- The overall index experienced it’s largest one-month decline since November 200.8

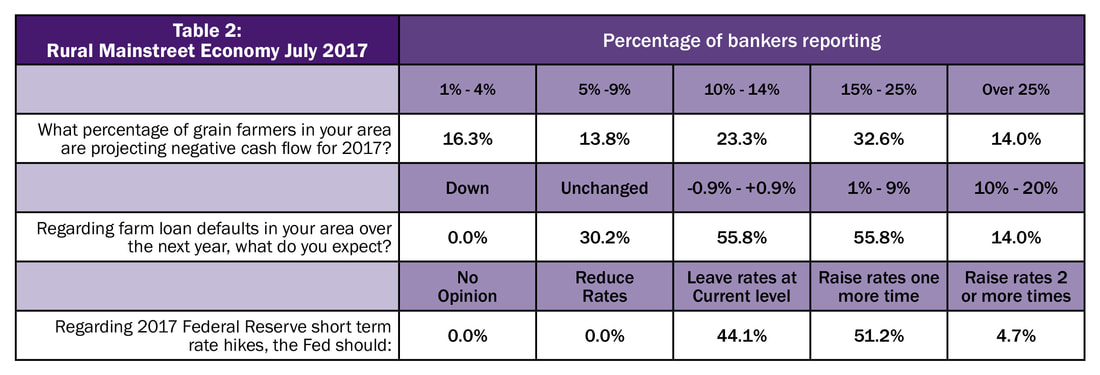

- On average, bankers expect 15.1 percent of grain farmers to suffer negative cash flows for 2017.

- Loan volumes rise to second highest reading in survey history.

- On average, bankers estimated loan defaults of 4.9 percent over next 12 months, down from the 5.4 percent predicted last year at this time.

- Approximately 55.9 percent of bank CEOs say the Federal Reserve should raise interest rates at least one more time in 2017.

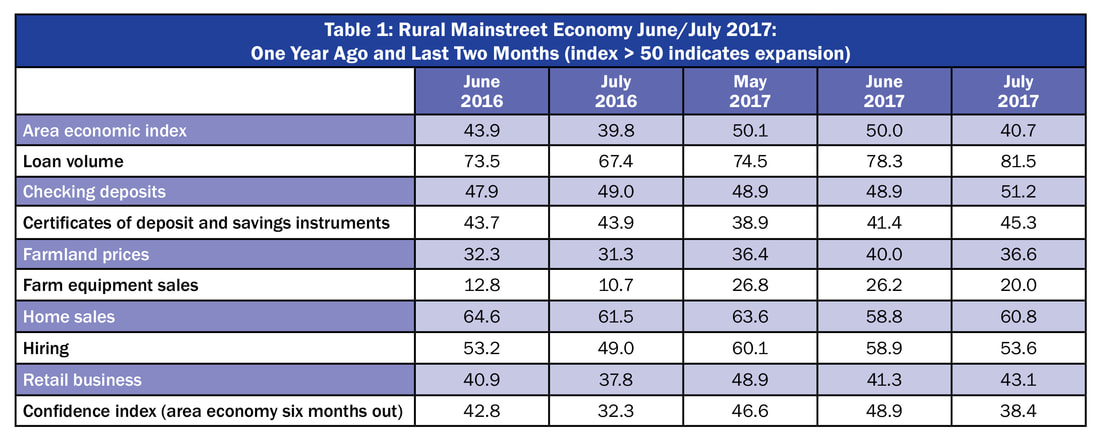

Overall: The index, which ranges between 0 and 100, tumbled to 40.7, its lowest level since November of last year, and down from 50.0 in June.

“This is the largest one-month decline we have recorded since November 2008, or in the middle of the national recession, “said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University's Heider College of Business. “Drought conditions in portions of the region, combined with weak grain prices, negatively affected economic conditions, and the economic outlook for a large share of bank CEOs this month.”

Scott Tewksbury, president of Heartland State Bank in Edgeley, North Dakota, reported, “As of July 15, this is the third driest year since 1901. Crop conditions are poor and economic activity is weaker than it would be otherwise.”

But in neighboring Minnesota, Pete Haddeland, CEO of the First National Bank in Mahnomen, said, “Our crops look good here. The wheat is great.”

This month, and in July 2016, bank CEOs were asked to project the percentage of grain farmers likely to experience negative cash flows for 2017. On average, bankers expect 15.1 percent of grain farmers to suffer negative cash flows for 2017. This is an improvement from last year when 19.1 percent anticipated negative cash flows for 2016.

The July farm equipment-sales index fell to 20.0 from 26.2 in June. This marks the 47th consecutive month the reading has dropped below growth neutral 50.0.

Fritz Kuhlmeier, CEO of Citizens State Bank in Lena, Illinois, reported, “Crop conditions in northwest Illinois are such that I expect yields well below the recent trendline.”

Banking: Borrowing by farmers was very strong for July as the loan-volume index climbed to 81.5, the second highest reading on record, and up from 78.3 in June. The checking-deposit index was 51.2, up from June’s 48.9, while the index for certificates of deposit and other savings instruments increased to 45.3 from 41.3 in June.

This month, as in July of last year, bankers were asked to project loan defaults for the next 12 months. On average, bankers estimated loan defaults of 4.9 percent which was down from the 5.4 percent predicted last year at this time.

Approximately 55.9 percent of bank CEOs say the Federal Reserve should raise interest rates at least one more time in 2017.

Hiring: The job gauge dropped to 53.6 from June’s healthy 58.9. Rural Mainstreet businesses not linked to agriculture increased hiring for the month as businesses tied to the farm experienced layoffs.

Confidence: The confidence index, which reflects expectations for the economy six months out, slumped to a weak 38.4 from 48.9 in June, indicating a continued pessimistic outlook among bankers. “While farm commodity prices have improved, they remain weak and below breakeven for a large share of grain farmers. This combined with drought conditions in portions of the region dented economic confidence,” said Goss.

Home and Retail Sales: Home sales moved higher for the Rural Mainstreet economy for July. The July reading rose to 60.8 from June’s 58.8. The July retail-sales index inched upward to a weak 43.1 from 41.3 in June. “Much like their urban counterparts, Rural Mainstreet retailers are experiencing significant pullbacks in sales,” reported Goss.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) slumped to 39.1 from 50.2 in June. The farmland and ranchland-price index fell to 35.5 from June’s 40.1. Colorado’s hiring index for July sank to 49.2 from June’s 62.1. Illinois: The July RMI for Illinois plummeted to 40.2 from 50.6 in June. The farmland-price index declined to 36.3 from June’s 40.4. The state’s new-hiring index dropped to 54.2 from last month’s 64.0. Iowa: The July RMI for Iowa tumbled to 41.7 from 50.5 in June. Iowa’s farmland-price index for July dipped to 37.3 from 40.5 in June. Iowa’s new-hiring index for July remained healthy at 60.7, though it was down from June’s 64.3. Kansas: The Kansas RMI for July sank to 39.4 from June’s 47.6. The state’s farmland-price index slipped to 35.8 from 39.2 in June. The new-hiring index for Kansas declined to 50.6 from 55.9 in June. Minnesota: The July RMI for Minnesota slumped to 42.8 from June’s regional high of 51.7. Minnesota’s farmland-price index dipped to 38.0 from 41.1 in June. The new-hiring index for the state declined to a still strong 65.5, down from last month’s 68.1. | Missouri: The July RMI for Missouri fell to 42.2 from 51.6 in June. The farmland-price index improved to 42.3 from June’s 41.0. Missouri’s new-hiring index declined to a still strong 62.8 from 68.1 in June. Nebraska: The Nebraska RMI for July sank to 42.1 from June’s 51.4. The state’s farmland-price index declined to 37.5 from 40.9 in June. Nebraska’s new-hiring index stood at a strong 62.5, but down from 67.4 in June. North Dakota: The North Dakota RMI for July 41.5 from June’s 48.7. The state’s farmland-price index inched higher to 41.0 from June’s 40.9. North Dakota’s new-hiring index jumped to 59.9 from 55.4 in June. South Dakota: The July RMI for South Dakota fell to 38.9 from June’s 47.2. The farmland-price index slumped to 35.4 from June’s 38.1. South Dakota's new-hiring index slipped to 48.1 from June’s 48.9. Wyoming: The July RMI for Wyoming tumbled to 40.0 from June’s 48.1. The July farmland and ranchland-price index dipped to 36.1 from June’s 38.7. Wyoming’s new-hiring index improved slightly to 53.0 from 52.7 in June. |

(Click each table to view larger.)

For historical data and forecasts, visit our website: https://www.creighton.edu/economicoutlook/

For ongoing commentary on recent economic developments, visit our blog at: http://www.economictrends.blogspot.com

RSS Feed

RSS Feed