- For an 11th straight month, the Rural Mainstreet Index fell below growth neutral.

- Farmland prices remained below growth neutral for the 32nd straight month.

- Bank CEOs reported a 6 percent decline in farmland prices over the past year.

- Bankers expect cash expenses will exceed cash revenues for one in five crop farmers in the region.

- Bank CEOs expect farm loan defaults to grow by 5.4 percent over the next year.

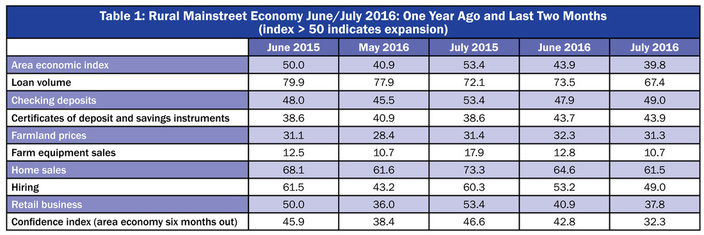

Overall: After improving for four of the last five months, the index, which ranges between 0 and 100, sank to 39.8 from 43.9 in June.

This is the 11th straight month the overall index has remained below growth neutral.

“Over the past 12 months, farm prices have fallen by 9 percent, and livestock prices are off by 16 percent. These weak agriculture commodity prices are pushing the overall Rural Mainstreet economy lower,” said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University's Heider College of Business.

As a result of weaker farm economic conditions, bankers expect almost one in five crop farmers, or 19.5 percent, to suffer negative cash flows where cash expenses exceed cash revenues for 2016.

This month, bankers estimated, on average, farmland prices have fallen by 6 percent over the past 12 months. However, as in previous months, there is a great deal of variation across the region in the direction and magnitude of farmland prices, with prices growing in some portions of the region.

One bank CEO said, “The cow and calf operators, which dominate our market, are the ones that will feel the effect of the downturn in the market the most.”

The July farm equipment-sales index sank to 10.7 from 12.8 in June. “Weakness in farm income and low agriculture commodity prices continue to restrain the sale of agriculture equipment across the region,” said Goss.

Banking: Borrowing by farmers remains strong even though the July loan-volume index dipped to 67.4 from last month’s 73.5. The checking-deposit index increased to 49.0 from June ‘s 47.9, while the index for certificates of deposit and other savings instruments improved slightly to 43.9 from to 43.7 in June.

This month, bankers were asked to assess the likelihood of loan defaults in their area. On average, farm loan defaults are expected to rise by 5.4 percent over the next 12 months. However almost one-fifth, or 18.3 percent, of bank CEOs estimate loan defaults will expand by more than 10 percent.

Hiring: After moving above growth neutral for June, the Rural Mainstreet hiring index fell below the threshold for July. According to bankers, Rural Mainstreet businesses reduced jobs slightly for June with a hiring index of 49.0 which was down from June’s reading of 53.2. “Rural Mainstreet employment is down by approximately 1.8 percent from this time last year. This contrasts to employment gains for urban areas of the region of approximately 1.4 percent for the same 12-month period,” said Goss.

Lydell Woodbury, president at the First Nebraska Bank in Stanton, Nebraska, reported, “We have quite a few job openings, but no labor pool to draw from.”

Confidence: The confidence index, which reflects expectations for the economy six months out, plummeted to 32.3 from 42.8 in June indicating a continuing pessimistic outlook among bankers. “While bankers already had a downbeat assessment of the rural economy, the British vote to leave the EU (Brexit) softened the outlook even more. Like bankers, I expect Brexit, once begun, to increase the value of the U.S. dollar with a resulting decline in agriculture commodity prices,” said Goss.

The outlook for some bankers was positive. Pete Haddeland, CEO of the First National Bank in Mahnomen, Minnesota, said, “Great looking crop. Rain at the right time.”

Home and retail sales: Home sales remain the bright spot of the Rural Mainstreet economy with a robust July index of 61.5, down from a solid 64.6 in June. The July retail-sales index slumped to 37.8 from 40.9. “Home sales in rural areas of the region continue on a strong trajectory, but rural retailers much like their urban counterparts are experiencing downturns in sales,” said Goss.

Each month, community bank presidents and CEOs in nonurban agriculturally and energy-dependent portions of a 10-state area are surveyed regarding current economic conditions in their communities and their projected economic outlooks six months down the road. Bankers from Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming are included. The survey is supported by a grant from Security State Bank in Ansley, Neb.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) rose to 52.4 from 51.3 in June. The farmland and ranchland-price index slid to 42.1 from June’s 52.6. Colorado’s hiring index for July fell to 52.6 from June’s 59.8. Colorado’s job growth over the last 12 months; Rural Mainstreet, -0.2 percent; Urban Colorado, 2.8 percent. Illinois: The July RMI for Illinois fell to a regional low of 18.1 from June’s 31.8. The farmland-price index increased to 29.4 from June’s 22.7. The state’s new-hiring index slumped to 42.4 from last month’s 48.9. Illinois’ job growth over the last 12 months; Rural Mainstreet, -2.7 percent; Urban Illinois 1 percent. Iowa: The July RMI for Iowa sank to 51.9 from June’s 59.1. Iowa’s farmland-price index for July dipped to 49.7 from 51.5 in June. Iowa’s new-hiring index for July fell to 55.4 from 59.4 in June. Iowa’s job growth over the last 12 months; Rural Mainstreet, 1.5 percent; Urban Iowa, 0.9 percent. Kansas: The Kansas RMI for July advanced to a weak 37.4 from June’s 25.1. The state’s farmland-price index for July increased to 25.6 from 22.5 in June. The new-hiring index for Kansas sank to 39.5 from 44.9 in June. Job growth in Kansas over the last 12 months; Rural Mainstreet, -2.8 percent; Urban Kansas, 0.8 percent. Minnesota: The July RMI for Minnesota fell to 35.9 from June’s 44.1. Minnesota’s farmland-price index slumped to 30.0 from 36.9 in June. The new-hiring index for the state dipped to 48.2 from last month’s 54.1. Minnesota’s job growth over the last 12 months; Rural Mainstreet, -0.5 percent; Urban Minnesota 1.3 percent. | Missouri: The July RMI for Missouri decreased to 37.8 from 44.2 in June. The farmland-price index slipped to 29.6 from June’s 29.9. Missouri’s new-hiring index plummeted to 22.6 from 46.7 n June. Missouri’s job growth over the last 12 months; Rural Mainstreet, -8.2 percent; Urban Missouri 1.8 percent. Nebraska: The Nebraska RMI for July shrank to 51.5 from a regional high of 63.2 in June. The state’s farmland-price index slipped 49.3 from June’s 49.7. Nebraska’s new-hiring index declined to 55.2 from 58.8 in June. Nebraska’s job growth over the last 12 months; Rural Mainstreet, 1.5 percent; Urban Nebraska, 1.4 percent. North Dakota: The North Dakota RMI for June dipped to 35.9 from 36.7 in June. The farmland-price index sank to 21.2 from 28.2 in June. North Dakota’s new-hiring index slumped to 25.6 from June’s 38.9. North Dakota’s job growth over the last 12 months; Rural Mainstreet, -9.7 percent; Urban North Dakota, 0.6 percent. South Dakota: The July RMI for South Dakota improved to 40.1 from 39.7 in June. The farmland-price index grew to 28.0 from 27.7 in June. South Dakota's new-hiring index fell to 47.5 from June’s 50.8. South Dakota’s job growth over the last 12 months; Rural Mainstreet, 0.0 percent; Urban South Dakota, 2.3 percent. Wyoming: The July RMI for Wyoming plummeted to 31.2 from June’s 41.2. The June farmland and ranchland-price index rose to 30.3 from 24.5 in June. Wyoming’s new-hiring index sank to 34.9 from June’s 38.9. Wyoming’s job growth over the last 12 months; Rural Mainstreet, -3.1 percent; Urban Wyoming, -3.6 percent. |

RSS Feed

RSS Feed