- The Rural Mainstreet Index fell below growth neutral to its lowest level in almost two year.

- Three of four bank CEOs reported the trade war was having a negative impact on their local economy.

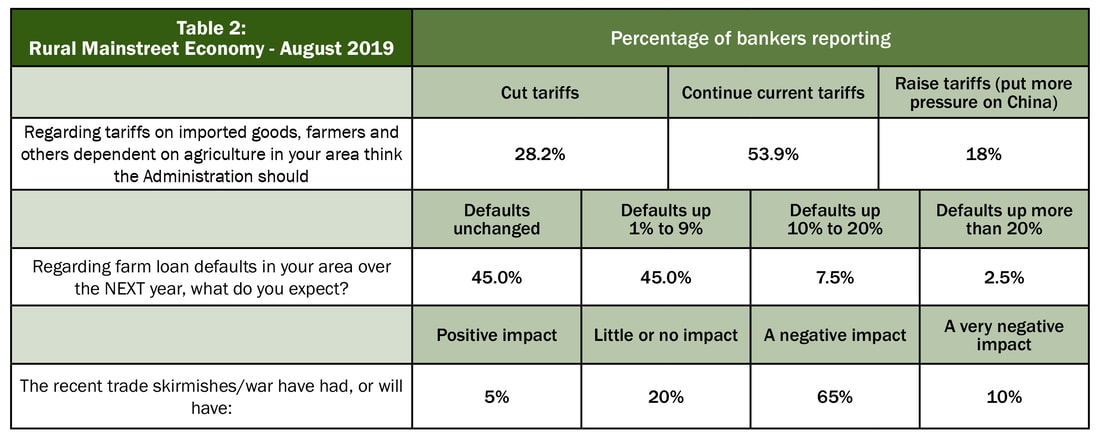

- Seven of 10 bankers support continuing, or even raising tariffs on imported Chinese goods.

- Despite worsening economic conditions on the farm, bankers expect only a modest 4% rate of farm loan defaults over the next year.

- Business confidence index plummeted to its lowest level since October 2017.

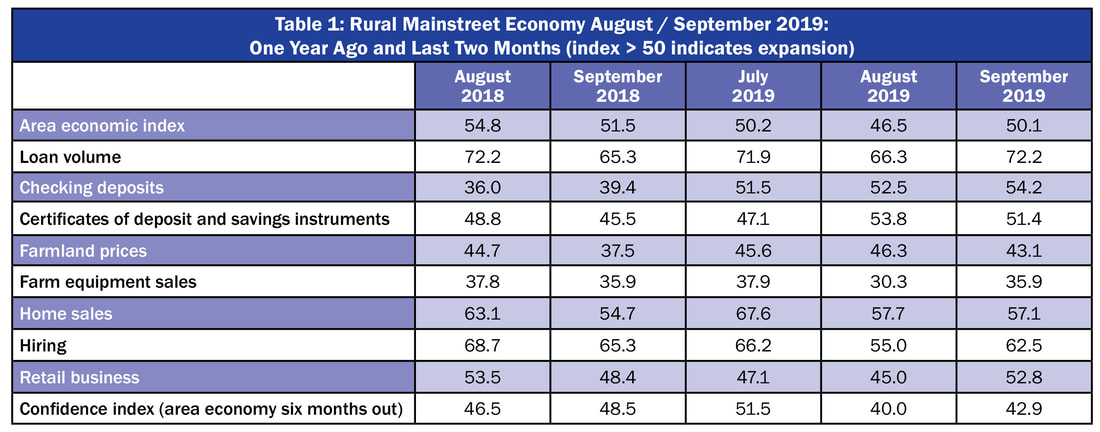

Overall: The overall index slumped to 46.5 from 50.2 in July. This is the lowest reading for the index since October 2017. The index ranges between 0 and 100 with 50.0 representing growth neutral, and an RMI below the growth neutral threshold. 50.0, indicates negative growth for the month.

“The trade war with China and the lack of passage of the USMCA (NAFTA’s replacement) are driving growth lower for areas of the region with close ties to agriculture. Despite a $16 billion federal government support package coming soon, a drop in farm income is negatively affecting the Rural Mainstreet Economy,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Three of four bankers reported the trade war was having a negative impact on their local economy.

As stated by Jeffrey Gerhart, CEO of the Bank of Newman Grove in Newman Grove, Nebraska, “Trade wars have been and will continue to be a drain on our ag economy”.

“Despite the negative impact of tariffs and the trade war, only 28.2% of bankers support cutting tariffs on imported goods from China,” said Goss.

Rod Cornelius, market president for Pinnacle Bank in Grand Island, Nebraska reported, “I quickly surveyed 12 local producers, a majority indicated (U.S. should) increase tariff pressure - go big or go home. Although the majority again indicated the tariffs are negatively impacting the local economy.”

The August farm equipment-sales index dropped to 30.3 from July’s 37.9. This marks the 72nd straight month the reading has remained below growth neutral 50.0. “The dismal economic outlook for farm income continues to decimate agriculture equipment sales in the region,” reported Goss.

Banking: Borrowing by farmers for August remained strong. The borrowing index slipped to 66.3 from July’s 71.9. The checking-deposit index rose to 52.5 from July’s 51.5, while the index for certificates of deposit and other savings instruments expanded to 52.5 from 47.1 in July.

Despite worsening economic conditions on the farm, bankers expect only a modest 4% rate of farm loan defaults over the next year.

Hiring: The employment gauge sank to a still solid 55.0 from July’s very strong 66.2. Despite tariffs and flooding over the past several months, Rural Mainstreet businesses continue to hire at a solid pace.

Over the past 12 months, the Rural Mainstreet economy added jobs at a 0.3% pace compared to a higher 1.5 % for urban areas of the same 10 states. Rural areas in four Rural Mainstreet states, Illinois, Iowa, Missouri, and Nebraska lost jobs over the past 12 months.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, plummeted to 40.0 from July’s 51.5, indicating a very negative economic outlook among bankers. This is the lowest confidence index recorded since October 2017.

Home and Retail Sales: The home-sales index decreased to a still solid 57.7 from July’s 67.6. The retail sales index for August slumped to 45.0 from July’s 47.1. “It appears that the region experienced a significant slump in retail sales from June’s solid sales index of 58.1,” said Goss.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index (RMI) for August dipped to 50.0 from July’s 53.0. The farmland and ranchland-price index climbed to 47.1 from July’s 46.2. Colorado’s hiring index for August fell to 61.8 from July’s 74.5. Over the past 12 months rural areas in Colorado have experienced job growth of 3% compared to a somewhat weaker, but still healthy, 1.9% for urban areas of the state. Illinois: The August RMI for Illinois decreased to 45.2 from 49.1 in July. The farmland-price index was unchanged from July’s 45.2. The state’s new-hiring index dropped to 56.2 from last month’s 59.5. Over the past 12 months rural areas in Illinois have experienced job losses with a shrinkage of 0.5% compared to a much stronger 1.7% for urban areas of the state. Jim Eckert, president of Anchor State Bank in Anchor, reported that “Crops in our immediate area (central Illinois) look pretty good, but need rain soon. You don't have to go very far north or south to find poor-looking crops, very far behind normal and very, very dry.” Iowa: The August RMI for Iowa sank to 46.2 from July’s 49.9. Iowa’s farmland-price index improved to 46.1 from July’s 45.4. Iowa’s new-hiring index for August fell to 51.8 from 61.6 in July. Over the past 12 months rural areas in Iowa have experienced job losses with a reduction of 0.4% compared to a much stronger 1.4% for urban areas of the state. Kansas: The Kansas RMI for August slid to 45.6 from 49.0 in July. The state’s farmland-price index grew to 45.9 from July’s 45.2. The new-hiring index for Kansas plummeted to 49.9 from 59.4 in July. Over the past 12 months rural areas in Kansas have experienced job losses with a contraction of 0.3% compared to a stronger 1.8% for urban areas of the state. According to Don Vogel, CEO of Farmers National Bank, “Our rural area is dependent on ag and is down due to reduced acreage planted, due to wet spring conditions, reduced yield due to current dry conditions, and tariffs.” Minnesota: The August RMI for Minnesota slid to 47.1 from July’s 55.3. Minnesota’s farmland-price index rose to 46.3 from 45.5 in July. The new-hiring index for August declined to 54.0 from July’s 63.0. Over the past 12 months rural areas in Minnesota have experienced job growth of 1.4% compared to a significantly weaker 0.5% for urban areas of the state. | Missouri: The August RMI for Missouri fell to 41.1 from 45.1 in July. The farmland-price index for the state increased to 44.7 from July’s 44.1. Missouri’s new-hiring index for July tumbled to 38.0 from July’s 48.9. Over the past 12 months rural areas in Missouri have experienced mounting job losses with job reductions of minus 4% compared to a much stronger 1.6% for urban areas of the state. Nebraska: The Nebraska RMI for August fell to 44.4 from July’s 47.9. The state’s farmland-price index slipped to 43.5 from last month’s 44.0. Nebraska’s new-hiring index slumped to 46.8 from July’s 56.3. Over the past 12 months rural areas in Nebraska have lost jobs at a rate of minus 1.1% compared to a stronger 1.3% for urban areas of the state. But there is some optimism among bankers. John Nelsen, branch president of FirsTier Bank in Holdrege, said, “If we happen to win the trade war, we will have a very positive impact on our local economy. We need to play it out.” North Dakota: The North Dakota RMI for August declined to 47.4 from July’s 51.0. The state’s farmland-price index increased to 46.4 from 45.7 in July. The state’s new-hiring index fell to a still solid 54.9 from 64.5 in July. Over the past 12 months rural areas in North Dakota have experienced job growth of 1.6% compared to a weaker 0.4% for urban areas of the state. South Dakota: The August RMI for South Dakota sank below growth neutral, falling to 48.7 from July’s 51.5. The state’s farmland-price index improved to 46.8 from July’s 45.8. South Dakota’s new-hiring index plummeted to 58.2 from 66.1 in July. Over the past 12 months rural areas in South Dakota have experienced job growth of 3% compared to a healthy 2.3% for urban areas of the state. Wyoming: The August RMI for Wyoming sank to 48.5 from July’s 51.7. The August farmland and ranchland-price index increased to 46.7 from July’s 45.9. Wyoming’s new-hiring index slumped to 57.7 from 66.5 in July. Over the past 12 months rural areas in Wyoming have experienced job growth of 2.9% compared to a weaker 0.9% for urban areas of the state. |

RSS Feed

RSS Feed