- Overall index falls below growth neutral for first time since January.

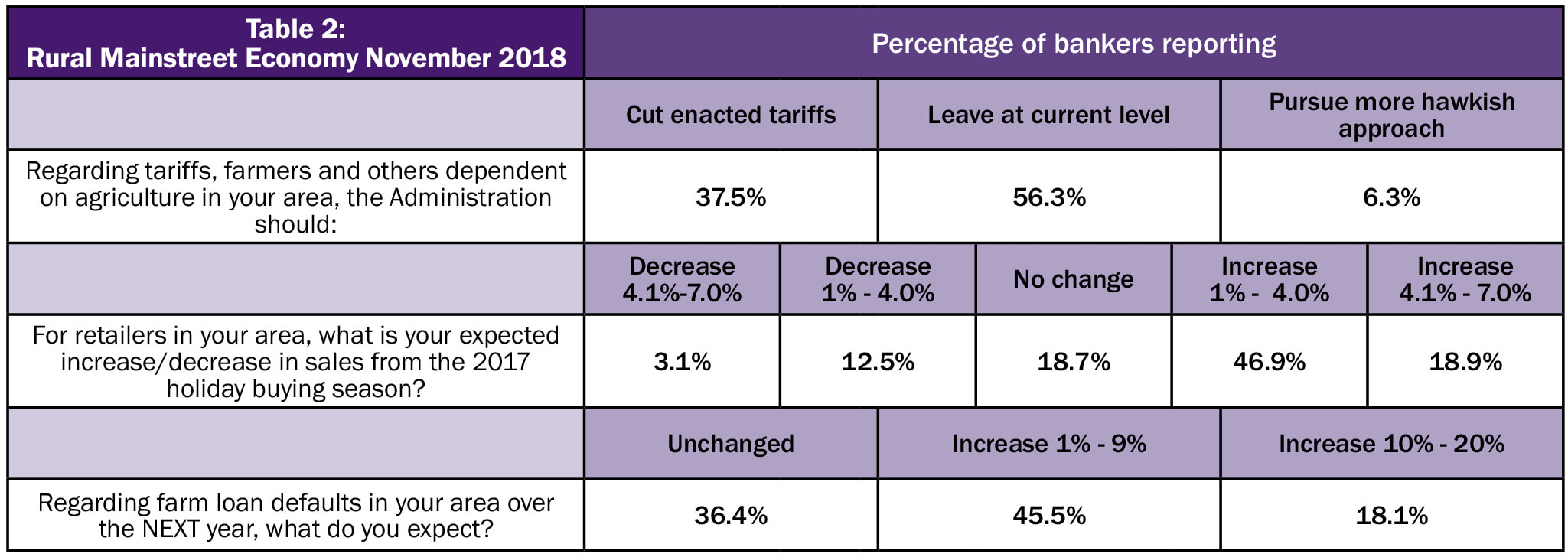

- Approximately 37.5 percent of bank CEOs support reducing recently enacted tariffs on imported goods.

- On average, bank CEOs expect holiday retail sales in their area to expand by only 1.7 percent from last year.

- On average, bankers project that farm loan defaults will rise by 5.0 percent over the next year.

OMAHA, Neb. (Nov. 15, 2018) – The Creighton University Rural Mainstreet Index for November fell below growth neutral for the first time since January of this year, according to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy.

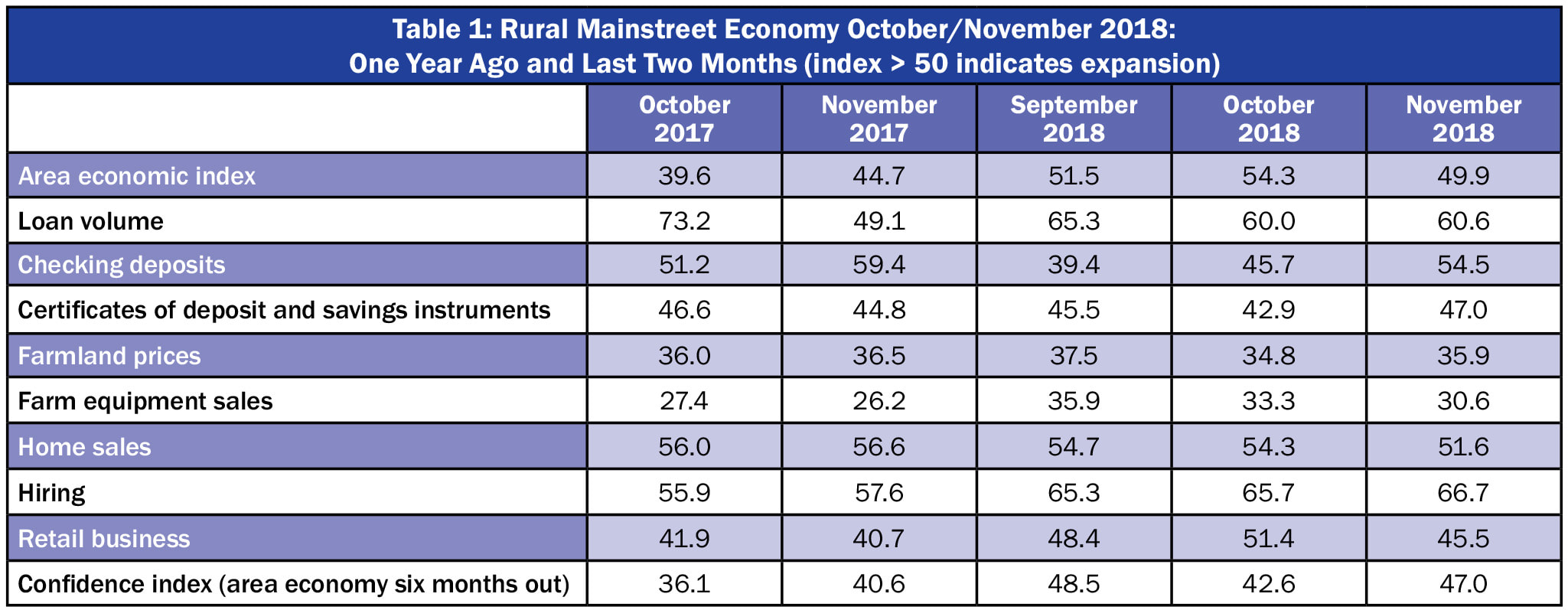

Overall: The overall index sank to 49.9, its first sub-growth neutral reading since January of this year, and down from October’s 54.3. The index ranges between 0 and 100 with 50.0 representing growth neutral.

“Our surveys over the last several months indicate the Rural Mainstreet economy is expanding outside of agriculture. However, the negative impacts of tariffs and low agriculture commodity prices continue to weaken the farm sector,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Approximately 37.5 percent of bank CEOs support reducing recently enacted tariffs on imported goods.

Jeffrey Gerhart, CEO of the Bank of Newman Grove, Newman Grove, Nebraska, said, “Farmers continue to feel the negative impact of tariffs and that impacts their ability to make a buck. Farmers do not need this kind disruption in their markets. This is bad policy from the White House.”

Bank CEOs were asked to estimate the change in farm loan defaults over the next year in their area. On average, bankers project that farm loan defaults will rise by 5.0 percent over the next year.

The November farm equipment-sales index fell to 30.6 from October’s 33.3. This marks the 63rd consecutive month that the reading has moved below growth neutral 50.0.

According to Jim Eckert, president of Anchor State Bank in Anchor, Illinois, “Even though farm yields were decent, low prices have depressed land and equipment sales.”

Banking: Borrowing by farmers advanced for November as the loan-volume index stood at 60.6, up slightly from 60.0 in October. The checking-deposit index increased to 54.5 from October’s 45.7, while the index for certificates of deposit and other savings instruments increased to 47.0 from 42.9 in October.

Hiring: The employment gauge climbed to a very healthy 66.7 from October’s 65.7. The Rural Mainstreet economy is now experiencing healthy job growth. Over the past 12 months, the Rural Mainstreet economy added jobs at a 1.5 percent pace compared to a lower 1.4 percent for urban areas of the same 10 states.

Confidence: The confidence index, which reflects expectations for the economy six months out, rose to a weak 47.0 from October’s feeble 42.6, indicating a pessimistic economic outlook among bankers.

“Just as last month, tariffs, trade tensions, and weak agriculture commodity prices negatively influenced the economic outlook of bank CEOs,” said Goss.

Home and Retail Sales: The home-sales index decreased to 51.6 from 54.3 in October. Retail sales slumped for the month with an index of 45.5, down sharply from October’s 54.3.

“On average, bank CEOs expect holiday retail sales in their area to expand by only 1.7 percent from last year. The downturn in farm commodity prices and income is spilling over into the retail sector across the region,” said Goss.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index for November rose to 55.2 from October’s 54.6. The farmland and ranchland-price index increased to 36.3 from 35.1 in October. Colorado’s hiring index for November climbed to 67.9 from October’s 65.7. Over the past 12 months, Colorado’s Rural Mainstreet economy added jobs at a 3.9 percent pace, while urban areas in the state increased jobs by 2.5 percent. Illinois: The November RMI for Illinois sank to 50.6 from 54.8 in October. The farmland-price index increased to 36.3 from October’s 35.2. The state’s new-hiring index climbed to 68.3 from last month’s 66.7. Jim Eckert, president of Anchor State Bank in Anchor, said, “Area crops were not as poor as expected. Corn yields were 5 to10% lower than 2017. Soybean crop was about the same as prior crop.” Over the past 12 months, Illinois’ Rural Mainstreet economy added jobs at a 2.4 percent pace, while urban areas in the state increased jobs by 0.7 percent. Iowa: The November RMI for Iowa slumped to 48.7 from October’s 53.5. Iowa’s farmland-price index increased to 35.6 from October’s 34.6. Iowa’s new-hiring index for November climbed to 60.7 from October’s 59.8. Over the past 12 months, Iowa’s Rural Mainstreet economy added jobs at a 0.1 percent pace, while urban areas in the state increased jobs by 1.7 percent. Kansas: The Kansas RMI for November sank to 48.5 from October’s 55.5. The state’s farmland-price index was unchanged from 35.5 in October. The new-hiring index for Kansas declined to 60.0 from 69.7 in October. Over the past 12 months, Kansas’s Rural Mainstreet economy added jobs at a 1.5 percent pace, while urban areas in the state increased jobs by 1.4 percent. Minnesota: The November RMI for Minnesota fell to 47.2 from October’s 53.9. Minnesota’s farmland-price index rose to 35.8 from 34.8 in October. The new-hiring index for November advanced to 63.3 from October’s 63.2. Over the past 12 months, Minnesota’s Rural Mainstreet economy lost jobs at a pace of 0.3 percent, while urban areas in the state increased jobs by 1.6 percent. | Missouri: The November RMI for Missouri declined to 50.8 from 54.5 in October. The farmland-price index for the state increased to 36.4 from October’s 35.1. Missouri’s new-hiring index for November jumped to 69.3 from October’s 65.6. Over the past 12 months, Missouri’s Rural Mainstreet economy added jobs at a 3.1 percent pace, while urban areas in the state increased jobs by 1.1 percent. Nebraska: The Nebraska RMI for November slumped to 49.5 from October’s 54.2. The state’s farmland-price index rose to 35.9 from last month’s 34.9. Nebraska’s new-hiring index dipped to 64.1 from 64.5 in October. Over the past 12 months, Nebraska’s Rural Mainstreet economy added jobs at a 1.1 percent pace, while urban areas in the state increased jobs by 2.1 percent. North Dakota: The North Dakota RMI for November declined to 50.0 from October’s 53.9. The state’s farmland-price index dipped to 36.1 from 36.7 in October. The state’s new-hiring index increased to 66.1 from 63.0 in October. Over the past 12 months, North Dakota’s Rural Mainstreet economy added jobs at a 1.4 percent pace, while urban areas in the state increased jobs by 0.8 percent. South Dakota: The November RMI for South Dakota remained above growth neutral, but declined to 51.0 from October’s 55.5. The state’s farmland-price index increased to 36.5 from October’s 35.4. South Dakota’s new-hiring index bounced to 70.2 from 69.6 in October. Over the past 12 months, South Dakota’s Rural Mainstreet economy added jobs at a 1.8 percent pace, while urban areas in the state increased jobs by 1.7 percent. Wyoming: The November RMI for Wyoming fell to 51.6 from October’s 56.3. The November farmland and ranchland-price index moved higher to 36.7 from October’s 35.8. Wyoming’s new-hiring index dipped to 72.5 from 72.8 in October. Over the past 12 months, Wyoming’s Rural Mainstreet economy added jobs at a 2.8 percent pace, while urban areas in the state increased jobs by 0.7 percent. |

RSS Feed

RSS Feed