- The overall index from February’s survey bounced above growth neutral to its highest reading since May 2014.

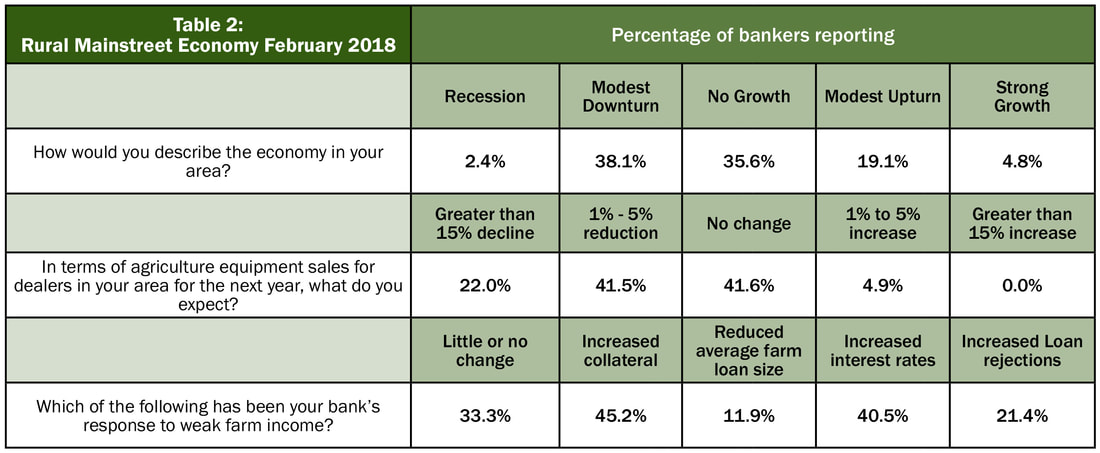

- Almost two-thirds of bank CEOs expect farm equipment sales to trend lower for 2018.

- On average bankers expect farm equipment sales to decline by 7 percent in 2018.

- One-third of bankers reported no change in their farm lending practices over the past year, while 45.2 percent indicated that their bank had raised collateral requirements for farm loans.

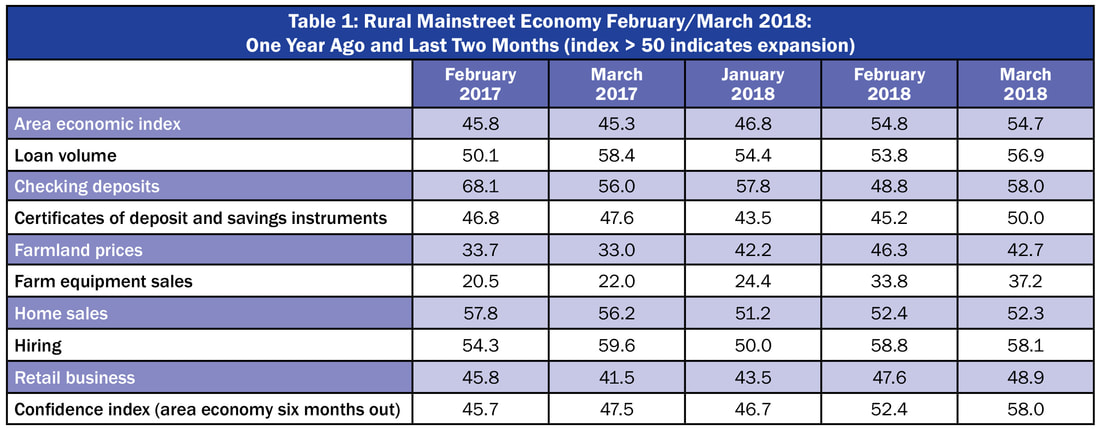

Overall: The overall index soared to 54.8 from 46.8 in January, the highest reading for the overall index since May 2014. The index ranges between 0 and 100 with 50.0 representing growth neutral.

“Given that fewer than one in four, or 23.9 percent, of bankers reported economic growth in their area, the solid February reading surprised me. However, weak agriculture commodity prices continue to weigh on the rural economy,” said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Jim Eckert, president of Anchor State Bank in Anchor, Illinois, reported, “We are seeing farmers with somewhat reduced income and moderate operating loan carryovers. However, without rain prior to planting, 2018 could be a bad year.”

Farming and Ranching: The farmland and ranchland-price index for February rose to 46.3 from 42.2 for January. This is the highest reading since July 2014, but it is the 51st straight month the index has fallen below growth neutral 50.0.

Almost two-thirds, or 63.5 percent of bankers, project that agriculture equipment sales will decline further in 2018. Only 4.9 percent of bank CEOs expect farm equipment sales to expand in 2018. Even so, these projections are an improvement from February 2017, when 73.9 percent of bank CEOs expected a slump in farm equipment sales for the year, and 4.3 percent anticipated an increase in equipment sales. On average a decline of seven percent is expected for 2018.

Banking: Borrowing by farmers sank for February, as the loan-volume index stood at 53.8 from 54.4 in January. The checking-deposit index fell to 48.8 from January’s 57.8, while the index for certificates of deposit and other savings instruments advanced to 45.2 from 43.5 in January.

Bank CEOs were asked how their banks were dealing with weak farm income. More than four in 10, or 45.2 percent, reported increasing collateral requirements, 21.4 percent indicated rejecting a higher percent of loan applications, and 11.9 percent reported reducing the average size of farm loans.

On the other hand, one third reported no change in their farm lending practices. As stated by Jeffrey Gerhart, chairman of Bank of Newman Grove, Newman Grove, Nebraska, “Our response to a weak farm economy is to continue working closely with our customers to get them through the tough times, just like we’ve always done.”

Hiring: The employment gauge climbed to 58.8 from January’s 50.0. The Rural Mainstreet economy experienced year-over-year job growth of only 0.4 percent compared to 1.3 percent for urban areas of the states.

Confidence: The confidence index, which reflects expectations for the economy six months out, rose to 52.4 from 46.7 in January indicating rising economic optimism among bankers. “However, an unresolved North America Free Trade Agreement, a weak USDA 2018 farm income projection, and anemic agriculture commodity prices continue to undermine economic optimism,” said Goss.

Home and Retail Sales: The home-sales index moved slightly higher for the Rural Mainstreet economy in February, rising to 52.4 from January’s 51.2. The February retail-sales index improved to a below growth neutral 47.6 from January’s 43.5.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) increased to 59.6 from 51.7 in January. The farmland and ranchland-price index expanded to 47.7 from January’s 43.7. Colorado’s hiring index for February rocketed to 68.6 from January’s 60.8. Illinois: The February RMI for Illinois climbed to 54.4 from 46.4 in January. The farmland-price index rose to 46.1 from 42.1 in January. The state’s new-hiring index advanced to 58.1 from last month’s 50.2. Iowa: The February RMI for Iowa expanded to a solid 55.3 from 47.3 in January. Iowa’s farmland-price index for February increased to 46.4 from January’s 42.4. Iowa’s new-hiring index for February soared to 60.0 from January’s 52.1. Kansas: The Kansas RMI for February jumped to 51.1 from January’s 43.1. The state’s farmland-price index rose to 45.1 from 41.1 in January. The new-hiring index for Kansas climbed to 51.5 from January’s 43.6. Minnesota: The February RMI for Minnesota expanded to 52.9 from January’s 46.5. Minnesota’s farmland-price index rose to 45.1 from 41.1 in January. The new-hiring index for the state climbed to 51.4 from January’s 43.6. Pete Haddeland, CEO of the First National Bank in Mahnomen, said “Farm cash flow projections for 2018 are very difficult to work (at this time).” | Missouri: The February RMI for Missouri soared to 59.6 from 51.6 in January. The farmland-price index slipped to 42.3 from 43.6 in January. Missouri’s new-hiring index shot up to 68.5 from 60.6 in January. Nebraska: The Nebraska RMI for February climbed to 54.3 from January’s 46.3. The state’s farmland-price index climbed to 46.1 from last month’s 42.1. Nebraska’s new-hiring index fell to a still solid 57.9 from 60.6 in January. North Dakota: The North Dakota RMI for February increased to 57.9 from January’s 51.4. The state’s farmland-price index moved higher to 47.2 from 43.1 in January. North Dakota’s new-hiring index bounced to 65.1 from 57.2 in January. South Dakota: The February RMI for South Dakota remained below growth neutral, but was up for February to 48.2 from 40.2 in January. The state’s farmland-price index dipped slightly to 40.0 from 40.2 in January. South Dakota's new-hiring index expanded to 45.8 from January’s 37.9. Wyoming: The February RMI for Wyoming rose to 52.3 from January’s 44.3. The February farmland and ranchland-price index climbed to 48.9 from 41.5 in January. Wyoming’s new-hiring index expanded to 53.9 from January’s 50.2. |

(Click each table to view larger.)

RSS Feed

RSS Feed