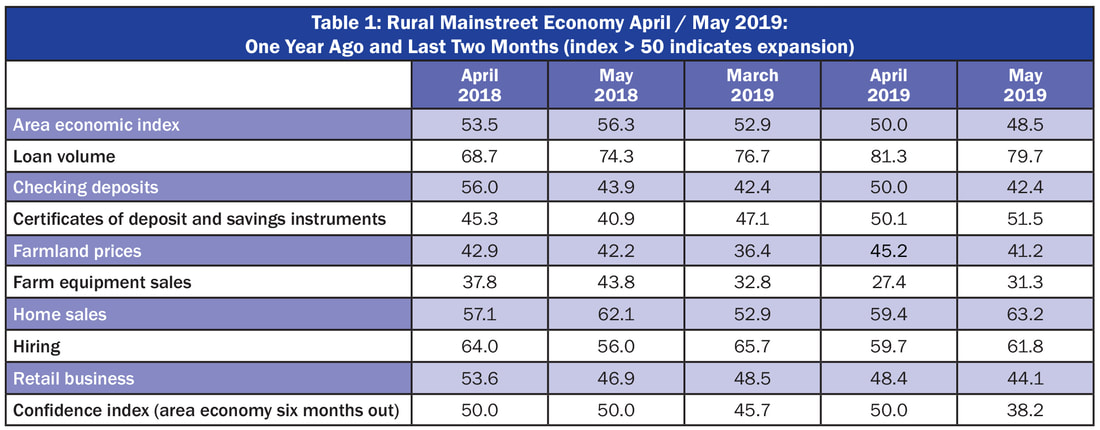

- For the fifth straight month the overall index has remained at or above 50.0.

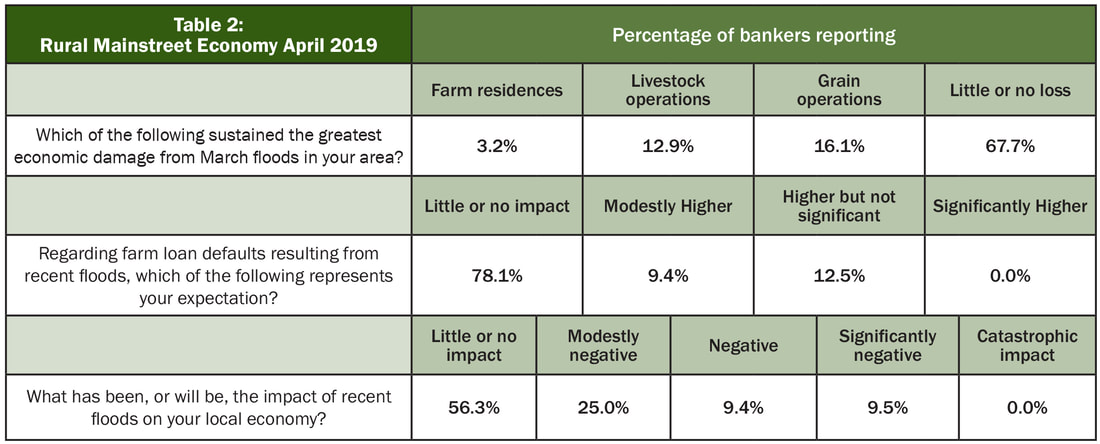

- More than one-fifth of bankers, or 21.9 percent, expect an increase in farm loan defaults stemming from recent floods.

- Farm loans soared to their highest level since initiation of survey in 2006.

- Approximately 43.8 percent of bankers reported that recent floods have had a negative impact on the local economy.

Overall: The overall index slipped to 50.0 from 52.9 in March. Since falling below growth neutral in November of last year, the overall RMI has risen above the growth neutral value. The index ranges between 0 and 100 with 50.0 representing growth neutral.

“Our surveys over the last several months indicate the Rural Mainstreet economy is expanding outside of agriculture. However, this month, 43.8 percent of bank CEOs indicated that the recent floods were having a negative impact on their local economy,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Farming and Ranching: The farmland and ranchland-price index for April rose to 45.2, its highest level since February of last year, and up from March’s 36.4. This is the 65th straight month the index has remained below growth neutral 50.0.

The April farm equipment-sales index sank to 27.4 from March’s 32.8. This marks the 68th straight month that the reading has fallen below growth neutral 50.0.

Bankers were asked which farmers sustained the greatest economic damages from the floods in their area. Of bankers reporting farm flood damage, approximately one-half indicated grain farmers incurred the greatest economic damage, while 40 percent indicated the greatest flood damage was sustained by livestock operators. The remaining 10 percent indicated the greatest flood damage was sustained by farm residences.

According to bank CEO Winum, “Short term it is important that Congress get past all the politics and pass a comprehensive disaster relief bill that allows people to make decisions. For the long-term viability of impacted homeowners, farmers and businesses, the commitment to rebuild our levees and re-evaluate flood control priorities going forward will ultimately determine whether communities and businesses can be confident that this event will never happen again.”

Banking: Borrowing by farmers for April surged as the borrowing index climbed to 81.3, a record high, from March’s high 76.7. The checking-deposit index increased to 50.0 from March’s 42.4, while the index for certificates of deposit and other savings instruments rose to 50.1 from 47.1 in March.

In terms of financial stress for farmers, more than one-fifth, or 21.9 percent, expect recent floods to increase farm loan defaults. On the other hand, 78.1 percent expect floods to have little or no impact on farm loan defaults.

Hiring: The employment gauge slipped to a still healthy 59.4 from March’s 65.7. Despite weak farm commodity prices and farm income, Rural Mainstreet businesses continue to hire at a solid pace. Over the past 12 months, the Rural Mainstreet economy added jobs at a 0.5 percent pace compared to a higher 0.9 percent for urban areas of the same 10 states.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, improved to 50.0 from March’s anemic 45.7, indicating a subdued economic outlook among bankers.

“March floods, tariffs, trade tensions, and anemic farm income negatively influenced the economic outlook of bank CEOs,” said Goss.

Home and Retail Sales: The home-sales index increased to a healthy 59.4 from 52.9 in March. The retail sales index for April dipped slightly to 48.4 from 48.5 in March.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005. Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index for April fell to 51.6 from 54.5 in March. The farmland and ranchland-price index rose to 45.6 from March’s 36.8. Colorado’s hiring index for April declined to 61.6 from March’s 67.1 Illinois: The April RMI for Illinois sank to 44.2 from 46.8 in March. The farmland-price index expanded to 43.6 from March’s 34.8. The state’s new-hiring index plummeted to 41.9 from last month’s 59.1. Iowa: The April RMI for Iowa improved to 51.5 from March’s 50.2. Iowa’s farmland-price index climbed to 44.4 from March’s 35.7. Iowa’s new-hiring index for April slumped to 50.3 from 55.7 in March. Regarding recent floods in the state, Larry Winum, CEO of Glenwood State Bank in Glenwood, reported, “Now is the time for our Federal legislators, USACE, FEMA, and all levee districts to come together and develop a comprehensive plan for our levee systems. We have been discussing this for years, now we have no excuse not to get something done permanently.” Kansas: The Kansas RMI for April sank to 47.6 from March’s 50.5. The state’s farmland-price index improved to 44.5 from 35.7 in March. The new-hiring index for Kansas declined to 51.1 from 56.5 in March. Minnesota: The April RMI for Minnesota slipped to 49.1 from March’s 52.0. Minnesota’s farmland-price index climbed to 44.9 from 36.1 in March. The new-hiring index for April declined to 55.0 from March’s 60.4. | Missouri: The April RMI for Missouri fell to 44.6 from 47.5 in March. The farmland-price index for the state increased to 43.7 from March’s 34.9. Missouri’s new-hiring index for April slumped to 43.1 from March’s 48.6. Nebraska: The Nebraska RMI for April fell to 47.9 from 50.8 in March. The state’s farmland-price index rose to 44.6 from last month’s 35.8. Nebraska’s new-hiring index declined to 51.8 from March’s 57.3. North Dakota: The North Dakota RMI for April fell to 55.0 from March’s 57.9. The state’s farmland-price index improved to 46.5 from 37.7. The state’s new-hiring index declined to 70.7 from 76.1 in March. South Dakota: The April RMI for South Dakota remained above growth neutral but fell to 51.3 from March’s 54.2. The state’s farmland-price index climbed to 45.5 from March’s 36.7. South Dakota’s new-hiring index declined to 60.8 from 66.2 in March. Wyoming: The April RMI for Wyoming advanced to 55.9 from March’s 55.1. The April farmland and ranchland-price index advanced to 45.7 from March’s 37.0. Wyoming’s new-hiring index decreased to 63.4 from 68.8 in March. |

RSS Feed

RSS Feed