- For a 13th straight month, the Rural Mainstreet Index fell below growth neutral.

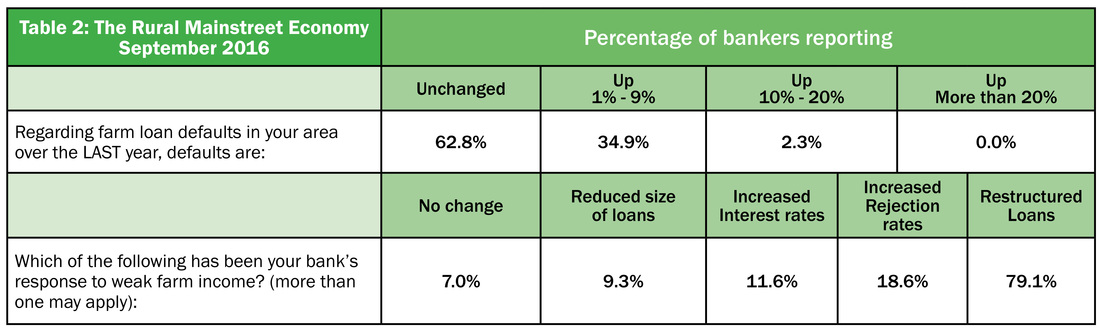

- Almost 4 of 5 bank CEOs indicated restructuring farm loans due to weak farm income.

- Farmland prices remained below growth neutral for the 34th consecutive month.

- Almost one-fifth of bankers reported increasing rejection rates on agricultural loans due to weak farm income.

OMAHA, Neb. – The Creighton University Rural Mainstreet Index sank for September and remained below growth neutral for the 13th straight month, according to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy.

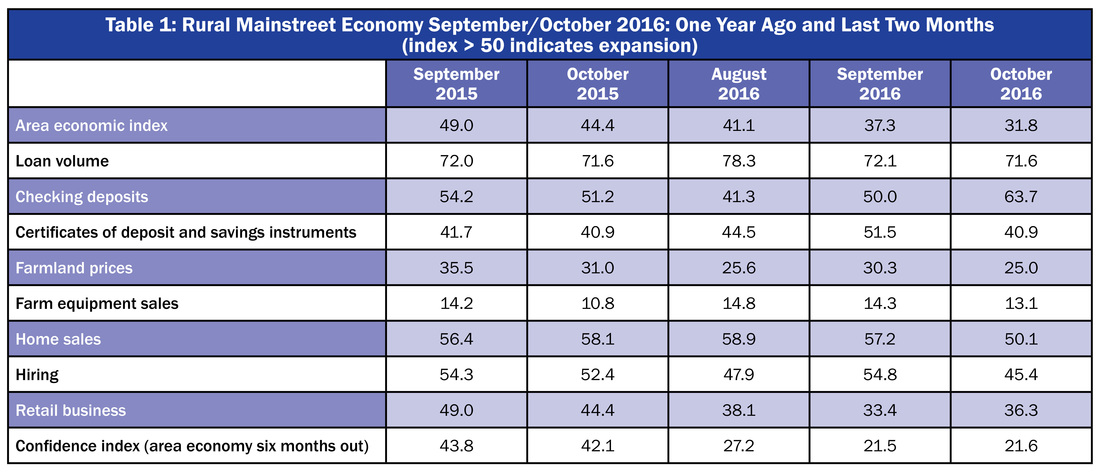

Overall: The index, which ranges between 0 and 100 fell to 37.3 from 41.1 in August. This month’s reading is well off the index for September 2015 when it stood at 49.0.

“According to the USDA, 2016 net farm income is expected to decline by almost 12 percent from 2015 levels. Even with an anticipated 25 percent increase in government support payments for 2016, the Rural Mainstreet economy continues to falter according to our surveys of bankers,” said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University's Heider College of Business.

“Even though loan defaults have changed little over the past year, downturns in farm income over the past three years are pushing bankers to change the terms of farm loans. According to Creighton’s September survey, almost four of five, or 79.1 percent, of bank CEOs reported a significant upturn in loan restructuring due to weak farm income,” said Goss.

Jim Eckert, president of Anchor State Bank in Anchor, Illinois, expects lower agriculture commodity prices to cause all but the best capitalized producers to only break even or lose money for 2016.

The September farm equipment-sales index sank to 14.3 from August’s 14.8. “Weakness in farm income and low agricultural commodity prices continue to restrain the sale of agriculture equipment across the region. This is having a significant and negative impact on both farm equipment dealers and agricultural equipment manufacturers across the region,” said Goss.

One bank CEO indicated there would be substantial 2017 impacts from current conditions. The CEO is concerned that bank regulators will not provide necessary “breathing room” for banks to weather plummeting farm income.

Banking: Borrowing by farmers remains strong as the September loan-volume index slipped to a strong 72.1 from last month’s 78.3. The checking-deposit index climbed to 50.0 from 41.3 in August, while the index for certificates of deposit and other savings instruments improved to 51.5 from 44.5 in August.

Hiring: After moving below growth neutral 50.0 for July and August, the Rural Mainstreet hiring index advanced to a solid 54.8 for September, up briskly from August’s 47.9 and July’s 49.0. For the region, Rural Mainstreet employment is down by 0.9 percent over the past 12 months.

But some bankers reported significant pullbacks in employment. For example, James Shafer, CEO of the First National Bank in Tremont, Illinois, reported, “Continued (loan) restructuring and layoffs by Caterpillar are having a strong, negative impact in our immediate area.”

Confidence: The confidence index, which reflects expectations for the economy six months out, plummeted to 21.5 from August’s 27.2, indicating an intense pessimistic outlook among bankers. “Recent downturns in already weak agriculture commodity prices pushed banker’s economic outlook even lower for the month,” said Goss.

Home and Retail Sales: Home sales remain the positive indicator of the Rural Mainstreet economy with a strong September index of 57.2, though it was down slightly from 58.9 in August. The September retail-sales index slumped to 33.4 from August’s very weak 38.1. “Despite low inventories of homes for sale, Rural Mainstreet home sales continue on a solid trajectory, but rural retailers, much like their urban counterparts, are experiencing downturns in sales,” said Goss.

Each month, community bank presidents and CEOs in nonurban agriculturally and energy-dependent portions of a 10-state area are surveyed regarding current economic conditions in their communities and their projected economic outlooks six months down the road. Bankers from Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming are included. The survey is supported by a grant from Security State Bank in Ansley, Nebraska.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) climbed to 54.7 from 51.1 in August. The farmland and ranchland-price index soared to 69.7 from August’s 59.0. Colorado’s hiring index for September jumped to 73.2 from 64.8 in August. Colorado job growth over the last 12 months; Rural Mainstreet, 1.2 percent; Urban Colorado, 3.3 percent. Illinois: The Septemer RMI for Illinois increased to a feeble 32.1 from 21.2 in August. The farmland-price index rose to 26.3 from August’s 17.5. The state’s new-hiring index climbed to 50.7 from last month’s 44.2. According to Fritz Kuhlmeier, CEO of Citizens State Bank in Lena, exceptional 2016 crop yields will make cash flows positive even with lower commodity prices. But Kuhlmeier says “2017 looks to be a real challenge on average crop yields without a reduction in cash rents.” Illinois job growth over the last 12 months; Rural Mainstreet, -1.5 percent; Urban Illinois 1.0 percent. Iowa: The September RMI for Iowa fell to a solid 56.2 from August’s 58.3. Iowa’s farmland-price index for September increased to 47.2 from 40.5 in August. Iowa’s new-hiring index for September expanded to 65.1 from August’s 58.1. Iowa job growth over the last 12 months; Rural Mainstreet, 1.9 percent; Urban Iowa, 1.5 percent. Kansas: The Kansas RMI for September increased to 35.4 from August’s 24.6. The state’s farmland-price index for September advanced to a weak 24.2 from August’s 13.4. The new-hiring index for Kansas increased to 51.7 from 44.6 in August. Kansas job growth over the last 12 months; Rural Mainstreet, -1.8 percent; Urban Kansas, 0.5 percent. Minnesota: The September RMI for Minnesota climbed to 39.0 from August’s 30.3. Minnesota’s farmland-price index grew to 26.3 from 18.0 in August. The new-hiring index for the state expanded to 57.5 from last month’s 49.9. According to Pete Haddeland, CEO of the First National Bank in Mahnomen, crops in his area looked great, but were a “little wet.” Minnesota job growth over the last 12 months; Rural Mainstreet, 0.1 percent; Urban Minnesota 1.8 percent. | Missouri: The September RMI for Missouri increased to 26.4 from 22.4 in August. The farmland-price index expanded to 29.7 from August’s 14.9. Missouri’s new-hiring index increased to 35.6 from 17.1 in August. Missouri job growth over the last 12 months; Rural Mainstreet, -8.2 percent; Urban Missouri 1.7 percent. Nebraska: The Nebraska RMI for September sank to 61.2 from August’s regional high of 64.5. The state’s farmland-price index climbed to 46.9 from August’s 43.5. Nebraska’s new-hiring index grew to 64.9 from 59.2 in August. Nebraska job growth over the last 12 months; Rural Mainstreet, 2 percent; Urban Nebraska, 1.0 percent. North Dakota: The North Dakota RMI for September increased to 20.9 from 17.8 in August. The farmland-price index climbed to 18.7 from August’s 12.1. North Dakota’s new-hiring index expanded to 37.8 from 25.6 in August. North Dakota job growth over the last 12 months; Rural Mainstreet, -8.1 percent; Urban North Dakota, 1.3 percent. South Dakota: The September RMI for South Dakota fell to 52.1 from August’s 54.3. The farmland-price index expanded to 41.2 from August’s 27.3. South Dakota's new-hiring index improved to 62.8 from August’s 53.3. South Dakota job growth over the last 12 months; Rural Mainstreet, 1.8 percent; Urban South Dakota, 3.7 percent. Wyoming: The September RMI for Wyoming increased to 22.3 from 18.9 in August. The September farmland and ranchland-price index expanded to 19.7 from August’s 15.6. Wyoming’s new-hiring index increased to 48.5 from August’s 39.6. Wyoming job growth over the last 12 months; Rural Mainstreet, -2.6 percent; Urban Wyoming, -3.2 percent. |

RSS Feed

RSS Feed