- Overall index rose to its second highest reading since before COVID-19.

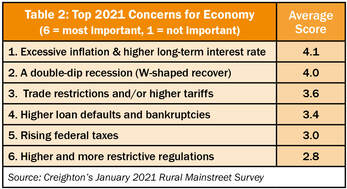

- Bankers biggest economic concerns for 2021 are excessive inflation and higher long-term interest rates.

- For the first time since 2013, Creighton’s survey has recorded four straight months of above growth-neutral farmland prices.

- Farm equipment-sales index rose to its highest reading since April 2013.

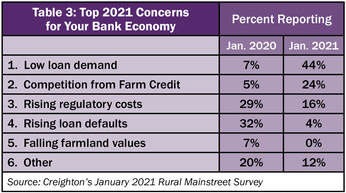

- Approximately 44% of bank CEOs expect low loan demand to be the greatest issue facing their banks for 2021, up from 7% last year at this time.

- Only 4% of bankers indicated that rising loan defaults and bankruptcies represented their greatest concern for 2021, down significantly from the 32% in 2020 survey.

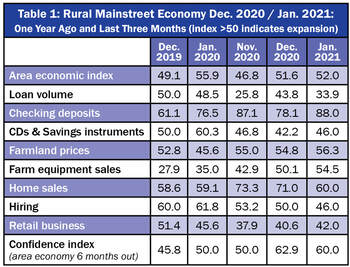

Overall: The overall index for January rose to 52.0 from December’s 51.6. The index ranges between 0 and 100 with a reading of 50.0 representing growth neutral.

“Recent sharp improvements in agriculture commodity prices, federal farm support payments, and Federal Reserve’s record low short-term interest rates have underpinned the Rural Mainstreet Economy in a solid and positive growth range. However, the rural economy remains well below pre-pandemic levels,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Jim Levick, president of Nebraska State Bank in Oshkosh, Nebraska said, “I feel the economy is moving in a positive direction that can be rattled by a combination of higher taxes, higher inflation, and a return of stricter regulation.”

Farming and Ranching: For a fourth straight month, the farmland price index advanced above growth neutral. The January reading climbed to 56.3, its highest level since July 2013, and was up from 55.0 in December. This is first time since 2013 that Creighton’s survey has recorded four straight months of above growth neutral farmland prices.

The January farm equipment-sales index rose to 54.5, its highest reading since April 2013, and up from 50.2 in December. After 86 straight months of readings below growth neutral, farm equipment sales bounced into growth territory for the last two months.

“As a result of the rapidly improving farm economy, the farm Exchange Traded Fund (MOO) traded on the New York Stock Exchange has risen to a record high of $83.32,” said Goss.

Banking: Bankers once again reported anemic loan volumes. The January loan volume index dropped to 33.9 from December’s 43.7, but up from November’s record low 25.8. The checking-deposit index soared to record high 88.0 from December’s 78.1, while the index for certificates of deposit, and other savings instruments increased to 46.0 from 42.2 in December.

“Approximately 44% of bank CEOs expect low loan demand to be the greatest issue facing their banks for 2021. This is up from 7% that recorded this as a top concern last year at this time,” reported Goss.

“One year ago, 32% of bankers indicated that rising loan defaults and bankruptcies were their greatest concern for 2020. This is significantly above the 4% of bankers that registered this as their greatest 2021 issue,” said Goss.

However, 24% indicated that rising competition from untaxed credit unions and Farm Credit posed the greatest 2021 bank threat. This is well up from the 5% recorded last year at this time. Joseph Anglin, senior vice president and chief financial officer at Pioneer Bank & Trust in Rapid City, South Dakota, said, “We compete day-in-and-day-out with them and they simply have a 21% advantage that they can leverage over tax paying banks.”

Hiring: The new hiring index fell to 46.0 from December’s 50.0, and November’s 53.2. Data from the U.S. Bureau of Labor Statistics indicate that nonfarm employment levels for the Rural Mainstreet economy are down by 145,000 (non-seasonally adjusted), or 3.3%, compared to pre-COVID-19 levels, and by 251,000, or 5.6%, from 12 months earlier. “It will take many months of above growth neutral readings to get back to pre-COVID-19 employment levels for the region,” said Goss.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, declined slightly to a still healthy 60.0 from December’s 62.9. “Federal farm support payments, improving gain prices, and advancing exports have supported confidence offsetting negatives from pandemic ravaged retail and leisure and hospitality companies in rural areas,” said Goss.

Home and Retail Sales: The home-sales index fell to a still healthy 60.0 from 71.0 in December. The retail-sales index for January increased to a frail 42.0 from 40.6 in December. “Online buying and business closures linked to COVID-19 continue to harm the region’s retailers,” said Goss.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005. Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index (RMI) for January dipped to 41.6 from December’s 42.9. The farmland and ranchland-price index expanded to 51.1 from 50.5 in December. Colorado’s hiring index for January sank to 41.8 from December’s 46.7. Over the past 12 months, Colorado’s Rural Mainstreet economy has lost 12.5% of its nonfarm employment compared to a 3.8% loss for urban areas of the state. Illinois: The January RMI for Illinois slipped to 50.6 from 51.5 in December. The farmland-price index advanced to 55.6 from December’s 54.8. The state’s new-hiring index sank to 46.3 from 51.0 in December. Jeff Bonnett, President of Havana National Bank in Havana reported that, “Farmland values in our general area are not on the decline as supported by recent auctions.” Over the past 12 months, Illinois’ Rural Mainstreet economy has lost 5.9% of its nonfarm employment compared to a 7.0% loss for urban areas of the state. Iowa: The January RMI for Iowa increased to 51.2 from December’s 50.2. Iowa’s farmland-price index rose to 55.9 from 54.1 in December. Iowa’s new-hiring index for January fell to 46.6 from 50.3 in December. James Brown, CEO of Hardin County Savings Bank in Eldora, reported, “Our ag customer reviews have been much better than we anticipated last fall due to improved commodity prices and insurance payments from the derecho.” Over the past 12 months, Iowa’s Rural Mainstreet economy has lost 6.0% of its nonfarm employment compared to a 4.5% loss for urban areas of the state. Kansas: The Kansas RMI for January increased to 53.6 from 52.7 in December. The state’s farmland-price index increased to 57.1 from December’s 55.4. The new-hiring index for Kansas fell to 47.8 from 51.6 in December. Over the past 12 months, Kansas’ Rural Mainstreet economy has lost 4.0% of its nonfarm employment compared to a 4.5% loss for urban areas of the state. Minnesota: The January RMI for Minnesota rose to 48.0 from December’s 46.3. Minnesota’s farmland-price index climbed to 54.3 from 52.2 in December. The new-hiring index for January sank to 45.0 from December’s 48.3. Over the past 12 months, Minnesota’s Rural Mainstreet economy has lost 6.6% of its nonfarm employment compared to a 6.4% loss for urban areas of the state. | Missouri: The January RMI for Missouri jumped to a regional high 63.6 from 60.3 in December. The farmland-price index expanded to 62.1 from December’s 59.2. The state’s hiring gauge slumped to 49.1 from 55.4 in December. Over the past 12 months, Missouri’s Rural Mainstreet economy has experienced an increase in the size of its nonfarm employment by 1.5%, compared to a 4.3% loss for urban areas of the state. Nebraska: The Nebraska RMI for January expanded to 55.6 from December’s 54.2. The state’s farmland-price index declined to 56.1 from last month’s 56.2. Nebraska’s new-hiring index fell to 45.4 from 52.3 in December. Rod Cornelius, Branch President, Pinnacle Bank, Ogallala said, “Increase in grain prices - bonus for the procrastinating marketer.” Over the past 12 months, Nebraska’s Rural Mainstreet economy has lost 3.0% of its nonfarm employment compared to a 2.6% loss for urban areas of the state. North Dakota: The North Dakota RMI for January increased to 39.6 from December’s 36.8. The state’s farmland-price index slipped to 50.1 from 50.5 December. The state’s new-hiring index sank to 42.1 from December’s 48.7. Over the past 12 months, North Dakota’s Rural Mainstreet economy has lost 11.4% of its non-farm employment compared to a 4.4% loss for urban areas of the state. South Dakota: The January RMI for South Dakota advanced to 58.4 from 57.7 in December. The state’s farmland-price index climbed to 59.5 from 57.9 in December. South Dakota’s January hiring index plummeted to 50.2 from 57.9 in December. Over the past 12 months, South Dakota’s Rural Mainstreet economy has lost 2.1% of its nonfarm employment compared to a 4.4% loss for urban areas of the state. Wyoming: The January RMI for Wyoming improved to 51.4 from December’s 49.4. The January farmland and ranchland-price index expanded to 56.0 from 53.8 in December. Wyoming’s new-hiring index slumped to 56.7 from December’s 49.9. Over the past 12 months, Wyoming’s Rural Mainstreet economy has lost 5.0% of its nonfarm employment compared to a 4.7% loss for urban areas of the state. |

RSS Feed

RSS Feed