- Overall index moves above growth neutral for the 10th time in past 12 months.

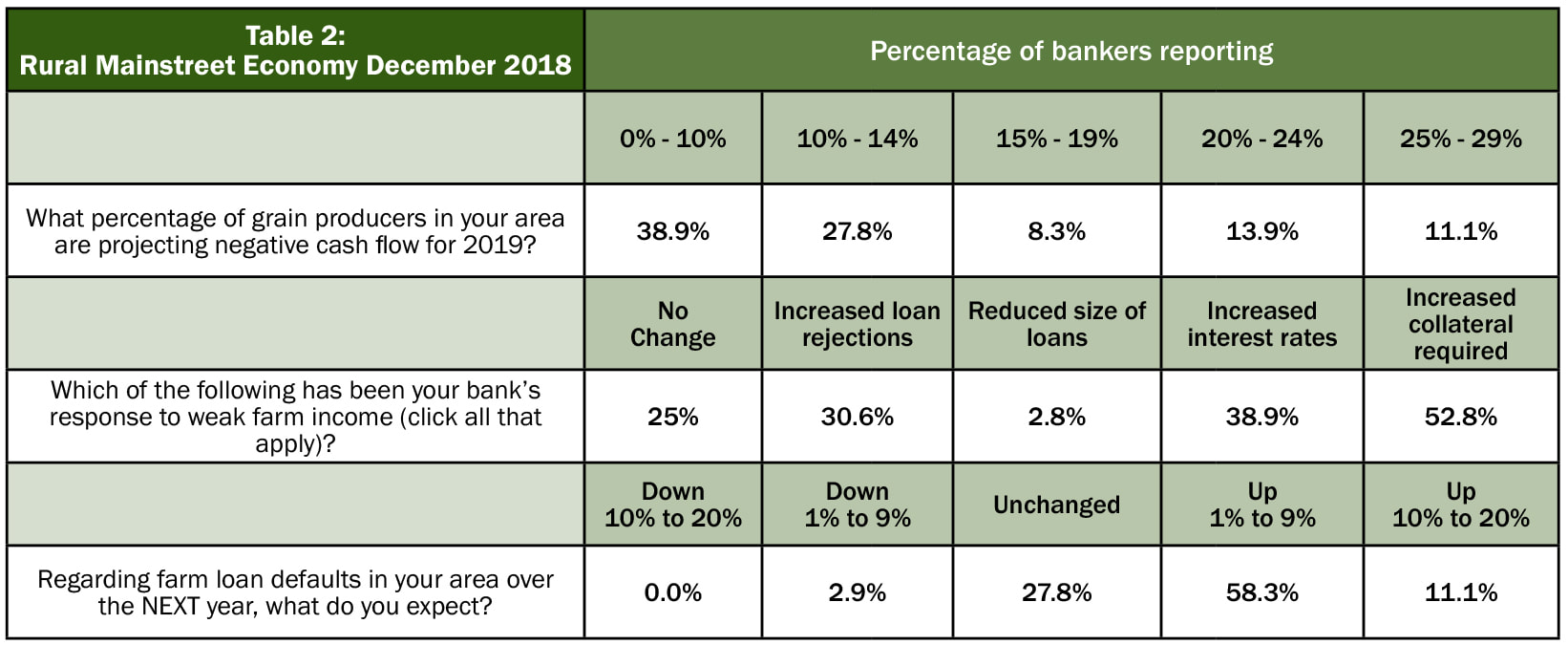

- Bankers project negative cash flow (losses) for more than one in six grain farmers.

- More than half of bankers have boosted collateral requirements for farm loans due to low agricultural income

- One-fourth of bank CEOs have made no change in farm lending practices due to weak farm income.

- Approximately one in 10 bank CEOs project 2019 farm loan defaults to rise by over 10 percent over 2018 levels.

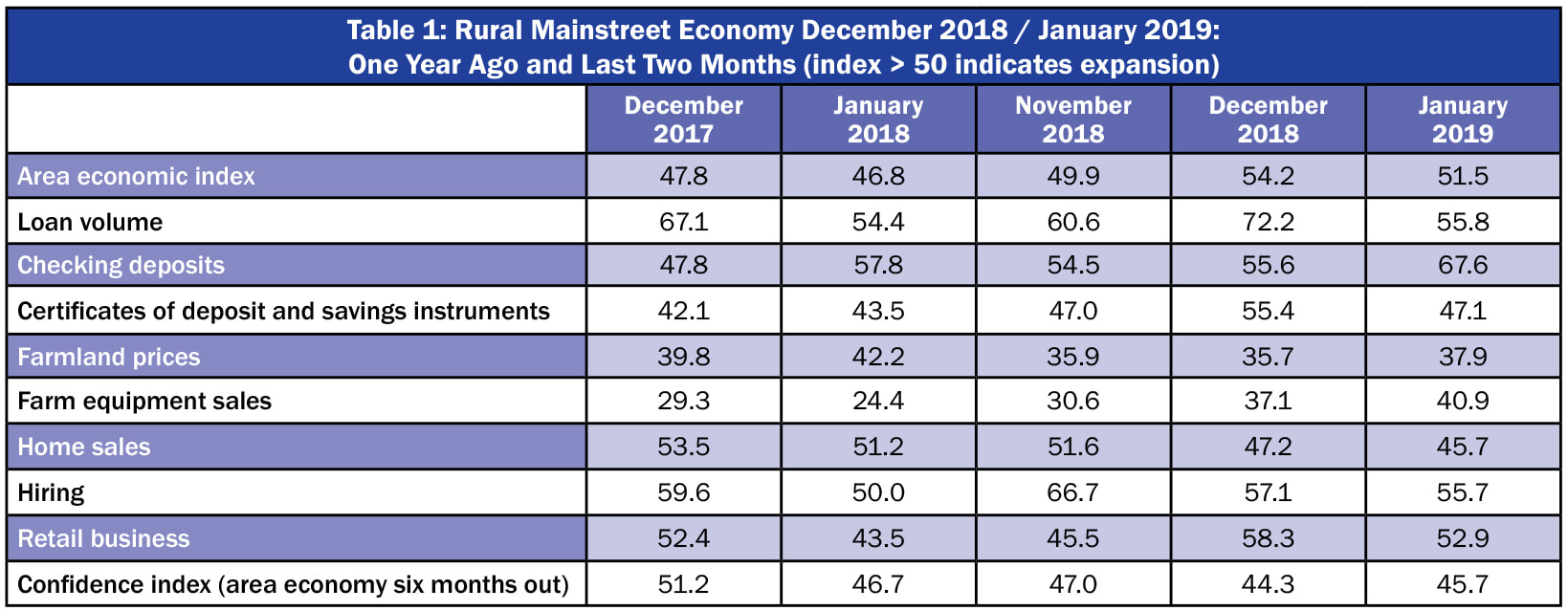

Overall: The overall index climbed to 54.2 from November’s 49.9, its first sub-growth neutral reading since January 2018. The index ranges between 0 and 100 with 50.0 representing growth neutral.

“Our surveys over the last several months indicate the Rural Mainstreet economy is expanding outside of agriculture. However, the negative impacts of tariffs and low agriculture commodity prices continue to weaken the farm sector,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Larry Winum, CEO of Glenwood State Bank in Glenwood, Iowa, said, “Glad to see Congress passed a bipartisan farm bill. (It) allows farmers and their community bankers to budget more accurately in the future.”

The December farm equipment-sales index increased to 37.1 from November’s 30.6. This marks the 64th consecutive month that the reading has moved below growth neutral 50.0.

Banking: Borrowing by farmers advanced for December, as the borrowing index soared to a 72.2 from November’s loan-volume index of 60.6. The checking-deposit index inched forward to 55.6 from November’s 54.5, while the index for certificates of deposit and other savings instruments increased to 55.6 from 47.0 in November.

More than half of bankers, or 52.8 percent, have boosted collateral requirements for farm loans due to low agriculture income. One-fourth of bank CEOs have made no change in farm lending practices due to weak farm income.

Hiring: The employment gauge fell to a still healthy 57.1 from November’s 66.7. The Rural Mainstreet economy is now experiencing healthy job growth. Over the past 12 months, the Rural Mainstreet economy added jobs at a 1.4 percent pace compared to a higher 1.5 percent for urban areas of the same 10 states.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, slumped to 44.3 from November’s 47.0, indicating a pessimistic economic outlook among bankers.

“As in the last month several months, tariffs, trade tensions, and weak agriculture commodity prices negatively influenced the economic outlook of bank CEOs,” said Goss.

Home and Retail Sales: The home-sales index decreased to 47.2 from 51.6 in November. Retail sales climbed to 58.3 from November’s much weaker 45.5.

James Brown, CEO of Hardin County Savings Bank in Eldora, Iowa, reported, “Our Shopko is closing in February. This is a big loss for a town our size (2,700). Our store has done quite well, but not good enough for them.”

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index for December declined to 53.9 from November’s 55.2. The farmland and ranchland-price index dipped to 35.7 from 36.3 in November. Colorado’s hiring index for December fell to 55.7 from November’s 67.9. Over the past 12 months, Colorado’s Rural Mainstreet economy shed jobs at a minus 0.1 percent pace, while urban areas in the state increased jobs by 3.0 percent. Illinois: The December RMI for Illinois climbed to 54.9 from 50.6 in November. The farmland-price index slipped to 36.2 from November’s 36.3. The state’s new-hiring index declined to 59.9 from last month’s 68.3. Illinois’ Rural Mainstreet economy added jobs at a 1.6 percent pace, while urban areas in the state increased jobs by 0.9 percent. Iowa: The December RMI for Iowa rose to 53.7 from November’s 48.7. Iowa’s farmland-price index was unchanged from November’s 35.6. Iowa’s new-hiring index fell to 54.8 from November’s 60.7. Larry Winum, CEO of the Glenwood State Bank in Glenwood, said, “The early snow fall in the Omaha area certainly has hampered harvest. The great yields anticipated will certainly be impacted negatively.” Over the past 12 months, Iowa’s Rural Mainstreet economy added jobs at a 0.6 percent pace, while urban areas in the state increased jobs by 2.0 percent. Kansas: The Kansas RMI for December advanced to 54.6 from November’s 48.5. The state’s farmland-price index inched to 36.0 from 35.5 in November. The new-hiring index for Kansas declined to 58.5 from 60.0 in November. Over the past 12 months, Kansas’s Rural Mainstreet economy added jobs at a 1.4 percent pace, while urban areas in the state increased jobs by an identical 1.4 percent. Minnesota: The December RMI for Minnesota rose to 52.8 from November’s 47.2. Minnesota’s farmland-price index slipped to 35.3 from 35.8 in November. The new-hiring index for December sank to 51.4 from November’s 63.3. Over the past 12 months, Minnesota’s Rural Mainstreet economy lost jobs at a pace of minus 0.7 percent, while urban areas in the state increased jobs by 1.6 percent. | Missouri: The December RMI for Missouri climbed to 56.7 from 50.8 in November. The farmland-price index for the state increased to 36.8 from November’s 36.4. Missouri’s new-hiring index for December declined to 66.9 from November’s 69.3. Over the past 12 months, Missouri’s Rural Mainstreet economy added jobs at a 6.5 percent pace, while urban areas in the state increased jobs by 1.0 percent. Nebraska: The Nebraska RMI for December expanded to 53.7 from November’s 49.5. The state’s farmland-price index slipped to 35.7 from last month’s 35.9. Nebraska’s new-hiring index fell to 54.9 from 64.1 in November. Over the past 12 months, Nebraska’s Rural Mainstreet economy added jobs at a 0.4 percent pace, while urban areas in the state increased jobs by 2.1 percent. North Dakota: The North Dakota RMI for December climbed to 54.5 from November’s 50.0. The state’s farmland-price index increased to 37.9 from 36.1 in November. The state’s new-hiring index declined to 58.3 from 66.1 in November. Over the past 12 months, North Dakota’s Rural Mainstreet economy added jobs at a 2.0 percent pace, while urban areas in the state increased jobs by 0.8 percent. South Dakota: The December RMI for South Dakota remained above growth neutral and increased to 54.9 from November’s 51.0. The state’s farmland-price index increased to 37.1 from November’s 36.5. South Dakota’s new-hiring index fell to 59.7 from 70.2 in November. Scott Tewksbury CEO of Heartland State Bank in Tulare said, “Early financial analysis from farmers seem to point to an improved year in 2018 due to dramatically higher than normal yields in our area, MFP payments and better forward marketing completed the first part of 2018.” Over the past 12 months, South Dakota’s Rural Mainstreet economy added jobs at a 1.7 percent pace, while urban areas in the state increased jobs by 1.9 percent. Wyoming: The December RMI for Wyoming rose to 56.1 from November’s 51.6. The December farmland and ranchland-price index dipped to 36.6 from November’s 36.7. Wyoming’s new-hiring index fell to 64.7 from 72.5 in November. Over the past 12 months, Wyoming’s Rural Mainstreet economy added jobs at a 3.2 percent pace, while urban areas in the state increased jobs by 0.1 percent. |

RSS Feed

RSS Feed