- The overall index sank to its lowest level since December 2016,and remained below growth neutral.

- For the 46th straight month, average farmland prices declined across the 10 state region.

- For the 49th straight month, the agriculture equipment sales index fell below growth neutral.

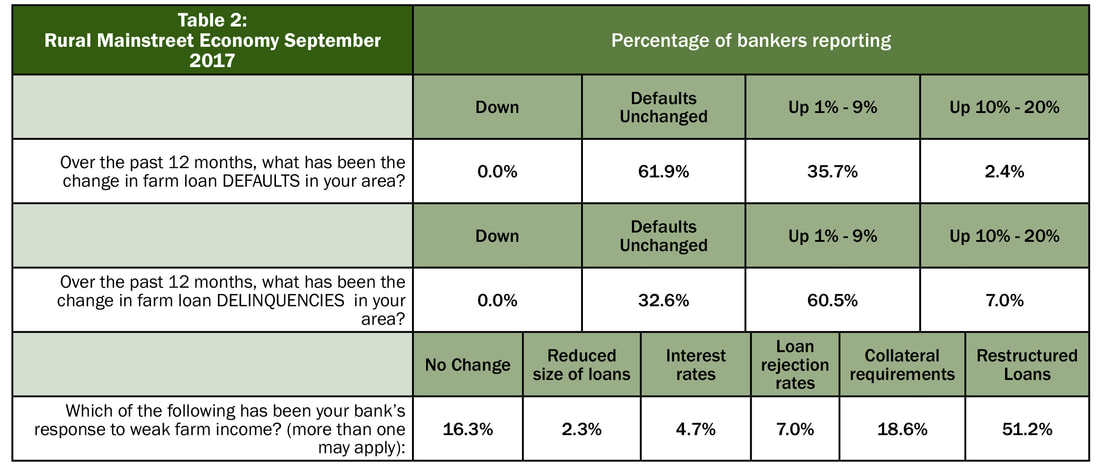

- As a result of falling farm income, more than 51 percent of bank CEOs, reported restructuring farm loans, and approximately 18.6 percent indicated increasing collateral requirements.

- Bank CEOs reported only a 2.1 percent increase in farm loan defaults over the past year.

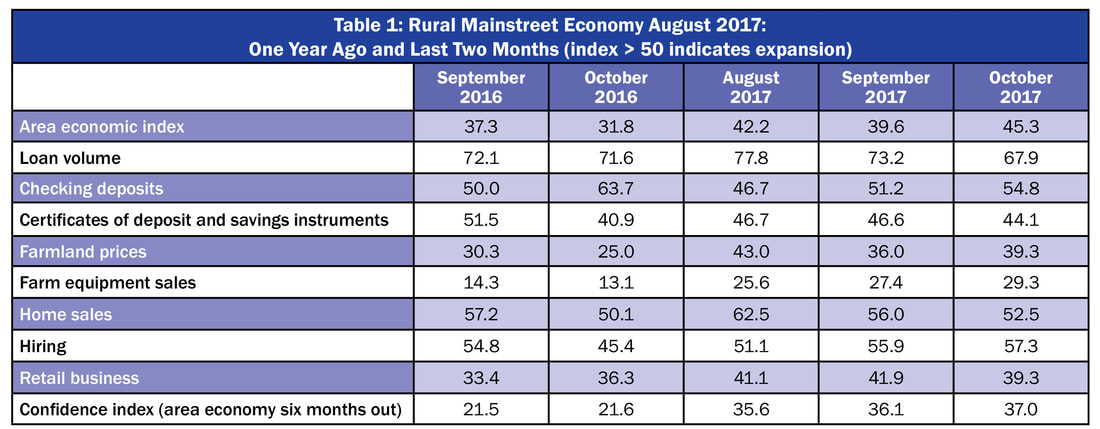

Overall: The index, which ranges between 0 and 100, slumped to 39.6, its lowest level since December 2016, and down from 42.2 in August.

“As a result of weak farm income, more than one-half, or 51.2 percent of bankers, reported restructuring farm loans while approximately 18.6 percent indicated their bank had increased collateral requirements. Despite weak farm income bank CEOs reported a low 2.1 percent increase in farm loan defaults, and a 4.1 percent rise in farm loan delinquencies,” said Ernie Goss, Jack A. MacAllister Chair in Regional Economics at Creighton University's Heider College of Business.

Farming and Ranching: The farmland and ranchland-price index for September slumped to 39.6 from 43.0 in August. This is the 46th straight month the index has fallen below growth neutral 50.0.

Moisture conditions across the region are producing a wide range of yields. For example, Bryan Grove, president of American State Bank in Grygla, Minn. said, “Soybean harvest is just beginning with mixed results. Areas that received timely rains should have an average crop. Isolated locations lacking moisture will likely have disappointing soybean yields. Corn will have similar variability.”

The September farm equipment-sales index increased to 27.4 from 25.6 in August. This marks the 49th consecutive month the reading has dropped below growth neutral 50.0.

Banking: Borrowing by farmers was strong for September as the loan-volume index fell to a still strong 73.2 from 77.8 in August. The checking-deposit index was 51.2, up from August’s 46.7, while the index for certificates of deposit and other savings instruments slipped to 46.6 from 46.8 in August.

Brian Nicklason, president of Woodland Bank in Grand Rapids, Minnesota, reported, “We are starting to see our usual fall decline in loan demand and deposit run-off a little early.”

Hiring: The employment gauge climbed to 55.9 from August’s 51.1. Rural Mainstreet businesses not linked to agriculture increased hiring for the month and at a faster pace than in August.

Confidence: The confidence index, which reflects expectations for the economy six months out, increased to a weak 36.1 from 35.6 in August, indicating a continued pessimistic outlook among bankers. “Concerns about trade, drought conditions in portions of the region, and low agriculture commodity prices impaired bankers’ economic outlook for the month,” said Goss.

Home and Retail Sales: Home sales moved lower for the Rural Mainstreet economy during September. The September reading fell to 56.0 from August’s 62.5. The September retail-sales index increased slightly to 41.9 from 41.1 in August. “Much like their urban counterparts, Rural Mainstreet retailers are experiencing significant pullbacks in sales,” reported Goss.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2005.

| Colorado: Colorado’s Rural Mainstreet Index (RMI) dropped to 39.2 from 41.8 in August. The farmland and ranchland-price index sank to 35.7 from August’s 42.8. Colorado’s hiring index for September climbed to 54.6 from August’s 50.4. Illinois: The September RMI for Illinois rose to 42.2 from 41.2 in August. The farmland-price index slumped to 35.9 from 42.3 in August. The state’s new-hiring index rose to 55.4 from last month’s 47.5. Jim Eckert, president of Anchor State Bank in Anchor, said, “Early yields indicate crop will be 15-20% less than last year. With this reduction and current low prices our farmers' incomes will be significantly less than 2016.” Iowa: The September RMI for Iowa sank to 39.9 from 42.3 in August. Iowa’s farmland-price index for September fell to 36.2 from August’s 43.1. Iowa’s new-hiring index for September climbed to 57.5 from August’s 52.5. Kansas: The Kansas RMI for September decreased to 36.5 from August’s 40.2. The state’s farmland-price index fell to 33.9 from 41.6 in August. The new-hiring index for Kansas slipped to 42.4 from August’s 43.0. Minnesota: The September RMI for Minnesota advanced to 50.2 from 42.4 in August. Minnesota’s farmland-price index sank to 36.3 from 43.2 in August. The new-hiring index for the state expanded to 58.5 from August’s 53.1. Pete Haddeland, CEO of the First National Bank in Mahnomen said, “Pre-lift on beets went well. Dry beans look good.” | Missouri: The September RMI for Missouri rose to 51.3 from 42.5 in August. The farmland-price index slumped to 38.6 from August’s 43.2. Missouri’s new-hiring index soared to 73.4 from 53.4 in August. Nebraska: The Nebraska RMI for September declined to 40.2 from 42.9 in August. The state’s farmland-price index sank to 36.4 from last month’s 43.5. Nebraska’s new-hiring index stood at a solid 58.8 from 55.2 in August. North Dakota: The North Dakota RMI for September dropped to 42.2 from August’s 50.1. The state’s farmland-price index moved to 37.7 from 44.1 in August. North Dakota’s new-hiring index soared to 67.9 from 59.1 in August. South Dakota: The September RMI for South Dakota slipped to 38.1 from August’s 38.5. The state’s farmland-price index sank to 35.0 from 41.7 in August. South Dakota's new-hiring index improved to 49.7 from August’s 43.4. Wyoming: The September RMI for Wyoming fell to 39.0 from August’s 41.2. The September farmland and ranchland-price index slumped to 35.6 from 42.3 in August. Wyoming’s new-hiring index advanced to 53.7 from August’s 47.5. |

(Click each table to view larger.)

RSS Feed

RSS Feed