- Overall index rocketed to a record high.

- Approximately, 60.6% of bank CEOs reported that their local economy expanded between April and May.

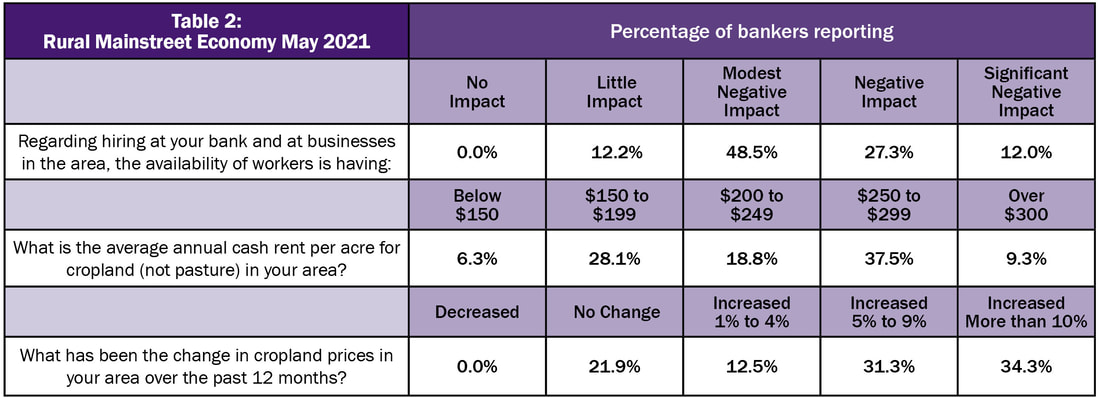

- Almost nine of 10 bank CEOs indicated that hiring at their bank and in the area was restraining growth.

- For the first time since 2013, the regional farmland prices expanded for eight straight months.

- On average, bankers reported annual cash rent per acre of $228, which represented growth of 7.3% over the past 12 months.

OMAHA, Neb. (May 20, 2021) – For the sixth straight month, the Creighton University Rural Mainstreet Index (RMI) climbed above growth neutral. According to the monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy.

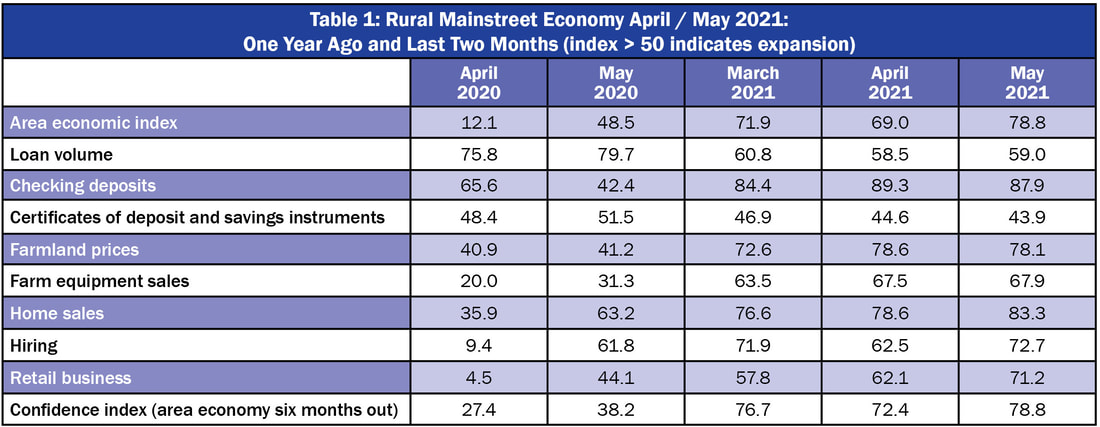

Overall: The overall index for May jumped to a record high of 78.8 from April’s very healthy 69.0. The index ranges between 0 and 100 with a reading of 50.0 representing growth neutral.

Approximately, 60.6% of bank CEOs reported that their local economy expanded between April and May.

Almost nine of 10 bank CEOs indicated hiring at their bank and in the area was restraining growth.

Farming and Ranching: For an eighth straight month, the farmland price index advanced above growth neutral. The May reading slipped from April’s nine-year high climbed of 78.6 to 78.1 for May. This is first time since 2013 that Creighton’s survey has recorded eight straight months of farmland prices above growth neutral.

On average, bankers reported annual cash rent per acre of $228 which represented growth of 7.3% over the past 12 months.

Rod Cornelius, market president of Pinnacle Bank in Grant, Nebraska, “(On average) Nonirrigated crop land cash rents are at $60. Irrigated crop land cash rents are $190.”

The May farm equipment-sales index rose to 67.9, its highest level since 2013, and up from April’s 67.5. After 86 straight months of readings below growth neutral, farm equipment sales bounced into growth territory for the last six months.

Banking: The May loan volume index increased to 59.0 from April’s 58.5. The checking-deposit index declined to a very strong 87.9 from April’s record high 89.3, while the index for certificates of deposit, and other savings instruments, declined to43.9 from 44.6 in April.

Hiring: The new hiring index climbed to 72.7 from 62.5 in April. Despite recent solid job gains for the region, data from the U.S. Bureau of Labor Statistics indicate that nonfarm employment levels for the Rural Mainstreet economy are down by 112,800 (nonseasonally adjusted), or 2.6%, compared to pre-COVID-19 levels.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, expanded to a very strong 78.8 from April’s 72.4. “Federal stimulus checks, strong grain prices, and advancing exports have supported confidence offsetting negatives from pandemic ravaged retail and leisure and hospitality companies in the rural economy,” said Goss.

However, bankers are concerned about the rapidly rising U.S. budget deficit. Larry Winum, CEO of Glenwood State Bank in Glenwood, Iowa, said, “When is Congress and the Federal Reserve going to get serious about implementing a plan to annually balance the budget and reduce the federal debt ($27.7 trillion, now equal to 100% of US GDP). It’s a problem that is not going away.”

Home and Retail Sales: The home-sales index climbed to a record 83.3 from April’s 78.6, also a record high. The retail-sales index for May increased to a strong 71.2 from 62.1 in April. “Creighton’s survey will have to record many months above growth neutral retail numbers before it can be concluded that Rural Mainstreet retailers are back to pre-pandemic levels,” said Goss.

According to David Steffensmeier, CEO of First Community Bank in Beemer, Nebraska, “Residential home prices are increasing faster than farmland prices at this time.”

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005 and launched in January 2006. Below are the state reports:

| Colorado: Colorado’s Rural Mainstreet Index (RMI) for May rose sharply to 77.9 from 66.7 in April. The farmland and ranchland-price index increased to 77.6 from April’s 71.7. Colorado’s hiring index for May climbed to 69.1 from April. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that Colorado’s Rural Mainstreet nonfarm employment remains more than 19,000 jobs, or 5.8%, below its pre-COVID-19 level. Illinois: The May RMI for Illinois declined to 67.8 from 69.8 in April. The farmland-price index rose to 78.8 from 77.8 in April. The state’s new-hiring index jumped to 74.4 from April’s 62.7. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that Illinois’ Rural Mainstreet nonfarm employment remains more than 34,000 jobs, or 2.6%, below its pre-COVID-19 level. Jim Eckert, president of Anchor State Bank in Anchor, “The majority of crops in our area are planted. However, the cool weather and lights frosts have not been helpful.” Iowa: The May RMI for Iowa ballooned to 79.9 from 69.8 in April. Iowa’s farmland-price index was unchanged 78.6 in April. Iowa’s new-hiring index for May climbed to 68.4 from 63.5 in April. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that Iowa’s Rural Mainstreet nonfarm employment remains more than 19,000 jobs, or 2.9%, below its pre-COVID-19 level. Larry Winum, CEO of Glenwood State Bank in Glenwood reported, “If we as a country want to maintain our strong economic position in the world, it is time to get our fiscal house in order. In my view, we all have a responsibility to be a part of the solution and hold our elected officials and the Federal Reserve accountable.” Kansas: The Kansas RMI for May expanded to 83.8 from 72.2 in April. The state’s farmland-price index climbed to 80.6 from April’s 80.2. The new-hiring index for Kansas rose to 76.2 from 65.1 in April. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that Kansas’ Rural Mainstreet nonfarm employment remains more than 4,400 jobs, or 1.0%, below its pre-COVID-19 level. Minnesota: The May RMI for Minnesota soared to 81.7 from 67.9 in April. Minnesota’s farmland-price index climbed to 79.5 from 78.0 in April. The new-hiring index for May rose to 75.1 from 62.9 in April. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that Minnesota’s Rural Mainstreet nonfarm employment remains more than 13,000 jobs, or 2.6%, below its pre-COVID-19 level. | Missouri: The May RMI for Missouri advanced to 87.8 from April’s 77.4. The farmland-price index dipped to 82.6 from April’s 82.8. The state’s hiring gauge bounced to 78.2 from 67.7 in April. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that Missouri’s Rural Mainstreet nonfarm employment is more than 2,900 jobs, or 1.4%, above its pre-COVID-19 level. Nebraska: The Nebraska RMI for May climbed to 88.0 from April’s 77.1. The state’s farmland-price index inched to 82.7 from last month’s 82.6. Nebraska’s new-hiring index jumped to 78.3 from 67.5 in April. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that Nebraska’s Rural Mainstreet nonfarm employment is more than 2,100 jobs, or 0.7%, above its pre-COVID-19 level. Jon Schmaderer, president of Tri-County Bank in Stuart, said, “Our biggest challenge today in rural Nebraska is attracting sufficient workforce and "across the board inflation.” However, the biggest near-term threat for our Agriculture community and small businesses across all of Rural America are the proposed changes to our tax structure.” North Dakota: The North Dakota RMI for May decreased to 53.8 from April’s 55.0. The state’s farmland-price index expanded to 72.0 from 71.6 in April. The state’s new-hiring index expanded to 67.6 from April’s 56.5. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that North Dakota’s Rural Mainstreet nonfarm employment remains more than 16,000 jobs, or 10.3%, below its pre-COVID-19 level. South Dakota: The May RMI for South Dakota advanced to 85.9 from April’s 77.2. The state’s farmland-price index climbed to 81.6 from 81.4 in April. South Dakota’s May hiring index climbed to 77.2 from 66.3 in April. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that South Dakota’s Rural Mainstreet nonfarm employment remains 2,000 jobs, or 1.0%, below its pre-COVID-19 level. Wyoming: The May RMI for Wyoming advanced to 78.4 from April’s 67.7. The May farmland and ranchland-price index sank to 72.3 from 77.9 in April. Wyoming’s new-hiring index expanded to 73.5 from April’s 62.8. Despite recent solid job gains, U.S. Bureau of Labor Statistics data indicate that Wyoming’s Rural Mainstreet nonfarm employment remains more than 9,000 jobs, or 4.6%, below its pre-COVID-19 level. |

Follow Ernie Goss on Twitter www.twitter.com/erniegoss

RSS Feed

RSS Feed