- For a ninth straight month, the overall index rose above growth neutral.

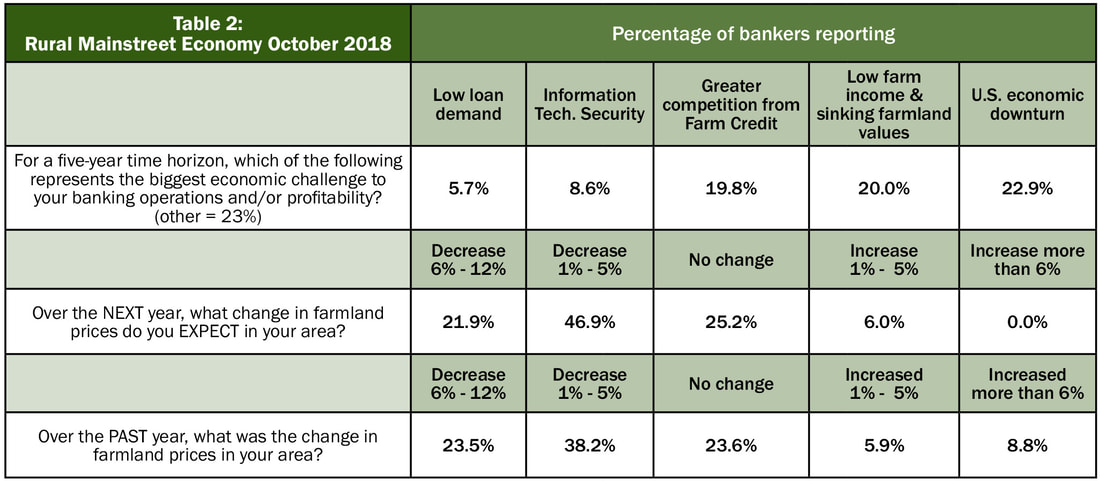

- On average, bankers estimated that farmland prices declined by 4.0 percent over the past 12 months and expect farmland prices to fall by another 3.2 percent over the next 12 months.

- Approximately one-fifth of bank CEOs expect low farm income and falling farmland prices to present the greatest challenge to banking operations over the next 5 years.

- Loan demand by farmers remains strong.

OMAHA, Neb. (Oct. 18, 2018) – The Creighton University Rural Mainstreet Index climbed above growth neutral in October for a ninth straight month, according to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy.

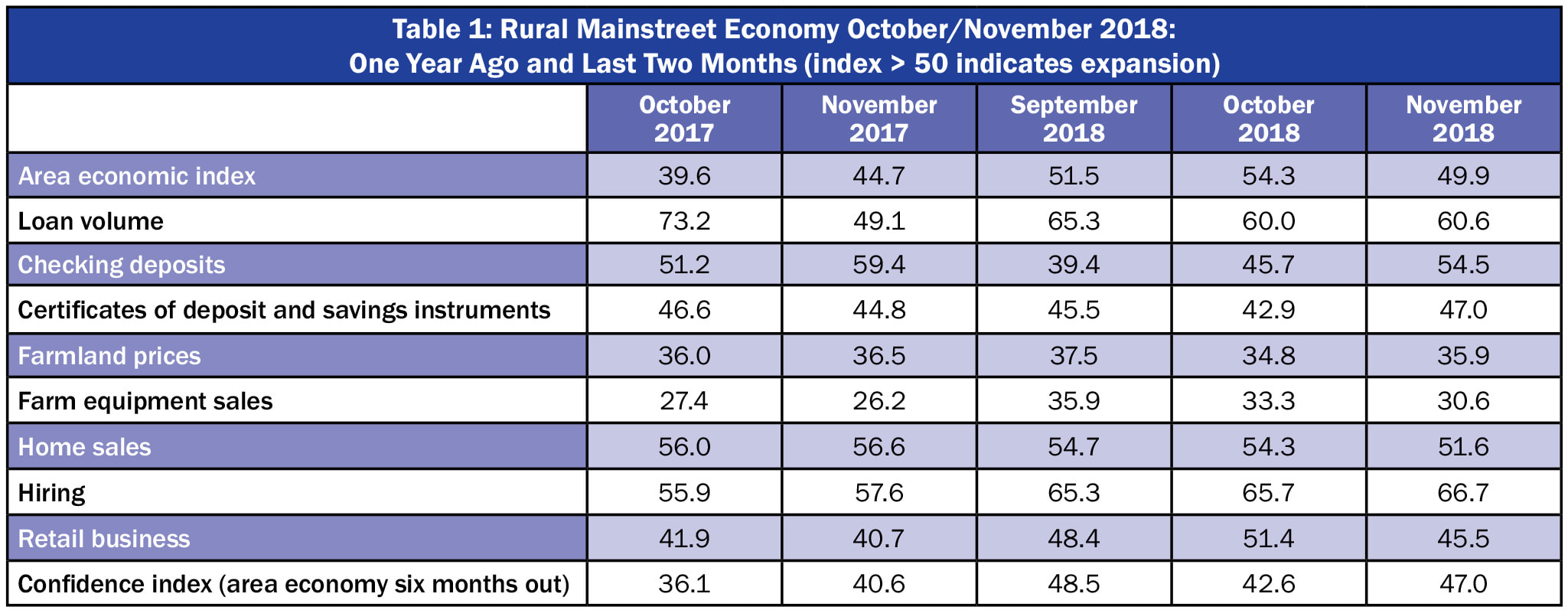

Overall: The overall index expanded to 54.3 from 51.5 in September. The index ranges between 0 and 100 with 50.0 representing growth neutral.

“Our surveys over the last several months indicate that the Rural Mainstreet economy is expanding outside of agriculture. However, the negative impacts of tariffs and low agriculture commodity prices continue to weaken the farm sector,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

James Brown, CEO of Hardin County Savings Bank in Eldora, Iowa, said, “Deteriorating crop conditions and the late harvest are the overriding concerns with our farmers.”

Bank CEOs were asked to estimate the change in farmland prices over the past 12 months and for the next 12 months. On average, bankers estimated that farmland prices declined by 4.0 percent over the past 12 months and expect farmland prices to fall by another 3.2 percent over the next 12 months.

According to Fritz Kuhlmeier CEO of Citizens State Bank in Lena, Illinois, “More than ever, farmland values are extremely dependent upon quality, and location, location, location.”

The October farm equipment-sales index fell to 33.3 from September’ 35.9. This marks the 62nd consecutive month that the reading has moved below growth neutral 50.0.

Banking: Borrowing by farmers contracted for October as the loan-volume index declined to 60.0 from 65.3 in September. The checking-deposit index increased to 45.7 from September’s 39.4, while the index for certificates of deposit and other savings instruments fell to 42.9 from 45.5 in September.

Hiring: The employment gauge climbed to 65.7 from September’s strong 65.3. The Rural Mainstreet economy is now experiencing healthy job growth. Over the past 12 months, the Rural Mainstreet economy added jobs at a 1.6 percent pace compared to a lower 1.5 percent for urban areas of the same 10 states.

Confidence: The confidence index, which reflects expectations for the economy six months out, sank to a very weak 42.6 from September’s 49.5, indicating a pessimistic economic outlook among bankers.

“Just as last month, tariffs, trade tensions, and weak agriculture commodity prices diminished the economic outlook of bank CEOs,” said Goss.

However, the Trump Administration’s decision to support expansion of ethanol usage is expected to have a positive impact but in the long term. “The ethanol boost may help our commodity prices eventually but probably not short term,” said Brown.

Home and Retail Sales: The home-sales index decreased to a still solid 54.3 from 54.7 in September. Retail sales sank for the month with an index of 54.3, up sharply from September’s 48.3. “Consumers are clearly more optimistic about the economy as they spent more heavily in October,” said Goss.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index for October fell to 54.6 from September’s 56.1. The farmland and ranchland-price index slumped to 35.1 from 38.0 in September. Colorado’s hiring index for October slipped to 65.7 from September’s 68.1. Colorado’s Rural Mainstreet economy added jobs at a 1.2 percent pace over the past 12 months. Illinois: The October RMI for Illinois climbed to 54.8 from 52.4 in September. The farmland-price index sank to 35.2 from September’s 45.5. The state’s new-hiring index rose to 66.7 from last month’s 65.9. Illinois’s Rural Mainstreet economy added jobs at a 2.0 percent pace over the past 12 months. Iowa: The October RMI for Iowa improved to 53.5 from September’s 51.2. Iowa’s farmland-price index for October sank to 34.6 from September’s 37.3. Iowa’s new-hiring index for October dipped to 59.8 from September’s 61.1. Iowa’s Rural Mainstreet economy added jobs at a 0.8 percent pace over the past 12 months. Kansas: The Kansas RMI for October expanded to 55.5 from September’s 53.2. The state’s farmland-price index sank to 35.5 from 38.1 in September. The new-hiring index for Kansas climbed to 69.7 from 69.0 in September. Kansas’s Rural Mainstreet economy added jobs at a 2.2 percent pace over the past 12 months. Minnesota: The October RMI for Minnesota expanded to 53.9 from September’s 50.0. Minnesota’s farmland-price index slumped to 34.8 from 37.2 in September. The new-hiring index for October advanced to 63.2 from September’s 58.8. Minnesota’s Rural Mainstreet economy added jobs at a 0.8 percent pace over the past 12 months. | Missouri: The October RMI for Missouri expanded to 54.5 from 52.7 in September 56.4. The farmland-price index for the state sank to 35.1 from September’s 37.9. Missouri’s new-hiring index for October declined to 65.6 from September’s 67.1. Missouri's Rural Mainstreet economy added jobs at a 1.7 percent pace over the past 12 months. Nebraska: The Nebraska RMI for October rose to 54.2 from 52.0 in September. The state’s farmland-price index fell to 34.9 from last month’s 37.6. Nebraska’s new-hiring index increased to 64.5 from 64.2 in September. Nebraska's Rural Mainstreet economy added jobs at a 1.2 percent pace over the past 12 months. North Dakota: The North Dakota RMI for October advanced to 53.9 from September’s 50.5. The state’s farmland-price index moved higher to 36.7 from 35.4 in October. The state’s new-hiring index increased to 63.0 from 58.4 in September. North Dakota's Rural Mainstreet economy added jobs at a 1.7 percent pace over the past 12 months. South Dakota: The October RMI for South Dakota remained above growth neutral improving to 55.5 from September’s 52.8. The state’s farmland-price index declined to 35.4 from September’s 38.0. South Dakota’s new-hiring index bounced to 69.6 from 67.5 in September. South Dakota's Rural Mainstreet economy added jobs at a 2.8 percent pace over the past 12 months. Wyoming: The October RMI for Wyoming climbed to 56.3 from September’s 53.5. The October farmland and ranchland-price index moved lower to 35.8 from September’s 38.4. Wyoming’s new-hiring index expanded to a very healthy 72.8 from 70.4 in September. Wyoming’s Rural Mainstreet economy added jobs at a 3.8 percent pace over the past 12 months. |

RSS Feed

RSS Feed