- For the first time since November the Rural Mainstreet Index (RMI) fell below growth neutral.

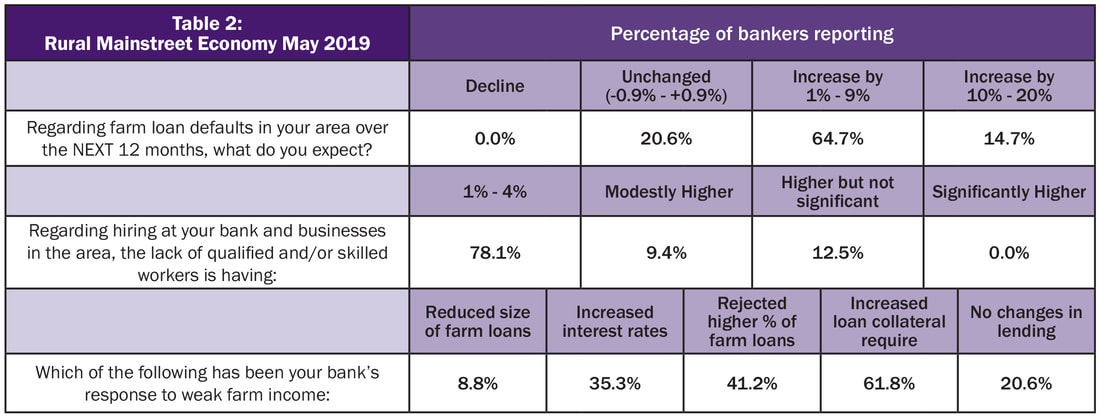

- Bank CEOs project the percentage of farm loan defaults over the next 12 months will double the default rates for 2017.

- In reaction to weak farm income, almost two-thirds of bankers have increased collateral for farm loans.

- More than one in four bankers reports rejecting a higher percentage of farm loans due to declining farm income.

- The economic confidence index dropped to its lowest level in almost two years.

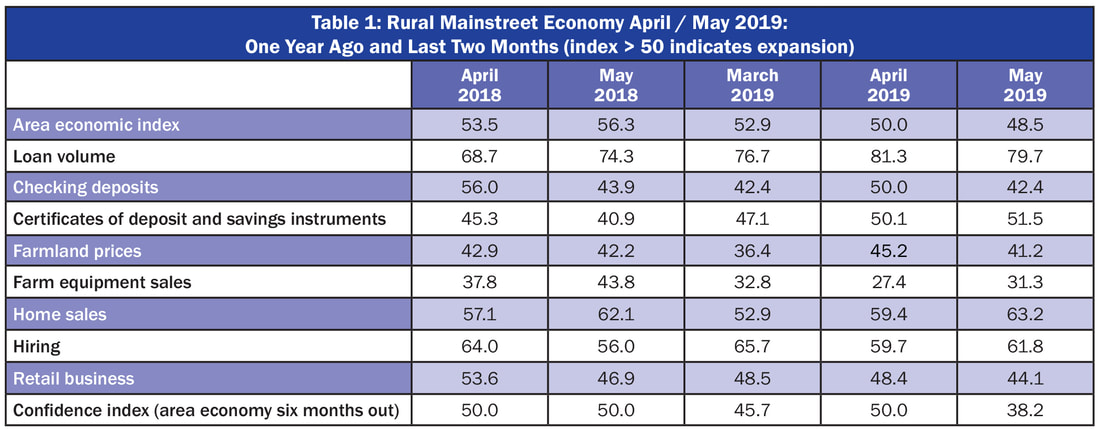

Overall: The overall index for May slipped to 48.5 from 50.0 in April. This is the first time since November of last year the index has fallen below growth neutral, indicating negative growth for the month. The index ranges between 0 and 100 with 50.0 representing growth neutral.

“The trade tensions and tariffs are hammering the farming economy. Grain farmers throughout the region continue to experience losses produced by trade issues and plentiful global supplies. On the other hand, the expanding U.S. domestic economy is supporting livestock producers in the region. For May, according to bankers, the negatives far outweighed the positives,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

According to Lonnie Clark, president of the State Bank of Chandler in Chandler, Minnesota, “The current low farm commodity prices are a negative to farmers.”

The May farm equipment-sales index increased to 31.3 from April’s 27.4. This marks the 69th straight month that the reading has fallen below growth neutral 50.0.

As stated by Jim Eckert, president of Anchor State Bank in Anchor, Illinois, “Our area has been very wet, although not as wet as some areas I saw in Indiana last weekend. Very little farm work has been done here and when it dries a bit, farmers will be forced to plant in less than optimum field conditions.”

Bankers were asked to project the growth in farm loan defaults for the next 12 months. On average, bankers expect farm loan defaults to climb by 10.9 percent. This is more than double the estimated rate of growth just two years ago.

In reaction to higher default rates, almost two-thirds, or 61.8 percent of bankers, increased collateral requirements, and more 41.2 percent rejected a higher percentage of farm loan applications.

Banking: Borrowing by farmers for May remained very strong as the borrowing index slipped to 79.7 from April’s record high 81.3, a record high. The checking-deposit index slumped to 42.4 from April’s 50.0, while the index for certificates of deposit and other savings instruments rose to 51.5 from 50.1 in April.

Hiring: The employment gauge climbed to a very strong 61.8 from April’s healthy 59.4. Despite weak farm commodity prices and farm income, Rural Mainstreet businesses continue to hire at a solid pace. Over the past 12 months, the Rural Mainstreet economy added jobs at a 0.2 percent pace compared to a higher 0.4 percent for urban areas of the same 10 states.

As a result of a shortage of workers, 70.6 percent of bankers reported a shortage of qualified workers was having a negative impact on economic growth in their area. “While this is quite high, it is down from last year at this time when 78.3 percent of bank CEOs indicated that finding and hiring qualified workers was restraining economic growth,” said Goss.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, plummeted to 38.2 from April’s 50.0, indicating a very pessimistic economic outlook among bankers.

“March floods, recently announced tariffs, and anemic farm income negatively influenced the economic outlook of bank CEOs,” said Goss.

Home and Retail Sales: The home-sales index increased to a healthy 63.2 from 59.4 in April. The retail sales index for May fell to 44.1 from 48.4 in April.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005. Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index for May fell to 49.6 from 51.6 in April. The farmland and ranchland-price index sank to 41.3 from April’s 45.6. Colorado’s hiring index for May declined to 61.3 from April’s 61.6. Illinois: The May RMI for Illinois slumped to 46.3 from 44.2 in April. The farmland-price index fell to 40.5 from April’s 43.6. The state’s new-hiring index expanded to 52.7 from last month’s 41.9. Iowa: The May RMI for Iowa declined to 46.5 from 51.5 in April. Iowa’s farmland-price index climbed to 47.2 from April’s 44.4. Iowa’s new-hiring index for May improved to 53.1 from 50.3 in April. Kansas: The Kansas RMI for May climbed to 48.9 from April’s 47.6. The state’s farmland-price index sank to 40.7 from 44.5 in April. The new-hiring index for Kansas advanced to 54.4 from 51.1 in April. Minnesota: The May RMI for Minnesota climbed to 52.3 from April’s 49.1. Minnesota’s farmland-price index fell to 41.2 from 44.9 in April. The new-hiring index for May expanded to 60.6 from April’s 55.0. | Missouri: The May RMI for Missouri fell to 43.3 from 44.6 in April. The farmland-price index for the state sank to 39.7 from April’s 43.7. Missouri’s new-hiring index for May increased to 44.7 from April’s 43.1. Nebraska: The Nebraska RMI for May slipped to 45.9 from 47.9 in April. The state’s farmland-price index sank to 40.4 from last month’s 44.6. Nebraska’s new-hiring index declined to 51.5 from April’s 51.8. North Dakota: The North Dakota RMI for May declined to 51.0 from April’s 55.0. The state’s farmland-price index dropped to 41.7 from 46.5 in April. The state’s new-hiring index declined to 65.2 from 70.7 in April. South Dakota: The May RMI for South Dakota remained above growth neutral, but fell to 50.2 from April’s 51.3. The state’s farmland-price index decreased to 41.5 from April’s 45.5. South Dakota’s new-hiring index advanced to 63.0 from 60.8 in April. Wyoming: The May RMI for Wyoming fell to 50.7 from April’s 55.9. The May farmland and ranchland-price index declined to 41.6 from April’s 45.7. Wyoming’s new-hiring index expanded to 64.3 from 63.4 in April. |

RSS Feed

RSS Feed