- Overall index moves above growth neutral and to its highest level since December of last year.

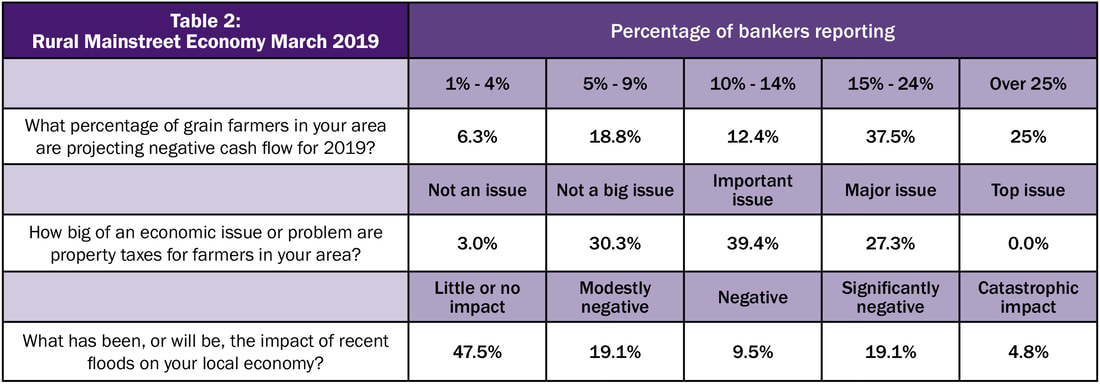

- More than half of supply managers reported negative economic impacts from flooding.

- Approximately 82.9 percent of bankers reported that the number one reaction to farmer financial stress has been restructuring loans.

- On average, bankers expect approximately 18 percent of grain farmers to experience expenses to exceed revenue for 2019. Up only slightly from March 2018.

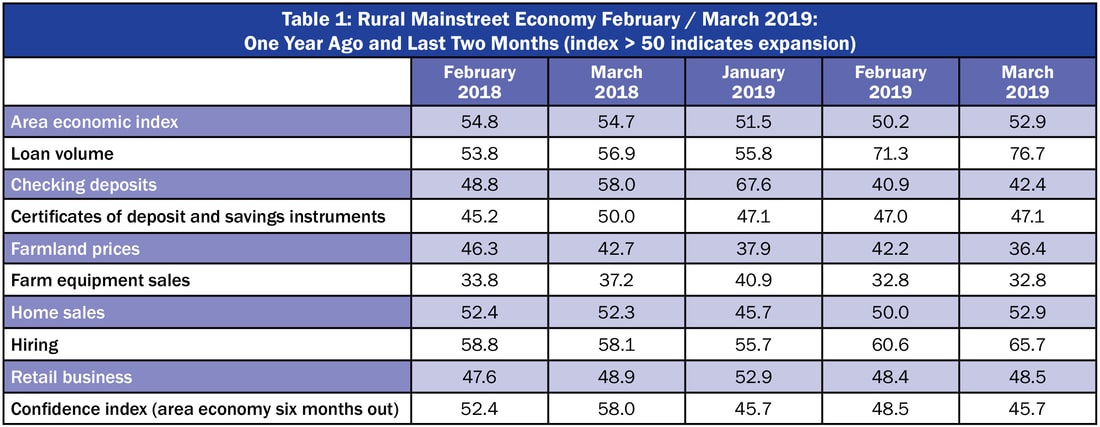

Overall: The overall index expanded to 52.9 from 50.2 in February. This is highest reading since December of last year, and the eleventh time in the past twelve months that the index has moved above growth neutral. The index ranges between 0 and 100 with 50.0 representing growth neutral.

Farming and Ranching: The farmland and ranchland-price index for March slumped to 36.4 from February’s 42.2. This is the 64th straight month the index has fallen below growth neutral 50.0.

The February farm equipment-sales index was unchanged from February’s 32.8. This marks 67th straight month that the reading has fallen below growth neutral 50.0.

Bankers were asked to estimate the percentage of grain farmers in their area that were projecting negative cash flow for 2019. On average, bankers expect approximately 18 percent of grain farmers to experience expenses to exceed revenue for 2019. This is approximately one percent higher than last March’s results when the same question was asked.

However, Fritz Kuhlmeier, CEO of Citizens State Bank in Lena, Illinois, reported, “2019 will again be a critical point in the progression of deterioration of balance sheets from this depressed farm economy. Working capital buffers have been greatly reduced by negative cash flows the last four years with cash flows again stressed to negative for the current crop year.”

Kuhlmeier also indicated that strong yields and last year's market facilitation payments on soybeans have slowed the financial decline.

Regarding property taxes on farmers, 25.7 percent of bankers reported that these taxes were a major problem or issue for farmers. Another 40.0 percent indicated that property taxes were an important issue for farmers.

In terms of financial stress for farmers, 82.9 percent of bankers reported that the number one reaction to financial stress was restructuring loans. Another 14.3 percent indicated that farmers were slow paying their loans and 2.9 percent reported financially stressed farmers selling the farm to more economically viable farm operators.

Banking: Borrowing by farmers for March was strong as the borrowing index climbed to 76.7 from February’s 71.3. The checking-deposit index increased to a weak 42.4 from February’s 40.9, while the index for certificates of deposit and other savings instruments rose to 47.1 from 47.0 in February.

Hiring: The employment gauge climbed to a healthy 65.7 from February’s 60.6. Despite weak farm commodity prices and farm income, Rural Mainstreet businesses continue to hire at an improved rate. Over the past 12 months, the Rural Mainstreet economy added jobs at a 0.3 percent pace compared to a higher 1.3 percent for urban areas of the same 10 states.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, fell to an anemic 45.7 from February’s 48.5, indicating a pessimistic economic outlook among bankers.

“March floods, tariffs, trade tensions, and anemic farm income negatively influenced the economic outlook of bank CEOs,” said Goss.

Home and Retail Sales: The home-sales index increased to 52.9 from 50.0 in February. The retail sales index for March was 48.5, unchanged from February.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005. Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index for March climbed to 54.5 from 52.3 in February. The farmland and ranchland-price index fell to 36.8 from February’s 42.7. Colorado’s hiring index for March climbed to 67.1 from February’s 63.9. In 2018, Colorado exported $577.5 million in goods to China. This represented a 1.4 percent decline from the 2017 level. Illinois: The March RMI for Illinois fell to 46.8 from 50.5 in February. The farmland-price index sank to 34.8 from February’s 42.3. The state’s new-hiring index increased to 59.1 from last month’s 58.5. In 2018, Illinois exported $3.4 billion in goods to China. This represented a 34.8 percent decline from the 2017 level. Iowa: The March RMI for Iowa improved to 50.2 from February’s 49.3. Iowa’s farmland-price index decreased to 35.7 from February’s 41.9. Iowa’s new-hiring index for March slipped to 55.7 from 55.9 in February. In 2018, Iowa exported $625.6 million in goods to China. This represented a 6.5 percent increase from the 2017 level. Kansas: The Kansas RMI for March dipped to 50.5 from February’s 50.9. The state’s farmland-price index slumped to 35.7 from 42.4 in February. The new-hiring index for Kansas declined to 56.5 from 60.1 in February. In 2018, Kansas exported $657.1 million in goods to China. This represented a 6.9 percent decline from the 2017 level. Minnesota: The March RMI for Minnesota rose to 52.0 from February’s 47.4. Minnesota’s farmland-price index declined to 36.1 from 41.4 in February. The new-hiring index for March soared to 60.4 from February’s 50.7. In 2018, Minnesota exported $2.3 billion in goods to China. This represented a 13.7 percent gain from the 2017 level. Missouri: The March RMI for Missouri fell to 47.5 from 53.4 in February. The farmland-price index for the state decreased to 34.9 from February’s 43.0. Missouri’s new-hiring index for March slumped to 48.6 from February’s 54.7. In 2018, Missouri exported $782.8 million in goods to China. This represented a 15.8 percent decline from the 2017 level. | Nebraska: The Nebraska RMI for March advanced to 50.8 from February’s 49.4. The state’s farmland-price index slumped to 35.8 from last month’s 42.0. Nebraska’s new-hiring index expanded to 57.3 from February’s 56.2. In 2018, Nebraska exported $424.6 million in goods to China. This represented a 12.1 percent decline from the 2017 level. James Stanosheck, president of the State Bank of Odell in Odell, reported “The big economic issue for Gage county is the repayment of a judgement against the county as a result of a what is called the Beatrice 6. The judgement amount $28 million to $30 million, will be paid by real estate taxes.” North Dakota: The North Dakota RMI for March rose to 57.9 from February’s 52.7. The state’s farmland-price index fell to 37.7 from 42.8 in February. The state’s new-hiring index soared to 76.1 from 65.0 in February. In 2018, North Dakota exported $21.6 million in goods to China. This represented a 58.2 percent decline from the 2017 level. South Dakota: The March RMI for South Dakota remained above growth neutral and climbed to 54.2 from February’s 51.3. The state’s farmland-price index sank to 36.7 from February’s 42.5. South Dakota’s new-hiring index expanded to 66.2 from 61.3 in February. In 2018, South Dakota exported $47.8 million in goods to China. This represented a 24.9 percent decline from the 2017 level. Wyoming: The March RMI for Wyoming advanced to 55.1 from February’s 52.5. The March farmland and ranchland-price index sank to 37.0 from 43.3 in February. Wyoming’s new-hiring index declined to 68.8 from 69.2 in February. In 2018, Wyoming exported $53.0 million in goods to China. This represented a 44.5 percent increase from the 2017 level. |

RSS Feed

RSS Feed