.6 in November. The state’s farmland price index rose to 69.7 from 68.9 in November. The state’s new hiring index expanded to 53.8 from November’s 53.6. According to the International Trade Administration, the export of agriculture products from North Dakota expanded from $764.0 million for the first ten months of 2022 to $792.0 million for the same period in 2023 for 3.7% growth. South Dakota: The December RMI for South Dakota improved to 46.1 from 44.2 in November. The state’s farmland price index climbed to 66.2 from 65.4 in November. South Dakota’s December new hiring index increased to 49.5 from 49.2 in November. According to the International Trade Administration, the export of agriculture products from South Dakota expanded from $105.0 million for the first ten months of 2022 to $112.0 million for the same period in 2023 for 6.7% growth. Wyoming: The December RMI for Wyoming increased to 49.9 from November’s 47.8. The December farmland and ranchland price index grew to 67.3 from 66.4 in November. Wyoming’s new hiring index rose slightly to 50.8 from November’s 50.5. According to the International Trade Administration, the export of agriculture products from Wyoming declined from $6.6 million for the first nine months of 2022 to $4.0 million for the same period in 2023 for a 39.3% slump. |

RSS Feed

RSS Feed